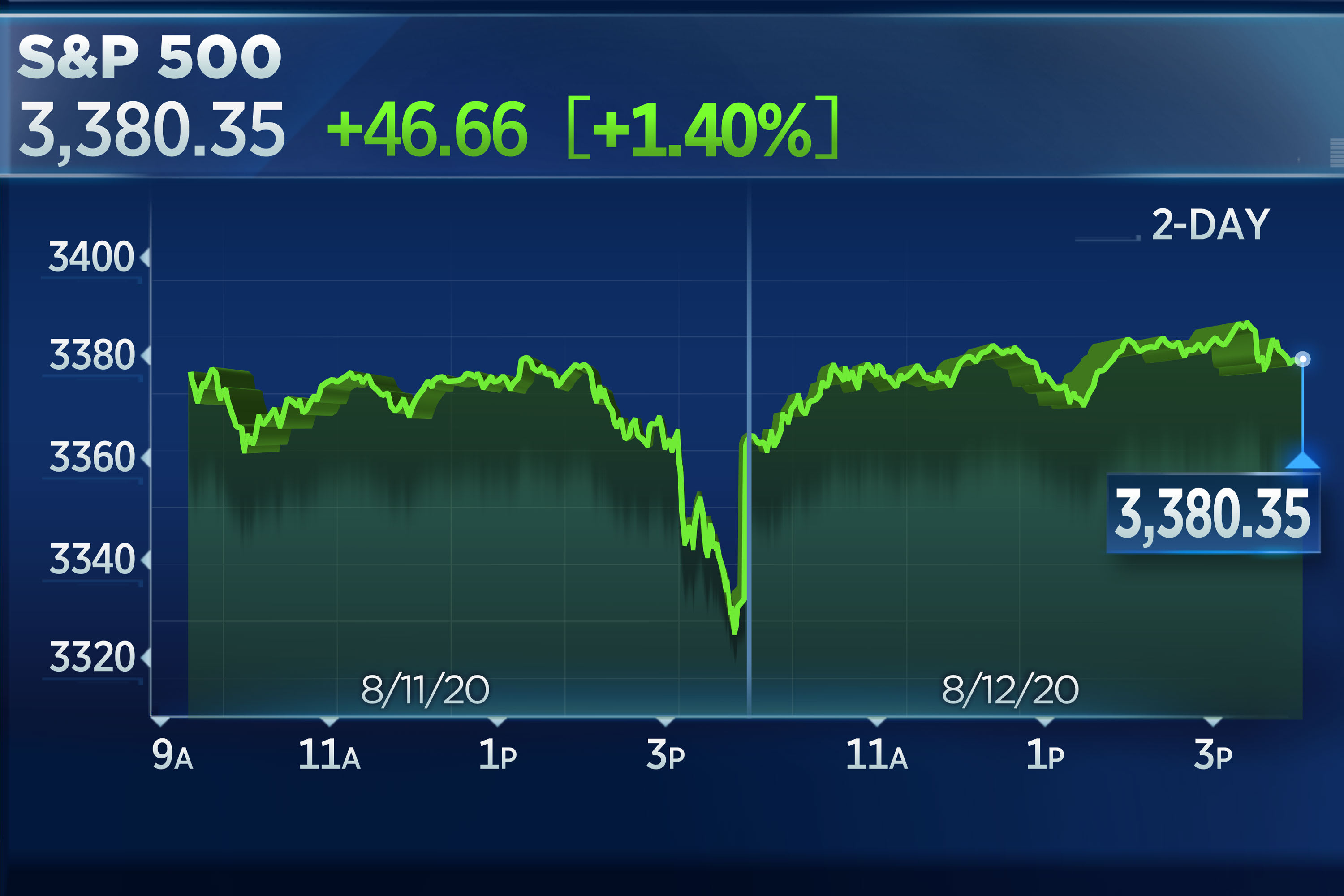

Stocks rose sharply on Wednesday, putting the S&P 500 just below its all-time high set in February, as shares of the major tech companies recovered some of their steep losses from the previous session.

The S&P 500 gained 1.4%, its biggest one-day jump since July 6, to close at 3,380.35. In the final hour of trading, the broader market index briefly traded above its record closing high of 3,386.15. The index also ended the session just 0.4% shy of its intraday all-time high of 3,393.52

The Dow Jones Industrial Average jumped 289.93 points, or 1.1%, to close at 27,976.84. The Nasdaq Composite outperformed, rallying 2.1% to 11,012.24.

Facebook, Amazon and Netflix were all up at least 1.5% while Alphabet advanced 1.8%. Microsoft and Apple gained more than 2.8% each.

Stocks that would benefit from the economy reopening lagged, however. Cruise operator Carnival dropped 4%. JPMorgan Chase, Bank of America and Citigroup were all lower.

“There’s a big debate happening in the market right now,” said Yousef Abbasi, global market strategist at StoneX. “Does the tech outperformance continue? Or does hope around a vaccine, a better-than-expected Q2 earnings season and the hope the strong economic data continues to hold up start to justify the idea that some froth should probably come out of tech?”

Abbasi noted the financials sector is one space where investors have “some interesting levers they can pull to actually generate decent performance, particularly if you believe the economy will continue to recover.”

Sentiment was also lifted in part by President Donald Trump saying late Tuesday that the U.S. government will purchase 100 million doses of Moderna’s experimental coronavirus vaccine, which is currently in late-stage human trials.

Coronavirus stimulus undertainty

Traders seemed to shrug off uncertainty over a second coronavirus stimulus bill. On Wednesday, House Speaker Nancy Pelosi said both sides were still “miles apart” on relief negotiations.

Treasury Secretary Steven Mnuchin said Monday the White House is open to resuming coronavirus aid talks with Democrats and putting more relief money on the table to reach a compromise. Those comments came after President Donald Trump signed over the weekend four executive orders to extend some coronavirus aid.

The major averages were coming off a volatile session in which steep declines from Big Tech dragged lower the broader market.

“A combination of the S&P 500 Index making its first real attempt at an all-time record high after seven straight days of advances, its old leadership — technology and FAANGs — continuing a recent trend of struggling and another day without an agreement nor even renewed talks in DC regarding a new stimulus package finally caught up with the stock market,” Jim Paulsen, chief investment strategist at the Leuthold Group, told CNBC. “The first signs of trouble today brought a lot of selling by investors anxious to lock-in recent gains.”

Subscribe to CNBC PRO for exclusive insights and analysis, and live business day programming from around the world.