Twitter shares are doing something unusual this year — they are going up.

In every full calendar year since the social media company’s initial public offering in November 2013, the stock has posted double-digit losses. This year, Twitter is up nearly 29 percent year to date, on pace for its best full year on record.

The stock posted gains in the first two months it was public, in late 2013.

The stock was down in Wednesday trading amid a broader tech sell-off. Still, some traders are optimistic about the technical picture.

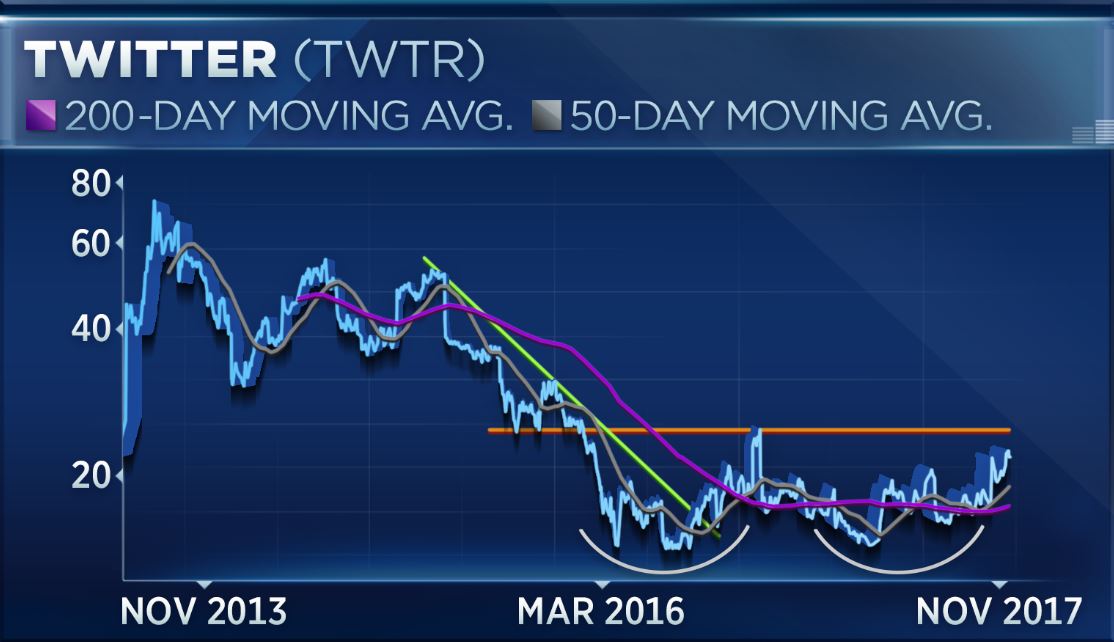

On a weekly chart of Twitter, the stock has made a class double-bottom formation over the course of the last two years, said Craig Johnson, chief market technician at Piper Jaffray.

“The next resistance for this stock is going to be about $25. That’s the level that we need to watch. A break through $25 is going to set this stock up for a whole other leg higher, and we should be buying it based on this double-bottom pattern setting up here right now. So, I’d be a buying of this stock here, definitely for a trade up to $25, and then look for a stronger move after $25,” Johnson said Tuesday on CNBC’s “Trading Nation.”

Others are less optimistic about the stock’s direction.

“I’m incredibly conflicted about the stock because I think it’s the great social media platform out there, yet one that is frustratingly difficult to monetize,” said Boris Schlossberg, managing director of foreign exchange strategy at BK Asset Management.

Facebook has not been able to deter users from Twitter in the way it has from Snap‘s social media platform, Snapchat, Schlossberg said. Still, Twitter’s business model has not been successfully monetized, he said.

“Until you [monetize Twitter], it’s hard to make a fundamental case for Twitter. I think the reason you’re seeing so much price action is because the market is probably betting that a bigger player — perhaps Google, perhaps somebody else — is going to come in and put them inside their fold,” he said.

The stock is still trading below its IPO price of $26 per share and was lower on Wednesday, trading at $20.98.

Disclosure: CNBC parent NBCUniversal is an investor in Snap.