Timothy Massad, the former chairman of the Commodity Futures Trading Commission, told CNBC’s Jim Cramer on Tuesday that the future of cryptocurrency will depend on the outcome of the government’s recent lawsuits against currency exchange platforms Binance and Coinbase.

According to Massad, the government and the Securities and Exchange Commission must create a new industry framework that protects investors, prevents fraud and manipulation, and finally answers the contentious question: are digitized tokens securities?

“A lot of what goes on in the crypto world does just revolve around itself, you know, it’s a very interesting technology — the practical use cases that connect to the real economy, frankly, are still few and far between,” Massad said. “The question is, how do we create a framework where that innovation can still take place, and maybe lead to things of real value, but protect investors at the same time.”

One of the largest issues in crypto concerns wash trading, which is when someone trades with themselves or affiliates to mislead others about stock performance. Massad said this type of fraud accounts for 50% to 90% of the trading on crypto platforms.

“There’s no assurance that there’s any procedures to prevent that,” he told Cramer. “And these trading platforms, most of them do have their own proprietary trading operations, which they shouldn’t have.”

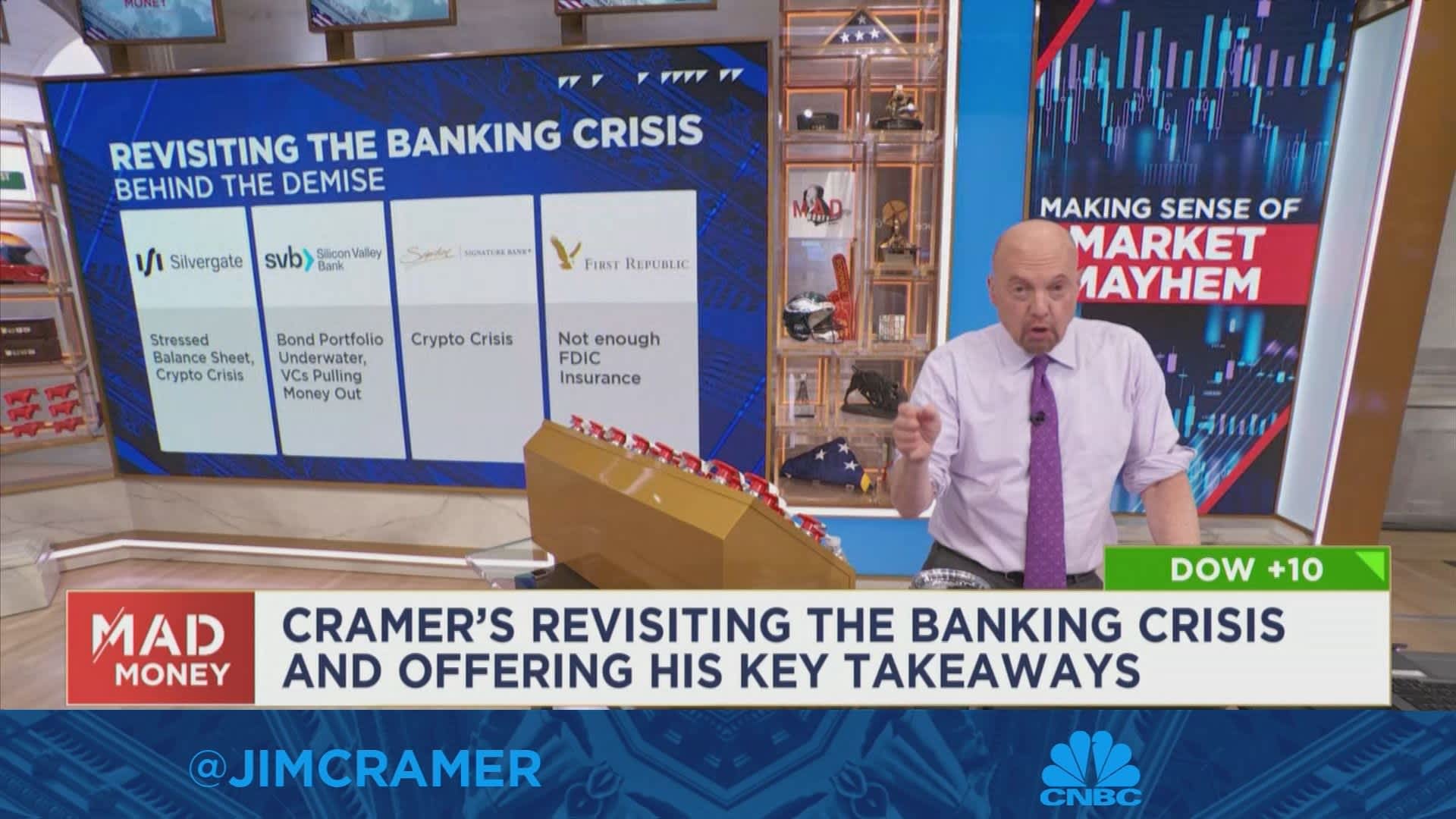

The SEC filed 13 charges against Binance on Monday alleging various kinds of fraud and misdeeds. Tuesday morning, Coinbase was hit with a slew of similar, though more mild, charges, prompting its stock to plummet 12%.

“The business model of these exchanges is inconsistent with the way our securities markets work,” Massad stressed.

Massad added that he and Federal Reserve Chair Jay Powell have been advocating for measures that at least protect investors in the short term while the government works to create a whole new framework model.

“One of the issues with the model is, should you be able to trade bitcoin and ether, which, let’s say are commodities, on the same platforms as other things,” he said. “Now, under the SEC view, I don’t think that would be allowed. But, is that the model we want? So, again, there are some questions about where do we really want to go, but we’ve got to have much better investor protection.”