Tens of thousands of ships sailing the world’s oceans currently burn more than 3 million barrels a day of a high sulfur, sludge-like fuel, but starting next year the shipping industry will have to comply with rules to dramatically reduce sulfur emissions.

The change, mandated by the United Nations International Maritime Organization (IMO), is significant. The industry now burns fuels with a sulfur content of as high as 3.5 percent and will have to cut back to 0.5 percent.

For the world transportation market, the change is profound because shipping fuel is literally from the bottom of the oil barrel, like asphalt. The new fuel, however, will be much more refined and more like the lower sulfur diesel used by truckers and in jet fuel.

While huge investments have already been made, the change on Jan. 1 could send ripples through the transportation industry, causing estimated price spikes of 20 percent or more for fuel of all sorts.

As a result, cargo prices, airline tickets and the cost of sending a package could rise. Some analyst say there could even be temporary fuel shortages, as refiners and transport companies scramble to meet the needs of the shipping industry.

Ships can get avoid using the new fuel, which will be more expensive, by equipping themselves with multi-million dollar scrubbers to limit sulfur emissions from the current fuel. But a limited amount of ships can make those changes because it is costly and it may not be worthwhile on an older vessel.

The new regulations are the result of a recommendation that came from a subcommittee at the United Nations more than a decade ago and was adopted in 2016 by the UN’s IMO, which sets rules for shipping safety, security and pollution.

More than 170 countries including the U.S. have signed on to the fuel change. Starting in 2020, ships found in violation of the new laws risk being impounded, and ports in cooperating countries are expected to police visiting vessels.

“This is the biggest change in fuel specifications since lead was taken out of gasoline, and it’s global,” said Tom Kloza, head of global energy analysis at Oil Price Information Service. The phaseout of lead additives in fuels first began in 1970s but was mostly eliminated in the 1980s, and the final additives were banned in the 1990s.

The shipping industry will have to make its switch over to the new fuel on a hard deadline.

Some companies have added new ships that run on liquified natural gas, but that is limited. Fleets are expected to increasingly add LNG fueled ships but the transition could take a number of years. The shipping industry now uses more than 5 million barrels of fuel a day, including the high sulfur fuel, lighter marine fuel and a tiny amount of LNG, according to Citigroup.

“The fuel now used in shipping is the bottom of the barrel. It’s a very heavy black diesel oil that shippers use because it’s cheap. It also is one of the most polluting fuels. So it’s understandable people would want to regulate it. The whole purpose of this regulation change is to protect human health. That’s why it was proposed in 2007,” said Rick Joswick, head of oil pricing and trade flow analytics at S&P Global Platts.

While big shortages of marine fuel are not anticipated, the price of diesel, used in trucking, could temporarily jump and become more volatile starting in the fourth quarter as ships begin to fuel up for long journeys, energy analysts say. The actual impact is difficult to measure, because it will also be driven by oil prices, and it could affect other fuels too.

“We’ve been heavily involved in tracking this for the past year. It’s going to increase the cost of fuel,” said Glen Kedzie, vice president and energy and environmental counsel for the American Trucking Association, which represents more than 800 trucking fleets. “You will not come across any study that says this will make fuel prices cheaper. The fact is we’re kind of shifting the dynamics of who is competing for the middle blend of distillates. You’re kind of pushing another industry into that sector that includes heating oil, jet fuel and transportation fuel.”

By extension, that means that businesses that use these fuels — from airlines to container shippers to farmers and trucking firms — will pay higher prices and could potentially pass along any price hikes to consumers. It’s also conceivable that refineries could replace some of their gasoline production with marine fuel, if prices go high enough, analysts say.

“There’s enough of the new fuel. It’s never been a question of the refineries’ ability to supply the fuel. It’s really a matter of what price ships are going to have to pay for essentially diesel fuel. It’s a switch from high sulfur, low value fuel which was also sold for less,” said Kurt Barrow, IHS Vice President of Oil Markets, Midstream and Downstream. “The refiners have always been willing to provide diesel. It’s just a matter of the cost associated with that, particularly when you have a 3 million barrel overnight change. We’re going to increase crude runs. We’re going to utilize the global refinery system.”

