Even if Qualcomm declines Broadcom’s $103 billion buyout bid, shares of the chipmaker still have plenty of ways of climbing higher over the next year, according to one Wall Street analyst.

RBC Capital Markets upgraded Qualcomm shares to outperform from sector perform Tuesday, with a $70 price target, noting that Broadcom’s recent bid implied the stock could gain another 10 percent. But “with or without” Broadcom, analyst Amit Daryanani argues the stock could still gain over the next year.

“The probability of the initial unsolicited bid becoming the final bid is low and therefore think there is an upside narrative here,” wrote Daryanani in a note to clients. But even “if QCOM board rejects the offer, we think the roadmap for value creation is fairly distinct.”

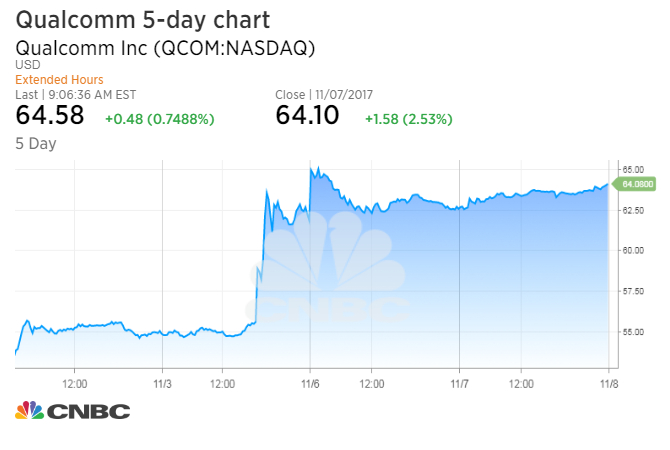

Qualcomm shares have risen roughly 17 percent since Friday, when reports of a potential bid from Broadcom first surfaced.

The $70 per share cash and stock offer would be the largest technology acquisition ever.

But even without a deal, Daryanani believes the company can grow on its own. Qualcomm’s deal with NXP Semiconductors is expected to close within the next few months, adding $1.20 to earnings per share. Qualcomm announced that it agreed to buy NXP Semiconductors for about $38 billion last year, as it seeks to expand the reach of its chips from phones to cars.

Improving relations with Apple would also bode well for Qualcomm, which supplies chips for the iPhone. The two companies have been locked in a multinational legal battle throughout the year; Apple teed off the dispute in January by suing Qualcomm for $1 billion for excessive royalties.

“Our investment thesis assumes Qualcomm and Apple should be able to resolve the dispute in calendar year 2018, possibly with Qualcomm offering some level of concessions,” added the analyst. “Should Apple and Qualcomm settle the dispute, we believe payments from Apple will resume and Qualcomm should expect catch-up payments from Apple as well.”