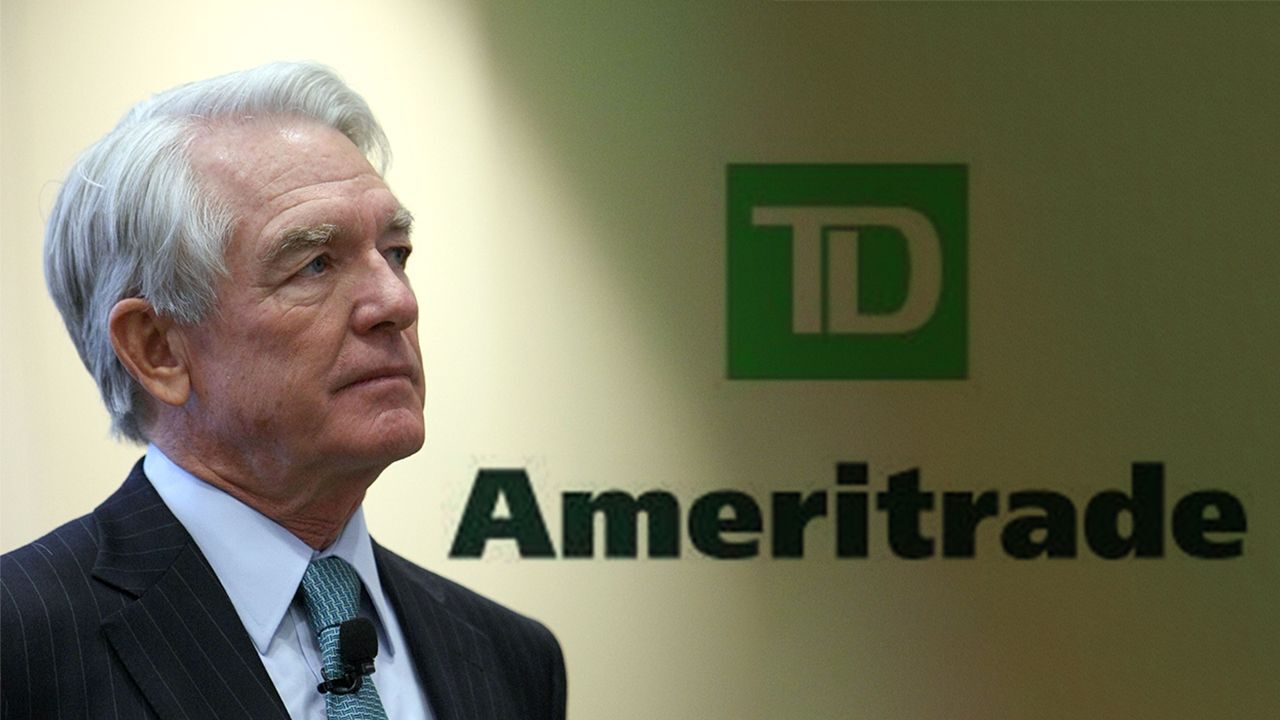

Charles Schwab Corporation founder Charles Schwab tells FOX Business’ Maria Bartiromo that customers should focus on identifying the lowest trading fees.

E-Trade the fourth major broker to nix online commission fees.

Continue Reading Below

E-Trade Financial will eliminate trade commissions joining broker industry rivals Charles Schwab Corp. and TD Ameritrade following their decision to drop commissions, the company announced Wednesday.

The announcement was made a day after Charles Schwab said they would be eliminating commissions on U.S. stocks, exchange-traded funds and option trades.

Starting Monday, E-Trade will be offering commission-free stocks and exchange-traded funds listed on U.S. exchanges. Interactive Brokers and TD Ameritrade confirmed that they will be dropping commissions shortly thereafter.

The move could prove to be beneficial to online traders as brokers shift their business model away from commissions and removing “the final pricing barrier to investing online,” Charles Schwab said in a statement.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| AMTD | TD AMERITRADE HOLDING | 33.54 | -1.13 | -3.26% |

| ETFC | E*TRADE GROUP (E*TRADE BANK AG) | 35.20 | -1.31 | -3.59% |

| SCHW | CHARLES SCHWAB | 36.51 | -1.25 | -3.31% |

| IBKR | INTERACTIVE BROKERS | 47.30 | -1.42 | -2.90% |

“This is our price. Not a promotion. No catches. Period,” Charles Schwab CEO and president, Walt Bettinger, said in a press release Tuesday. “Price should never be a barrier to investing for anyone, whether an experienced investor or someone just starting on the investing path.”

E-Trade is the latest broker to follow Charles Schwab’s lead, and it expects a $75 million impact on its second-quarter operating results as brokering firms race to reduce or eliminate fees for their stock-trading and wealth management services.

“E*TRADE customers benefit from working with the best online broker in the industry, defined by the number one options trading platform, intuitive and easy-to-use online and mobile tools, with exceptional service from financial professionals 24/7,” said chief executive officer Mike Pizzi.

“With this new commission schedule we are further raising the bar, delivering an unrivaled experience at price points that cannot be beat—main street investors will now trade the stocks and ETFs of their choice for $0, while our most active derivative traders will continue to enjoy our industry-leading contract rate, which when combined with the $0 base rate, our first-class derivatives platform, and world-class active trader service team, results in an unparalleled value proposition.”

The collective move to get rid of such commissions in recent days has caused shares to plunge for the industry’s biggest e-brokers, with E-Trade down 16 percent on the week, Charles Schwab down 9.1 percent, Interactive Brokers down 9 percent and TD Ameritrade leading the pack at a whopping 26 percent on the week.

CLICK HERE TO READ MORE ON FOX BUSINESS

In recent years, the brokerage industry has had to contend with the emergence of zero-commission trading investing apps such as Robinhood, which has forced the industry’s hand in adopting a more customer-friendly focus.