Kloza said the price of truck fuel diesel at the pump could rise above $4 per gallon, from the current national average of about $2.95 per gallon. “Higher prices for diesel and for freight, for shipping by trucks, they work their way through the system and they’re passed along as inflation. When you have higher prices for diesel for a sustained amount of time, it’s not something that resonates through the population like with gasoline, but it’s something that can resonate through inflation and raise the price of goods a little bit.”

While the price of all fuels could rise, Goldman Sachs commodity strategists in a recent report said they do not expect a big impact on distillate prices or supply because of anticipated weaker demand for diesel from truckers and lower oil prices. They also expect more ships to add scrubbers.

Eric Lee, Citigroup energy analyst, however, said it’s likely fuel costs will rise, starting at the end of the year, and refiners’ margins on diesel will also rise. In one scenario, if Brent crude reaches $70 in the fourth quarter, he said diesel fuel could rise to as much as $3.35 per gallon. He said gasoline prices could also rise.

Joswick said the wholesale price of diesel could rise by 20 percent to 25 percent as the shipping industry changes over. “This will hit the market probably in the third quarter. Right now, it’s totally under the radar with respect to prices … and it’s understandable. Bunker fuel is just something that makes people’s eyes glaze over,” he said.

“Things like diesel fuel and jet fuel would go up. It’s not the 3 million barrel a day market. It’s the much larger diesel and jet fuel market,” said Joswick. “The diesel market is about 30 million barrels a day. The jet market is about 8 million barrels a day. This 3 million swing in bunker fuel will affect the 38 million and the 3 million barrels of diesel fuel it uses.”

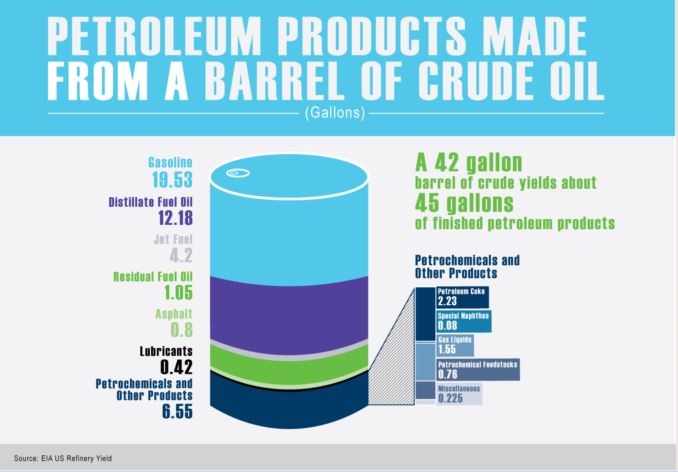

Each barrel of oil that enters a refinery contains the makings for a range of fuels, the prominent one being gasoline. A certain amount is refined as high sulfur fuel and also asphalt, at the bottom of the barrel. There is the middle of the barrel, which provides the lower sulfur distillates — diesel, jet fuel and heating oil. Gasoline and lighter fuels are at the top. Kedzie said the marine fuel is from that middle tier, and could also be made by blending a higher sulfur fuel with diesel.

“There’s a school of thought that thinks the new shipping rules will trigger a Y2K, and there’s a school of thought that thinks it will cause the next Apocalypse. I’m leaning toward quite a bit of disruption and impact on prices. It’s really going to have an impact on the vessels and what they have to use,” said Kloza. “For diesel, I think it’s going to mean that diesel prices on the coasts of the United States are going to be significantly higher than they are on the interior.”

Sulfur emissions from ships are currently very high, and Kloza said one study showed the annual emissions from one large container ship was comparable to the emissions from 10 to 15 million cars running on diesel fuel.

“On the diesel side, I think it’s clear it’s got to prop up diesel prices so there’s the potential possibility of a spike in diesel prices next winter, and heating oil,” said Kloza. “You’re talking about rolling out a new marine fuel right in the winter of the northern hemisphere.” He added, “If that market for marine fuel is high enough, the stuff that normally gets turned into gasoline and on road diesel is going to go to the vessel market.”

But Citigroup’s Lee and other analysts said there could be a response from President Donald Trump if diesel or other fuels rise very much. The president has periodically lambasted OPEC for high oil prices, including in a tweet on Monday that knocked the price of crude down by three percent.

