Historic Pepsi-Cola neon sign on the Long Island City waterfront in Queens, New York City.

Karlheinz Irlmeier | Getty Images

Here are the most important things to know about Thursday before you hit the door.

1. Is the economic slowdown contained?

Investors will be holding their breath for a read on the health of the services sector, as fears of a looming economic recession weigh on markets.The stock market got knocked on Tuesday when data showed the weakest manufacturing activity in a decade and the sell-off continued on Wednesday. If this figure Thursday shows the economic weakness has spread to the consumer, investors could be in trouble.

The Institute for Supply Management’s nonmanufacturing economic reading will be released at 9 a.m. and economists forecast a 55.3 figure, down from 56.4 in August. A reading below 50 signals contraction.

“To be sure, the contraction in manufacturing needn’t mean the whole US economy slips into recession,” said UBS’s global chief investment strategist in a note to clients. “Manufacturing represents only around 10% of the US economy. Service sector sentiment remains robust.”

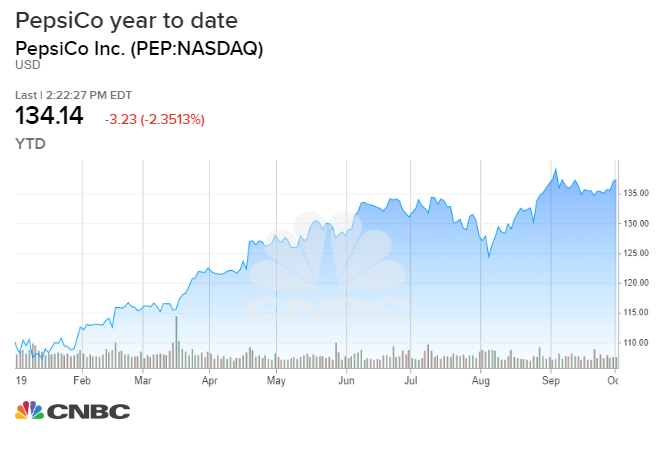

2. PepsiCo’s rally

We’ll get a slew of consumer earnings on Thursday including PepsiCo, Constellation Brands and Costco.

Shares of PepsiCo have rallied more than 20% this year, beating the S&P 500 (up about 15% year to date) and the Consumer Staples Select Sector SPDR exchange-traded fund (XLP) (up about 18% year to date.)

Bank of America estimates Pepsi will report earnings per share of $1.49, two cents above consensus.

“Overall we expect solid underlying results as Frito Lay North America ( FLNA ) has maintained momentum and Pepsi Beverages North America (PBNA) trends are improving (helped by weather and Gatorade),” said Bank of America’s Bryan Spillane in a note to clients.

3. Sell-off continues?

Stocks, along with bonds and the dollar, sold off on Wednesday for a second day over fears the U.S. could enter a recession in the next 12 months. The CBOE Volatility index, otherwise known as Wall Street’s fear gauge, spiked above 20 points for the first time since September 3 on Wednesday. The Dow has now lost more than 800 points in two days.

Major events (all times ET):

8:30 a.m. Initial claims

8:30 a.m. Fed Vice Chair for Supervision Randal Quarles

9:45 a.m. Services PMI

10:00 a.m. ISM nonmanufacturing

10:00 a.m. Factory orders

12:10 p.m. Cleveland Fed President Loretta Mester

1 p.m. Dallas Fed President Robert Kaplan

3:45 p.m. Chicago Fed President Charles Evans

6:45 p.m. Vice Chair Richard Clarida

Major earnings:

PepsiCo (Before the bell)

Constellation Brands (Before the bell)

Costco (After the bell)

—with reporting from CNBC’s Michael Bloom