This story is part of CNBC Make It’s Millennial Money series, which profiles people across the U.S. and details how they earn, spend and save their money.

Ask Alex Sanchez how many points the Dow is up or down on a given day, and the 24-year-old can give you an update that’s just as good as if you tuned into CNBC.

The West Chicago resident is a bit finance obsessed. He watches YouTube videos on budgets and investing, tracks his net worth on a white board in his bedroom and aims to save more than $7,000 each month. In addition to his full-time job as an overhead lineman at an electric utility company in the Chicagoland area, he has two side hustles to help pad his savings account and investment portfolio.

Sanchez has big plans. He’s a fan of the FIRE — financial independence, retire early — community, and he’d like to be a millionaire by 30.

But he’s not just interested in his own financial future. As a first-generation American, he’s also planning to help his parents, who immigrated from Mexico and met in the West Chicago area, retire comfortably one day.

“I have to give back to my parents, because they came here as immigrants to give us, their kids, a better life,” Sanchez tells CNBC Make It. “I know all the sacrifice and pain that they went through, and I would stress it’s my duty to give back to them.”

Alex Sanchez outside his home in West Chicago.

CNBC Make It

Sanchez says he grew up lower middle class, and while his parents provided everything he and his brother, Oscar, could need, they also often missed events, like his baseball games, because they had to work.

Investing and saving a significant portion of his income has become a way for Sanchez to ensure that he has the flexibility to choose how he spends his time. Should he have children of his own one day, he doesn’t want to miss out on Little League for work. And he wants to make sure his parents aren’t tied to their jobs forever.

I have to give back to my parents, because they came here as immigrants to give us, their kids, a better life. I would stress it’s my duty to give back to them.

Alex Sanchez

“I want, as fast as I possibly can, to tell them to quit their jobs and not worry about their bills, because I can handle their bills,” he says. “Everything I do is pretty much for them.”

What he earns

Sanchez’s income fluctuates monthly, depending on the number of overtime hours he works at his day job, and how much business his lawn-care company drums up. He recently got a promotion at work that puts him at a base salary of $120,656. With a $10,000 annual bonus and all of the overtime he’s accrued, he’s on track to earn more than $200,000 this year.

Sanchez dropped out of college, so he does not have student loans. The utility company he works for paid for his training, and he often works Monday through Saturday, typically 60 hours per week, depending on the company’s needs. If there is a storm or something else goes wrong with the utility wires, he’s expected to be on call. He will also occasionally travel to help areas hit hard by storms or other emergencies.

Alex Sanchez (far left) and his fellow linemen.

Courtesy of Alex Sanchez

It’s physical work that Sanchez enjoys. Some days he’s in the office, but most days he’s out in the field, replacing conductors and installing new electrical lines.

“There’s no better feeling than turning the lights on when everyone’s relying on you,” he says.

On top of his day job, he brings home an additional $3,100 per month, on average, from his side hustles. Sanchez runs his own lawn-care and snow-removal company, which grosses around $9,000 to $10,000 per month. After expenses, including taxes, salaries and other overhead, Sanchez earns around $1,500 per month, though it varies depending on the season.

Sanchez owns three rental properties, including an apartment, a condo and a single-family house that he co-owns with his mother. The properties gross $3,825 per month, and he takes home $1,600 per month, after expenses like taxes and insurance. His mother makes $500 from the property she co-owns with him.

Alex Sanchez is an overhead lineman for an electrical utilities company.

CNBC Make It

With his side hustle income, Sanchez is on track to earn more than $230,000 this year. His goal is to keep growing that total each year, as he adds rental properties to his portfolio and moves up the ladder at work.