“If you have this combination of a pick up in diesel prices, gasoline prices and shipping costs are higher, freight costs are higher and that filters through to other commodities. It’s the kind of thing the White House might be inclined to delay or push back on,” said Lee. “There will be some headline risk out of the White House, there could be other tweets that push us back late this year, early next year, as it’s an election year.”

While Trump could allow lax enforcement of the new regulations, ships traveling the world would still have to be in compliance if they wish to stop in other ports outside of the U.S. that are enforcing the new regulations. Analysts expect about 15 percent of the ships on the high seas to be non-compliant.

If fuel prices rise too much, the refining industry could be self-policing, and move quickly to provide more fuel. “My thing is the refining industry has a good track record of averting disaster. While it is concerning, I wouldn’t panic over it. There’s no greater incentive to race more production than if prices skyrocket,” said John Kilduff, partner with Again Capital.

The concern is that the rule change is global, and the U.S. is far from the largest user of high sulfur fuel with Singapore and Rotterdam being major bunker ports. “You’re going to have a lot of folks competing for a fixed asset, and it’s a global market,” said American Trucking Association official Kedzie. “Just because it might be refined here doesn’t mean it has to be used here. There’s no law that says any crude that’s pumped in this country or any product that’s refined in a U.S. refinery has to stay in the United States.”

The Coalition for American Energy Security said it believes the rule change provides a big opportunity for U.S. refined product exports and that recent analyses show the U.S. industry is on track to meet demand.

“IMO 2020 presents an enormous economic opportunity for the U.S. energy industry and its workers to supply low-sulfur fuels to the global market. These standards give the U.S. a significant advantage over foreign oil producers whose nations haven’t made necessary infrastructure investments,” a spokesman said.

Ultimately, the markets should calm down, but it’s difficult to tell just how much volatility there will be and how high prices could go, with the price of crude a major mitigating factor. Joswick said the heavy sulfur fuel is from about 3 percent of the world’s oil output.

IHS Markit’s Barrow estimates that perhaps 600,000 barrels a day of the higher sulfur fuel will continued to be used by ships with scrubbers. “Ships can either buy this new fuel which is more expensive or they could spend a few million dollars of capital to install a scrubber. We’ve seen a significant increase in orders and installation of scrubbers starting in 2018,” he said.

“Another 400,000 or 500,000 [barrels of bunker fuel] could be in noncompliance….Our analysis says some of the ships coming out of the ship yards will be designed with more efficient engines that use the new fuel,” he said. “Some in certain kinds of trade, particularly container vessels, those are in the future going to use LNG. Some cruise ships have put on scrubbers.”

Carnival, for one, said it already has scrubbers on most of its ships, and it has plans to add 11 LNG ships to its fleet over the next five years. “The Advanced Air Quality Systems (generically known as exhaust gas cleaning systems, or scrubbers) are installed on 71 of the company’s more than 100 ships and, through extensive independent testing, the systems have proven capable of outperforming low-sulfur fuel alternatives such as marine gasoil (MGO) in terms of cleaner air emissions with essentially no negative environmental impact to oceans and seas,” a spokesman said in an email.

Randal Mullett, transportation industry consultant with Mullett Strategies, said shippers will find ways to save on fuel costs.

“They’ve indicated they’re anticipating huge increases in their costs, and perhaps there are some other implications, like they revert to slow steaming to save fuel. That has big implications on supply chain,” he said, noting cargoes could arrive days later than normal if ships slow their travel speed.

Some analysts say the cost to shippers could rise by a third or more if they have to switch from high sulfur fuel to low sulfur fuel.

Joswick said he expects U.S. refiners to easily handle the increase in marine fuel.

“Refineries have a certain amount of flexibility and they respond to price. They all run their models to simulate how they can get the best margins,” he said. “U.S. refiners are very well positioned to do this. Refineries in Europe will be more challenged. The effect of this is price has to move [higher] for this to happen.”

Lee said the complex refiners along the Gulf Coast will benefit from the fuel change and they can easily respond to the demand. “The U.S. is very well positioned,” he said.

He said the adjustment period for the transportation industry could last a few years.

“By 2022, into 2023, prices will have normalized and there’s a new mix of fuel use in the shipping sector. On day one, diesel demand jumps and high sulfur fuel demand drops significantly,” Lee said. “Scrubbers are being installed and refiners are building more capacity. They aren’t doing it all on day one. It’s more a slow progression.”