Investors betting against Tesla were up nearly $800 million Thursday after the electric carmaker gave Model 3 production figures that fell way short of estimates and as the company’s chief executive officer entered federal court in Manhattan to defend against claims that he violated an October settlement with the U.S. government.

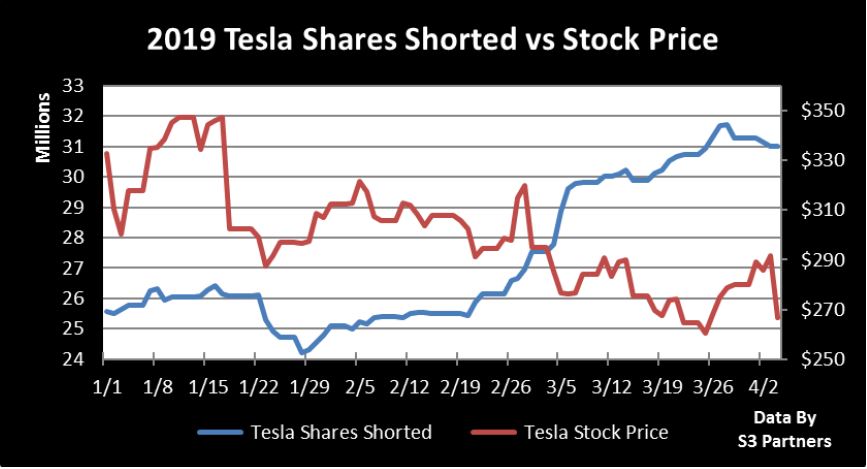

Tesla sank more than 8 percent Thursday to around $267 per share, giving short sellers betting against the stock $763 million in mark-to-market profits so far on the day, estimates S3 Analystics. Tesla’s short interest is now at $9.04 billion, with about 30 million shares shorted (25% of float) making it one of the most shorted stocks in the U.S. market, according to S3′s Ihor Dusaniwsky.

Source: S3 Analytics

CEO Elon Musk arrived at Manhattan federal court Thursday afternoon in the latest chapter of an extended battle with the Securities and Exchange Commission. The government agency is arguing that Musk broke the terms of a prior settlement by posting material company information on social media earlier this year.

In February, Musk tweeted to his more than 24 million Twitter followers: “Tesla made 0 cars in 2011, but will make around 500k in 2019.”

The SEC claims that Musk’s failed to receive approval from lawyers before posting in February. For his part, the CEO of the Palo Alto electric car maker has defended himself by saying that the tweeted information was non-material and did not need to be vetted.

“We are seeing increased short selling today as short sellers are increasing their exposure in today’s price drop and expected further weakness,” Dusaniwsky said in an emailed statement. He added that Tuesday’s price action adds to Tesla shorts’ yearly profits, and that they are now up $1.79 billion, 21.87% in mark-to-market profits this year.

Musk will try to convince the New York court that he should not be held in contempt and did not breach his settlement with the government. Tesla’s published in a press release Wednesday production numbers that not only disappointed investors, but may also make it difficult for Musk to show that his tweeting doesn’t affect the company’s value.

Said J.P. Morgan: “Full year delivery guidance was stated in the release to have been ‘reaffirmed’ at the prior level of 360,000 to 400,000 units, in our view undermining a key tenet of CEO Elon Musk’s legal defense against the SEC — that his February 19 tweet that Tesla will make around 500,000 vehicles in 2019 was not new information needing pre-approval.”