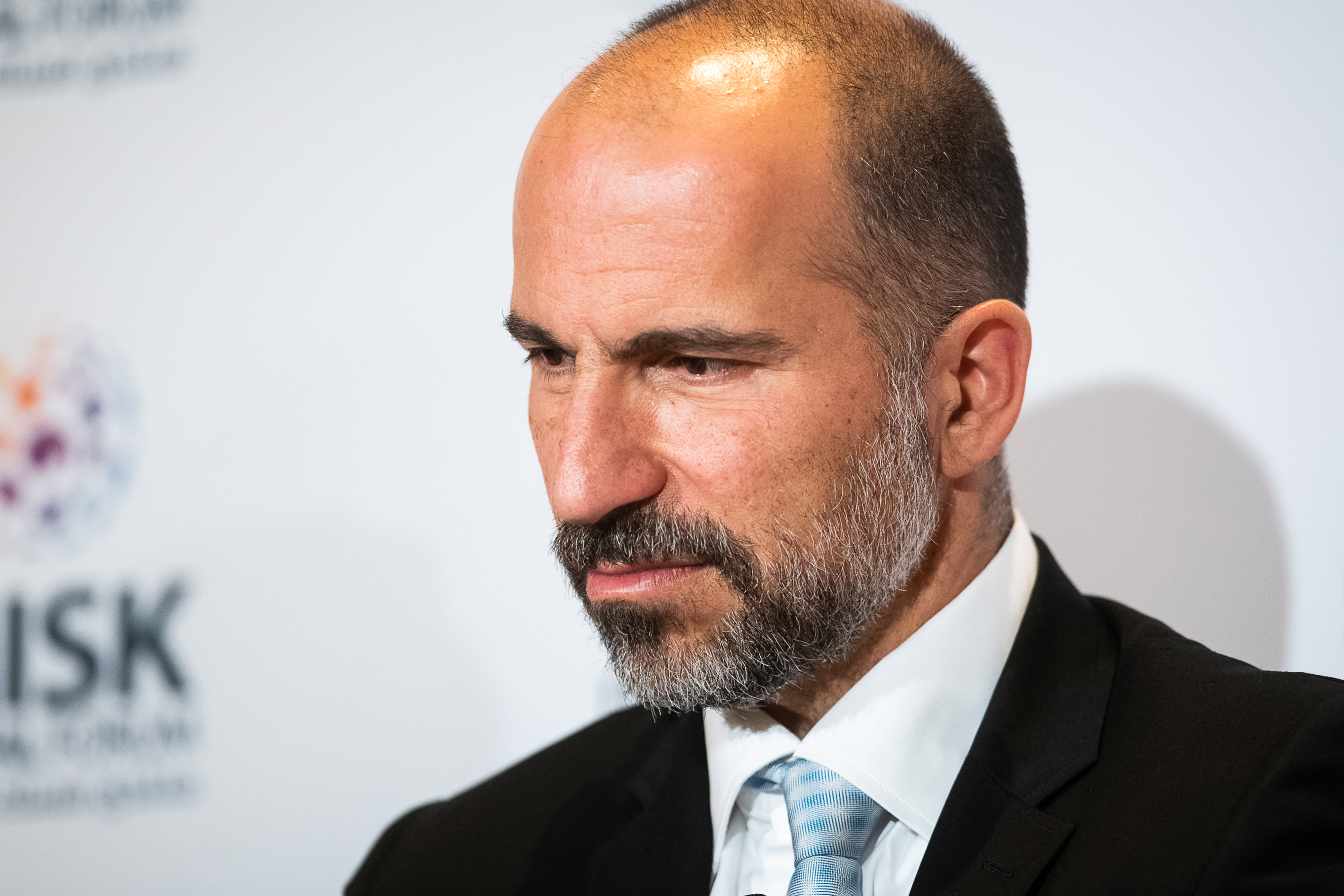

Dara Khosrowshahi, chief executive officer of Uber Technologies Inc., listens during a panel discussion at the Bloomberg Global Business Forum in New York, U.S., on Wednesday, Sept. 26, 2018.

Mark Kauzlarich | Bloomberg | Getty Images

Shares of Uber and Lyft fell to fresh lows on Tuesday, posting their lowest close ever, as the ride-hailing firms join a string of recently public companies facing fresh criticism from investors.

Uber closed down 4.3% to $29.15, falling below its previous low of $30.29 on Sept. 27. Earlier in the day, the shares hit an intraday all-time low of $28.65.

Lyft also fell sharply, ending the day down 3.1% to $39.57, compared to its previous low of $40.84 on Sept. 30. The stock dropped as low as $38.68 on Tuesday, touching a new intraday low.

Uber, which had a private valuation of $76 billion ahead of its IPO in May, has seen its valuation drop steeply as its stock price has dwindled. The company now has a market cap of roughly $49 billion.

Similarly, Lyft’s market cap is hovering around $11.6 billion, compared to its last private valuation of roughly $15 billion.

The companies are just a two examples of this year’s struggling tech IPO class. Investor scrutiny has hit a tipping point in the past few months in the wake of WeWork’s postponed IPO, SoftBank’s optimism around the office-sharing start-up and the middling performance of Peloton out of the gate last week. WeWork’s fate has caused some, like Fred Wilson, a venture capitalist at Union Square Ventures, to question the high-flying valuations of consumer-tech start-ups with lower margins than traditional tech companies whose businesses are based on software.