Stocks have a good chance of trading higher in the week ahead, if the typical Thanksgiving holiday week trading patterns take over.

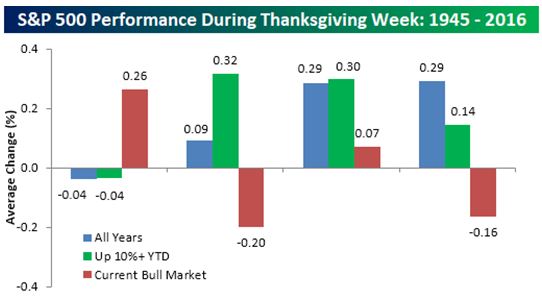

The S&P 500 has averaged a gain of 0.6 percent during Thanksgiving week, and has been higher 75 percent of the time since 1945. In the years when the market is already up 10 percent or more, Thanksgiving week was even stronger — gaining nearly 0.8 percent on average, according to Bespoke.

In the past week, the S&P 500 and Dow finished slightly lower, ending their worst two-week streak since August. The Nasdaq, however was in the green, up a half percent in its seventh positive week in eight. All three are within about 1 percent of their record highs.

Trading was choppy with the focus on tax reform, and an eye on the credit markets. High-yield debt sold off for part of the week, and the flattening yield curve, a technical phenomena in the Treasury market continued to cause unease.

Stock traders fear a flatter curve means a weaker economy is on the horizon. In this case the 2-year yield rose closer to the 10-year yield. At 62 basis points, the distance between them reached a 10-year low. The real concern would come in if the curve inverted, with the 2-year rising higher than the 10-year yield.

“I wouldn’t read too much into one week. The historical trend is a strong stock market through the year, tends to finish strong,” said Paul Hickey, co-founder of Bespoke. He said the S&P, from the closing price on the Wednesday before Thanksgiving through year-end, has averaged a gain of about 2 percent.

Source: Bespoke

The 2-year yield rose to 1.71 percent by late Friday and is reflecting expectations that the Federal Reserve will raise interest rates when it meets in December. Markets will be watching Fed Chair Janet Yellen, when she speaks in New York on Tuesday evening, and also the minutes from the last Fed meeting, released Wednesday afternoon, for any clues on interest rates.

There is little data, but existing home sales are reported Tuesday and durable goods are released Wednesday. Earnings are expected from a few retailers, including Urban Outfitters Monday. HP and Campbell Soup report Tuesday, and Deere reports Wednesday.

“The earnings season has wound down. Now, it’s what’s the next catalyst? You have people now thinking about going forward, what is the Fed going to do?” said Hickey. “We still have to square the discrepancy between what the market thinks the Fed’s going to do and where the Fed thinks it’s going.”

The Fed forecasts three interest rate hikes for 2018, but the markets expect two at most. This dilemma appears to be showing up in the yield curve, with the lower 10-year yield reflecting global central bank easing and a lack of inflationary pressure to push the Fed to raise rates faster.

“A flat yield curve has never been precursor for recession. It’s not until the curve gets inverted,” Hickey said, adding it may not invert any time soon.

Peter Boockvar, chief market analyst at Lindsey Group, said the stock market could start showing more reaction to rising U.S. interest rates, and central banks reducing their bond purchases in the coming months.

“We’re all very focused on the U.S. market, but the European stock market has not been trading well at all,” he said. “Each day that goes by we get closer to quantitative easing in Europe getting cut in half….We have another rate hike next month. This is not just about tax reform.”

Traders have been focused on each headline from Washington on tax reform, as Congress moves House and Senate bills forward. The House approved its version Thursday, and the Senate bill will be voted on next before the two can be reconciled.

“I think they assume they’ll pass some tax reform. Maybe they’re questioning what it’s going to look like…We priced it in already. We’ve been rallying since the election,” Boockvar said.

Art Hogan, chief market strategist at Wunderlich Securities, said the focus in the coming week will remain on each detail of the tax plans. “We’ll watch how the sausage gets made and we’ll continue to react and overreact to each headline,” he said.

The week ahead also brings Black Friday, the traditional start of the holiday season, but analysts say it’s lost its importance with online shopping wreaking havoc on traditional retail.

“Because of the internet and stores changing their hours, Monday is more relevant now because everybody goes back to work and gets online,” said Boockvar. “That’s when the deals really kick in.”

Source: Bespoke

Hickey said retail stocks are already badly beaten up, but they are also entering their traditionally weak time of year, post Thanksgiving.

In the current bull market, the S&P has been virtually flat on average but it has been higher six of the eight past years.

Monday

Earnings: Intuit, ZTO Express, Urban Outfitters, Agilent

10:00 a.m. Leading index

Tuesday

Earnings: HP, Game Stop, Cracker Barrel, Chico’s FAS, Campbell Soup, Dollar Tree, Hormel Foods, Salesforce.com, Hewlett Packard Enterprises

8:30 a.m. Philadelphia Fed nonmanufacturing

10:00 a.m. Existing home sales

6 p.m. Fed Chair Janet Yellen at NYU Stern School, Q&A

Wednesday

Earnings: Deere

8:30 a.m. Initial claims

8:30 a.m. Durable goods

10:00 a.m. Consumer sentiment

2:00 p.m. Fed minutes

Thursday

Thanksgiving Day

Friday

9:45 a.m. Manufacturing PMI

9:45 a.m. Non-manufacturing PMI