Retailers are apprehensive about the U.S.-China trade war, an executive at a Hong Kong cosmetics chain said Thursday, calling the conflict the biggest risk to his company’s business.

Guy Look, chief financial officer and executive director at Sa Sa International, said that while the Hong Kong retail chain has benefited this year from increased mainland Chinese tourist numbers, concerns are rising.

“Coming in to the second half, of course, the trade war, it’s really very much in the spotlight,” Look told CNBC’s Emily Tan on “Squawk Box” Thursday.

“For us retailers, we are really exchanging notes ourselves,” he said. “We don’t really have a crystal ball. And we really want to see what is in store for us.”

Asked about the biggest risk to Sa Sa’s business, Look said: “It’s very obvious. It’s the trade war and the sentiment relating to that.”

Sa Sa reported stellar earnings for the six months ended Sept. 30 on Wednesday, with profit rising 85 percent.

In its earnings release on Wednesday, Sa Sa cited trade war uncertainty and weakness in the Chinese yuan as negative factors going forward, adding it would “expand its retail network with caution.”

After its earnings report, Citi downgraded the company to “sell,” citing China’s weakening economy as a problem.

Investor sentiment turned negative with the cosmetic retailer’s stock price closing down 10 percent on Thursday.

Look said that initial efforts to economically integrate the Greater Bay Area — which includes Hong Kong, Macau and cities in nearby Guangdong province such as Shenzhen and Guangzhou — has been positive in bringing more mainland Chinese tourists to Sa Sa stores, of which there are 16 in that region.

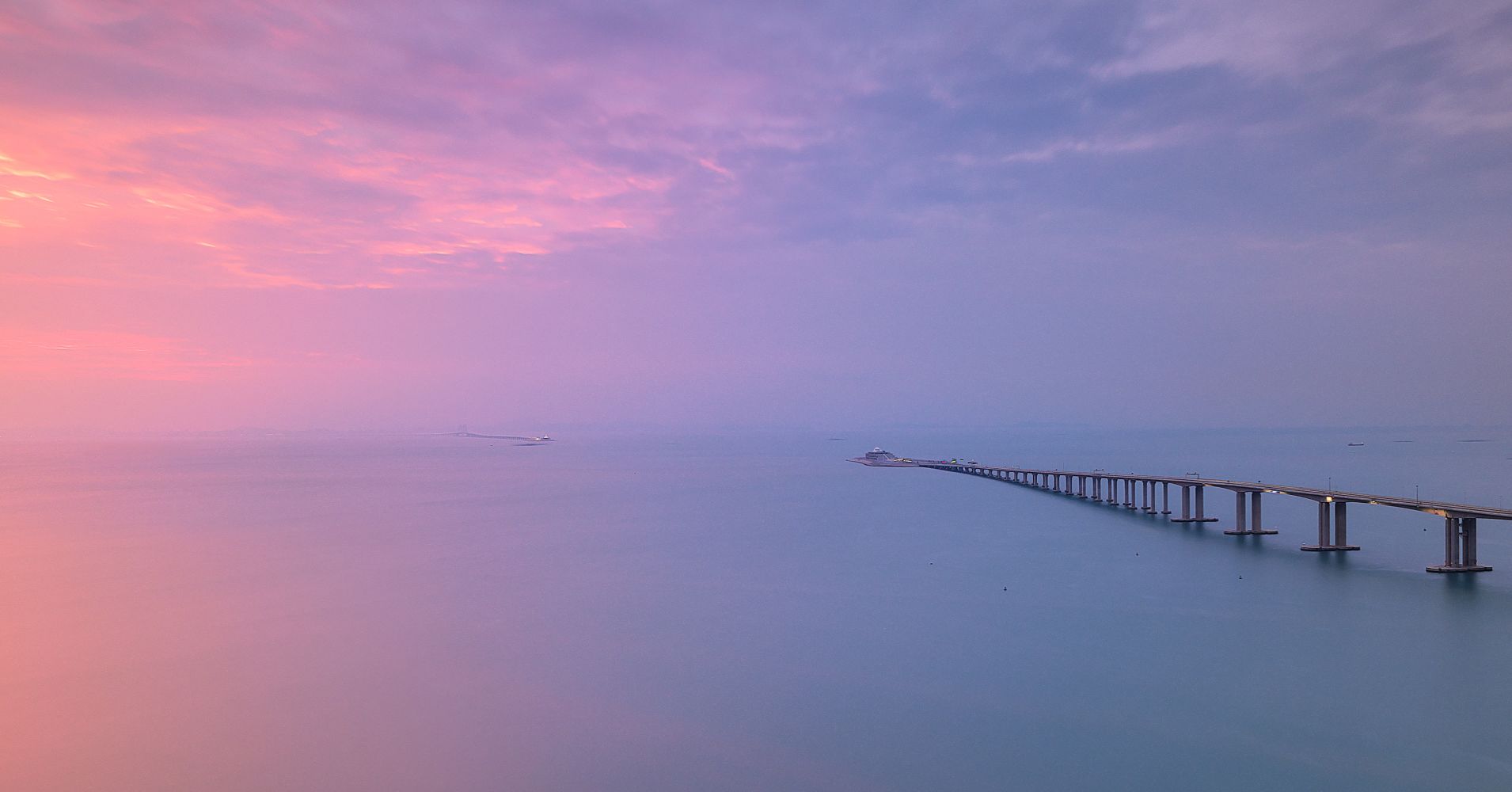

He cited benefits from the a new high-speed railway linking Hong Kong and the mainland that started operating in September as well as the opening last month of the Hong Kong-Zhuhai-Macau bridge, the world’s longest sea-crossing bridge.

In its report, Citi said: “We reckon the traffic benefit from transportation improvement may not be strong enough to offset the weakening purchasing power in the near term amid a soft economy.”

Look also suggested that the trade war had diluted some of those benefits, at least in the short run.

“We do see some weakening of sentiments in that respect,” he said, adding that spending has weakened. “And we really have to look and see what will happen.”