Traders work on the floor of the New York Stock Exchange, (NYSE) in New York, U.S., March 7, 2018. REUTERS/Brendan McDermid

March 8, 2018

By Sinéad Carew

(Reuters) – The S&P 500 was roughly flat on Thursday and oscillated between positive and negative territory as investors were nervous of making bets ahead of an announcement from President Donald Trump on metal tariffs after a volatile week marked by worries about a potential trade war.

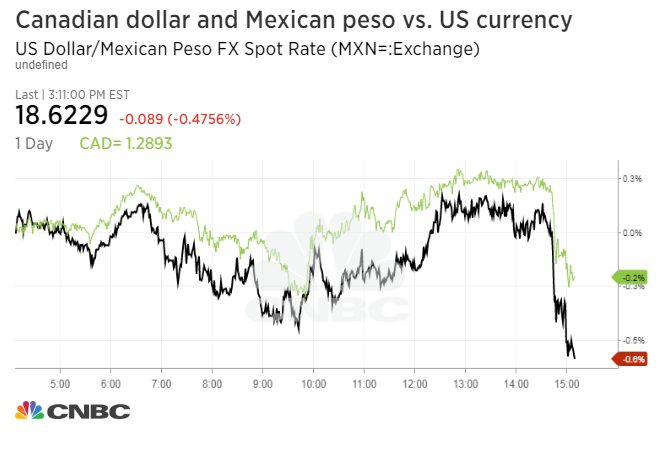

Trump is expected to formalize 25 percent import duties on steel and a 10 percent tariff on aluminum at 3:30 p.m ET (2030 GMT), after saying Canada and Mexico would be exempted if they agree on a trade deal with the United States.

But Trump told reporters ahead of the announcement that he had a right to exempt or add countries, adding to uncertainty among market participants.

Worries that the tariffs would ignite a global trade war have dominated markets since Trump announced to tariff plan last Thursday, and the exit of chief economic adviser Gary Cohn late Tuesday intensified such concerns.

“We’ve been busy buying and selling the rumor. We want to know what the news is. Announcing at the beginning of the trading day this would happen at the end was not great for market action. It ramped up uncertainty,” said Kim Forrest, senior portfolio manager at Fort Pitt Capital in Pittsburgh.

“He has a pattern of coming out hard and walking it back. Now we’ll see what he means.”

At 2:10 p.m. ET, the Dow Jones Industrial Average <.DJI> fell 69.67 points, or 0.28 percent, to 24,731.69, the S&P 500 <.SPX> lost 2.32 points, or 0.09 percent, to 2,724.48 and the Nasdaq Composite <.IXIC> dropped 1.45 points, or 0.02 percent, to 7,395.20.

Major trading partners Europe and China have warned they would respond to any action by the United States.

“If he (Trump) does announce much more draconian measures that are going to knock on to other products, I think there will be a sell-off,” said Dec Mullarkey, managing director at Sun Life Investment Management based in Wellesley, Massachusetts.

Express Scripts <ESRX.O> was among the top boosts for the S&P 500, rising 8 percent after health insurer Cigna <CI.N> agreed to buy the pharmacy benefits manager for almost $53 billion. Cigna shares were the biggest drag with a 11.2 percent drop.

Kroger <KR.N> fell more than 12 percent after the supermarket chain’s disappointing full-year profit forecast.

American Eagle Outfitters <AEO.N> fell 9.5 percent on concerns over falling margins.

Declining issues outnumbered advancing ones on the NYSE by a 1.23-to-1 ratio; on Nasdaq, a 1.23-to-1 ratio favored decliners.

The S&P 500 posted 22 new 52-week highs and 1 new low; the Nasdaq Composite recorded 145 new highs and 19 new lows.

(Reporting by Sruthi Shankar in Bengaluru; Editing by Sriraj Kalluvila and Chizu Nomiyama)