How he budgets

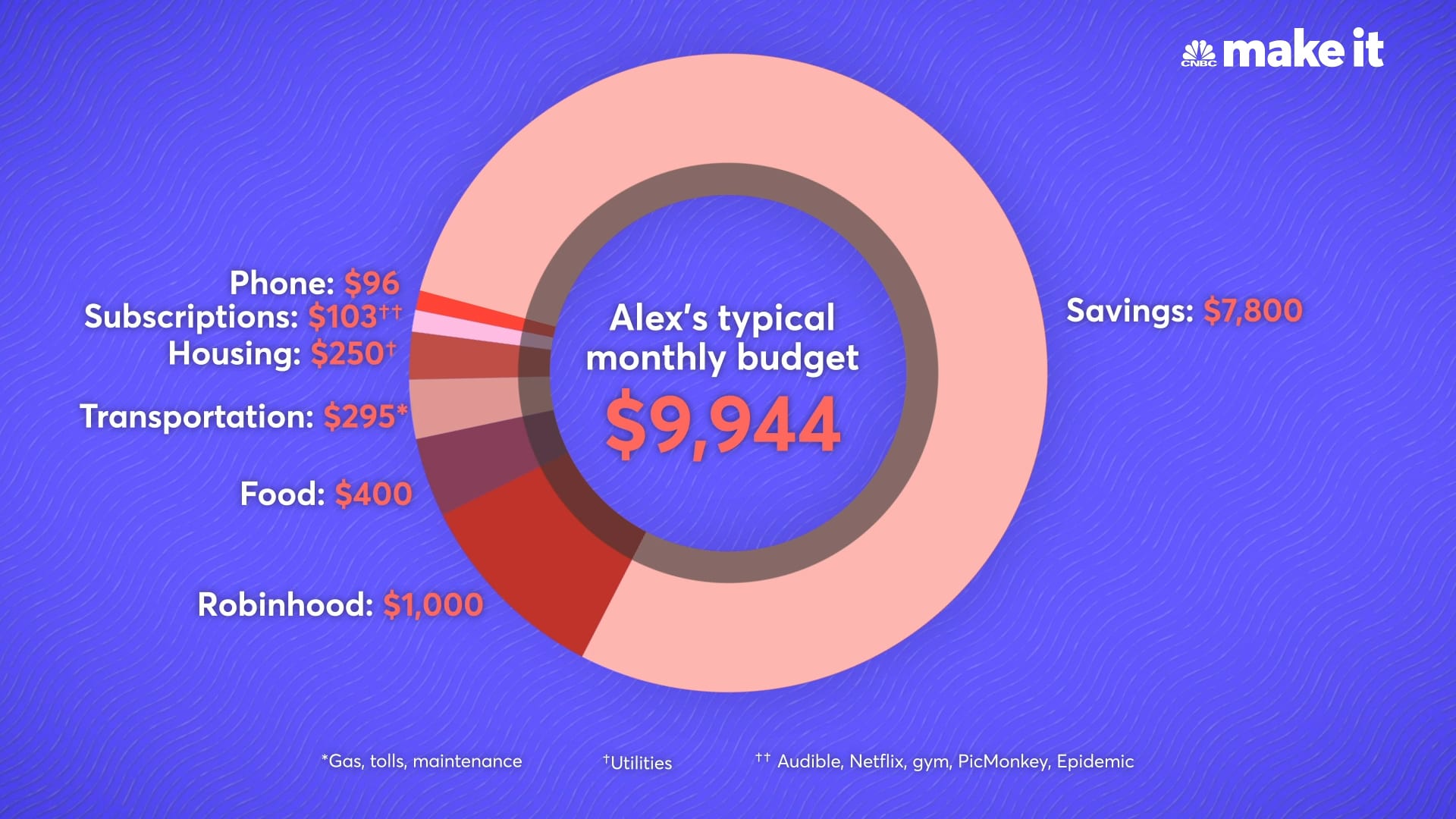

Here’s a breakdown of everything Sanchez spends in a typical month.

Business expenses: $8,850

Depending on how many jobs he books, Sanchez spends around $7,100 each month to operate his lawn-care business. That includes salaries for his brother and one other employee, overhead expenses, taxes and insurance

He has paid off the mortgages on two of the three rental properties he owns (he paid in cash), while he put 20% down on the third. Including taxes, maintenance, insurance and the mortgage for his newest property, he spends $1,750 per month for his current real estate portfolio.

Alex Sanchez owns and operates Excel Lawn Care & Snow for extra money.

CNBC Make It

Saving up the cash to buy the first two properties outright was important to Sanchez. He paid $68,000 for the condo last fall, and split the cost of the $92,000 house with his mother earlier this year.

