As equity markets hover just below all-time highs and volatility remains fairly muted, a key economic indicator is skidding to its lowest level since the global financial crisis.

The benchmark yield curve, the spread between the 10- and 2-year Treasury yields, flattened to a fresh decade low on Wednesday. The flattening yield curve is often viewed as a classic tell of slowing economic growth, leaving some market watchers calling the strength of the rally into question.

But one technical analyst says the perception that a flat yield curve is bad for stocks is nothing more than “fake news.”

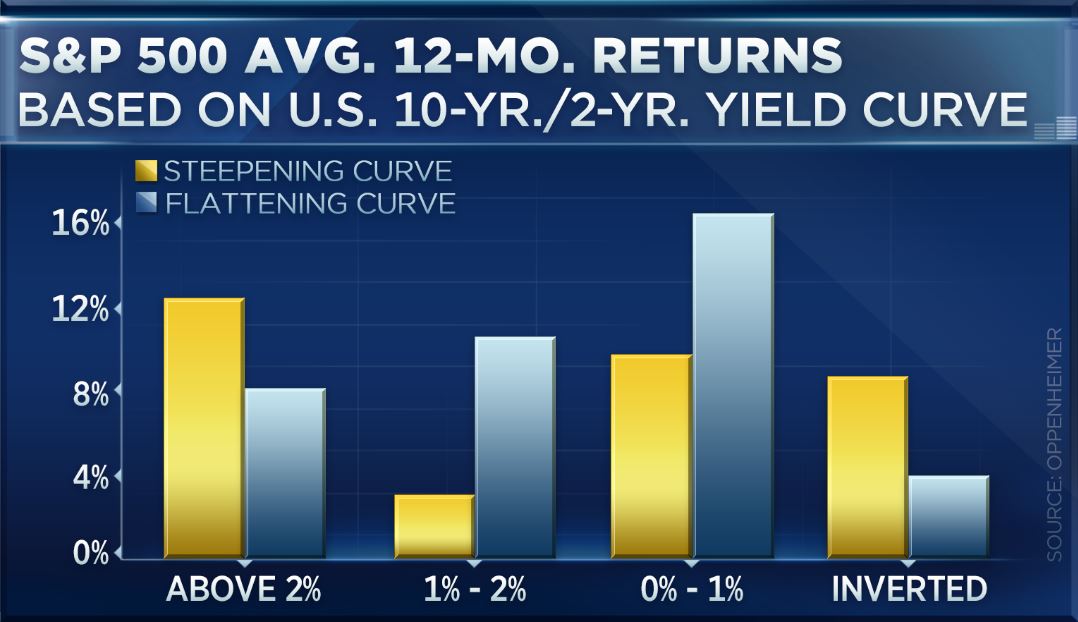

“The 10 minus 2 US Treasury Yield curve has declined to its flattest level since 2007, and while a flatter curve is often viewed as a macroeconomic concern, we’ve found that equities have actually posted their strongest returns at comparable points over the last 40 years,” Oppenheimer’s Ari Wald wrote in a recent note. “Directionally higher rates should also be a tailwind for the S&P’s bull cycle, in our view.”

In an interview Tuesday on CNBC’s “Trading Nation,” Wald said equities have never done better when considering where the level and the direction of the yield curve stands currently.

“In fact, how we measure it, the S&P 500 has averaged a 16.5 percent gain over the next 12 months based on the current level and direction going back 40 years of history. So to say that a flat curve is bad for stocks, … it’s fake news,” Wald said.

The thinking goes like this. A dramatically flattening yield curve is seen as a rather ominous sign because it indicates short-dated Treasury yields are rising as long-dated Treasury yields are falling, as has been the case this year. This activity is thought to suggest investors are betting on a slowdown in economic growth, and that inflation will wane. Of further concern is when the yield curve becomes “inverted,” or when yields on shorter-dated debt are greater than those on longer-dated debt, which is seen as indicative of an economic recession.

In a note to clients on Wednesday, Bank of America rates strategists wrote that further tightening from the Federal Reserve along with a flattening yield curve is “no longer sustainable.”

The authors, led by strategist Shyam S. Rajan, said the central bank and the spread between Treasury maturities are on a “collision course” as the Fed is all but sure to raise interest rates in December even as inflation remains tepid and the yield curve flattens precipitously.

Some are concerned about markets getting hit by a narrowing yield curve, particularly as the market rally’s reaction to a flattening curve and historically low interest rates is different than other periods of bull runs, said Gina Sanchez, CEO of Chantico Global. Specifically, she pointed to the 1990s.

“The reality is that particular time period is only one episode and that episode lasts from ’90 until 1999. And that was a very specific time period when you had a tremendous amount of liquidity being unleashed into the market,” Sanchez said Tuesday on “Trading Nation.”

“That liquidity found its way into the internet bubble, and that bubble basically inflated through that time period. So if you look at valuations for the S&P 500 in the beginning of that time period they were fairly low. They ended fairly high right? That’s what led to that stock market return. It really had nothing to do with the flattening of the yield curve.”

Treasury yields were broadly lower in Wednesday trading and stocks fell.