The banks have been under fire this week.

The KBE bank ETF has tumbled 6 percent since Monday with major banks like Citigroup and Bank of America tanking by more than 8 percent.

After sounding the alarms for the group, Matt Maley, equity strategist at Miller Tabak, has had a change of heart.

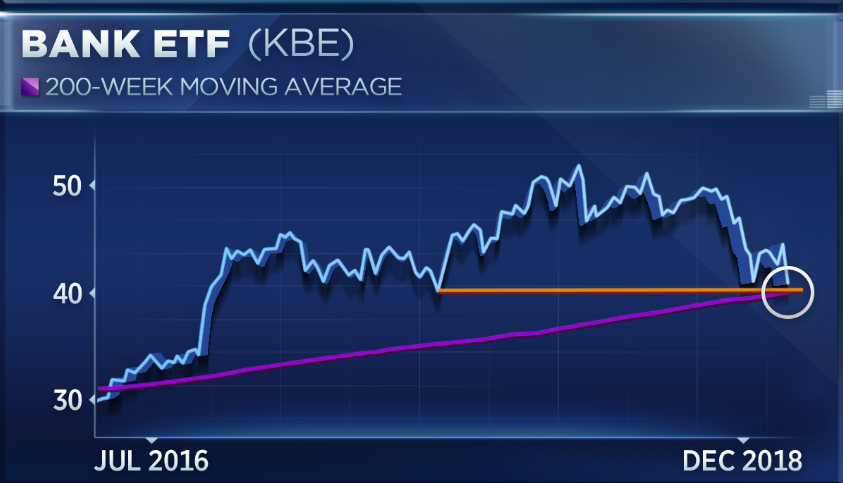

“I’ve been very bearish on the group all year long but we’re now getting to some levels here,” Maley said Thursday on CNBC’s “Trading Nation.” “If you look at the KBE bank ETF which just has banks in it and no credit cards or insurance companies, it’s getting down to its 200-week moving average. That level is also the same level that we saw at its lows in 2017.”

“That area should provide good support for the group given how oversold it’s become after its 21 percent decline,” he added.

The KBE ETF has fallen 12 percent so far this year, and is down 20 percent from 52-week highs, pushing it into a bear market.

This bond market rally also looks as though it’s getting to extreme levels and any weakness should be a positive for the banks, said Maley.

“Sentiment amongst the futures traders in the bond market, it’s up to 93 percent bulls so on a short-term basis, it looks like everyone’s on the bullish side, everybody’s looking for lower rates,” said Maley. “These bonds are getting ripe for a sell-off which of course would take rates higher which should give the bank stocks a great opportunity to see a sharp bounce.”

Bond yields move inversely to bond prices. Higher bond yields and a steepening yield curve benefit banks by beefing up profit on the spread between longer-term loans and shorter-term liabilities.

“If you don’t like the banks and you want to sell them, I think you’re going to get a better opportunity to do it later this month,” said Maley.

Stacey Gilbert, market strategist at Susquehanna, said the options market is not pricing in any kind of upside from here.

“Overall it continues to be cautious,” Gilbert said Thursday on “Trading Nation.” “Even with this pullback, we’re not seeing any one positioning for some sort of rally here even if it’s a dead cat kind of bounce.”

The KBE ETF is down 10 percent for the fourth quarter, tracking for its worst performance since 2011.