“I knew that if I was going to invest in real estate that I would need a lot of money,” he says. “I took on side hustles, I worked as much overtime as I could at work and I just kept my expenses as low as I could.”

Savings: $7,800

Sanchez aims to save $7,000 in cash each month, and contributes $800 to his 401(k). Right now he is prioritizing building up his liquid savings so he can buy more rental properties — his goal is to amass a portfolio of 20.

Plus, he’s already thinking about the possibility of marriage and a family. Aiming for early retirement, he wants to save as much as possible now so that when he does have children, there’s less pressure to save so much.

“I definitely try to save as much as I can,” he says. “I wasn’t raised with money, so I feel like that just pushes me, because I want to work harder to one day become wealthy.”

Robinhood: $1,000

Sanchez is very interested in the stock market and eventually wants to start day trading. On top of his retirement account, he invests an additional $1,000 per month using Robinhood, an investment app. Right now, he has more than $17,000 in investments in the account.

“I was never really taught how to manage money. I just knew my mom saved money, and she would always tell me to save,” he says. “Later, I realized that it has no point if you don’t invest it.”

Food: $400

Outside of his businesses, savings and investments, Sanchez tries to spend less than $1,500 per month on personal expenses, of which food is his largest spending category. He doesn’t eat out often, though occasionally he and Rosy, his girlfriend of five years, will go into the city of Chicago to enjoy a date night, costing around $100 per month. He cooks most of his meals at home, spending around $300 per month on groceries.

Transportation: $295

Saving such a high percentage of his income allowed Sanchez to quickly pay off his 2011 Ford Edge, so he doesn’t currently have a monthly loan payment. He spends around $200 in gas and $95 in tolls and maintenance.

Housing: $250

Sanchez lives with his mother and brother in the house where he grew up, and the mortgage is paid off. He covers utilities, including gas, hot water, electricity and trash service along with any maintenance issues. His brother pays for Wi-Fi. While his parents are separated, his father lives close by and visits Sanchez and his brother often.

Not every 24-year-old with a serious girlfriend would opt for this kind of living situation, but to Sanchez it makes perfect sense. He plans to live at home for a few more years, until he’s comfortable with his financial progress. The savings is well worth any potential privacy issues, and he likes that he’s able to help his mom out.

“I do plan on getting married and having kids, I’m just not in a rush,” he says. “Maybe I’ll have kids at 27, 28, but having three years of working, saving and investing will put me pretty far ahead, so I don’t have to put in as many hours when I have kids.”

‘Fun’ budget: $150

On top of the $100 restaurant budget, he allocates another $150 to “fun” each month. This money funds nights out with friends or other excursions with Rosy.

Sanchez makes a very conscious decision to not spend much on discretionary expenses. He says this goes back to one of the biggest lessons he’s learned about money: It is easy to make, but hard to keep.

Alex Sanchez and his dog Bella.

“Money to me represents your time. Every time I see a dollar, I see that dollar as my time, and time is the most important thing to me,” he explains. “The reason I don’t spend money on dumb things is because if I throw money away, I’m throwing my time, my life away — and it’s just something I’m never going to get back.”

His one recent splurge is a tattoo that he got in honor of one of his best friends, who died in 2018. Encompassing most of his left forearm, he has spent $500 on it so far, and plans to spend around $1,000 more.

“It’s just something that means a lot to me,” he says. “I’m not going to penny pinch on something that’s really important to me.”

Everything else:

- Insurance: $208 (includes health, dental, vision and car insurance)

- Travel: $100

- Subscription services: $103 (includes gym membership, Audible, Netflix and video software)

- Pets: $30 (includes food and toys for his dogs, Bella and CiCi)

How he intends to reach financial independence

Sanchez wants to become a millionaire by 30. He plans to do that by building up his real estate business: He wants to acquire four new properties each year for the next five years, for a total of 20 units. That passive income stream coupled with his savings rate and other investments makes him confident he’ll reach his goal.

“I definitely encourage other people to look into real estate,” he says. “It’s something that technology will never be able to replace. People always need a place to live, no matter what, even if the economy is bad.”

Alex Sanchez puts a down payment on a new rental property.

