The currency crisis in Turkey is being exacerbated by a skyrocketing annual inflation rate, which by some estimates, exceeds 100 percent.

Steve Hanke, who in past helped set-up systems to stabilize currencies in Argentina and Bulgaria, told CNBC on Tuesday, “Today, I measure inflation with high-frequency data, and the inflation rate in Turkey is 101 percent on an annual basis. That’s the first time it’s been over 100 percent.”

Hanke, who had served as a senior economist on President Ronald Reagan‘s Council of Economic Advisers, echoed his earlier tweet:

Countries with high inflation rates relative to others tend to see their currencies depreciate.

Over the past three weeks, the Turkish lira has plummeted, with selling intensifying into Monday’s record low of 7.24 Turkish lira per dollar after President Donald Trump on Friday said he would increase tariffs on steel and aluminium originating from Turkey. The escalating tariffs were a direct attack on Turkey’s refusal to free jailed American pastor Andrew Brunson.

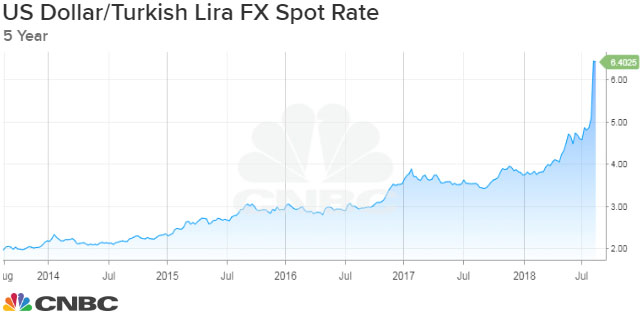

The lira was rebounding about 6 percent on Tuesday, but still remained more than 60 percent lower than when Recep Tayyip Erdogan became Turkey’s president in August 2014. The following chart shows 5 years of dollar strength against the lira.

Erdogan, in a speech Tuesday, said Turkey will boycott U.S. electronics, including Apple‘s iPhone, suggesting the Turkish people would stand together against dollar strength and inflation the same way they did against an attempted coup of his presidency in 2016. He accused the Trump administration of economically targeting Turkey like China and Russia. He again called on Turks to change U.S. dollars into lira in order “maintain the dignity” of the currency.

Buying lira with dollars would be costly as “the real yield being in Turkish dominated assets of any kind is hugely negative right now,” said Hanke, an applied economics professor at Johns Hopkins University. “They would have to raise interest rates over 100 percent per annum to stabilize the lira.”

Raising interest rates is a weapon countries can use to defend their currencies.

However, even if Erdogan were allow rate increases, which he’s been reluctant to do, Hanke said the only way to really stop the slide in the Turkish lira is to establish a currency board.

In a recent Wall Street Journal op-ed, Hanke described the monetary-reform measure: “The sole function of a currency board is to exchange the domestic currency it issues for an anchor currency at a fixed rate.”