CNBC Make It

Not everyone would want to operate two small businesses on top of a 60-hour-per-week job if they didn’t have to, but Sanchez doesn’t mind: “It’s just something that was in my DNA.”

“Ever since I was young, I just liked the idea of having money,” he says. “I would sell lemonade when I was a kid, I would go out door to door selling candy bars or rake [neighbors’] leaves.”

Sanchez doesn’t budget. Instead, he focuses on how much he’d like to save each month.

“If I know I’m having $10,000 come in for the month, I try to save 80% of the income,” he says. “If I hit the goal, I don’t worry about the budgeting. If I don’t hit it I go back and say, ‘OK, what did I do wrong?'”

His money mindset is infectious. His younger brother, Oscar, who is attending college but still lives at home, says he used to live paycheck to paycheck but has made some changes as his older brother has shared some of his personal financial wisdom. Oscar recounts a time when they both were heading out for the day, and Alex took the time to explain the stock market to him for 30 minutes.

Now, Oscar is trying to save more money, too.

“The way he thinks about money is pretty advanced for someone his age,” says the 20-year-old of his older brother. “He’s a pretty straight arrow. He’s very frugal, but not in a bad way. He’s sure of what he doesn’t value.”

What the experts say

CNBC Make It asked Barbara Ginty, a certified financial planner and host of the “Future Rich” podcast, to comment on what Sanchez is doing right with his money and where he could improve.

Courtesy of Barbara Ginty.

Max out the 401(k) contributions

Right now Sanchez is on track to contribute $9,600 to his 401(k). But given his savings rate, he could easily invest $19,000, the 2019 contribution limit. And that will help bring down his taxable income.

Focus on the real estate side hustle

Building his rental property portfolio is a smart way to FIRE, says Ginty. Even if he were to eventually drop his day job, he’d have a virtually passive income stream. If he wants it to be truly hands off, Sanchez could hire a management company to handle tenant relations.

“If you struggle to get employees or they are problematic, you might struggle to grow the lawn business,” says Ginty. “With the real estate, that seems like a business you could grow more easily when you are working a full-time job.”

Alex Sanchez’s dog Cici.

CNBC Make It

She suggests that Sanchez continue to live at home as he builds up his savings, and use the income from his day job to invest in his businesses, which could allow him to work on his own terms in a few years.

“[Real estate] is great income, so do it as long as you can,” she recommends. Once Sanchez expands his businesses, “he can use that income to help his parents retire if they are not in the position to do so on their own.”

Spend more on yourself

Ginty points out that Sanchez could spend a bit more on himself each month. Working toward his goals is admirable, but more date nights with Rosy or quality time with his brother and parents might add to his happiness now, considering he’s able to save so much money. Dropping a few dollars on experiences with friends and family wouldn’t really hurt his bottom line, and his parents likely want him to enjoy some of the fruits of his labor.

That said, if allocating his money how he does currently makes him happy, and he’s laser-focused on helping his parents, there’s no reason to change.

Alex Sanchez owns a lawn and snow removal business.

CNBC Make It

“He could allocate some more money in his budget, if he chose to, for discretionary use,” she says. “But if his goal is FIRE, he is doing the right thing by having such a high savings ratio.”

He’s doing a ‘great job’

At his current rate, Sanchez is saving 46% of his income, an impressive feat, says Ginty, that puts him on track to FIRE. (He saves or invests a total of $8,800 out of his $19,250 monthly earnings.)

“If you do want to be part of FIRE, I think it’s really important that you have multiple income streams, and he is accomplishing that,” she says. “It’s incredible that he’s saving that much.”

Building up a passive income stream with the rental properties is a great way to approach it, she says. Ultimately, all of Sanchez’s hard work now will give him freedom in the future.

“Not to say that you sit at home and never work again, but it will give him more control over his future,” she says. “He doesn’t have to stay [at his current job] until he gets his next job, he can live off of rental streams for support. That’s a nice place to be.”

What’s your budget breakdown? Share your story with us at makeitcasting@nbcuni.com for a chance to be featured in a future installment.

Don’t miss: How a 25-year-old making $70,000 in New York City spends her money