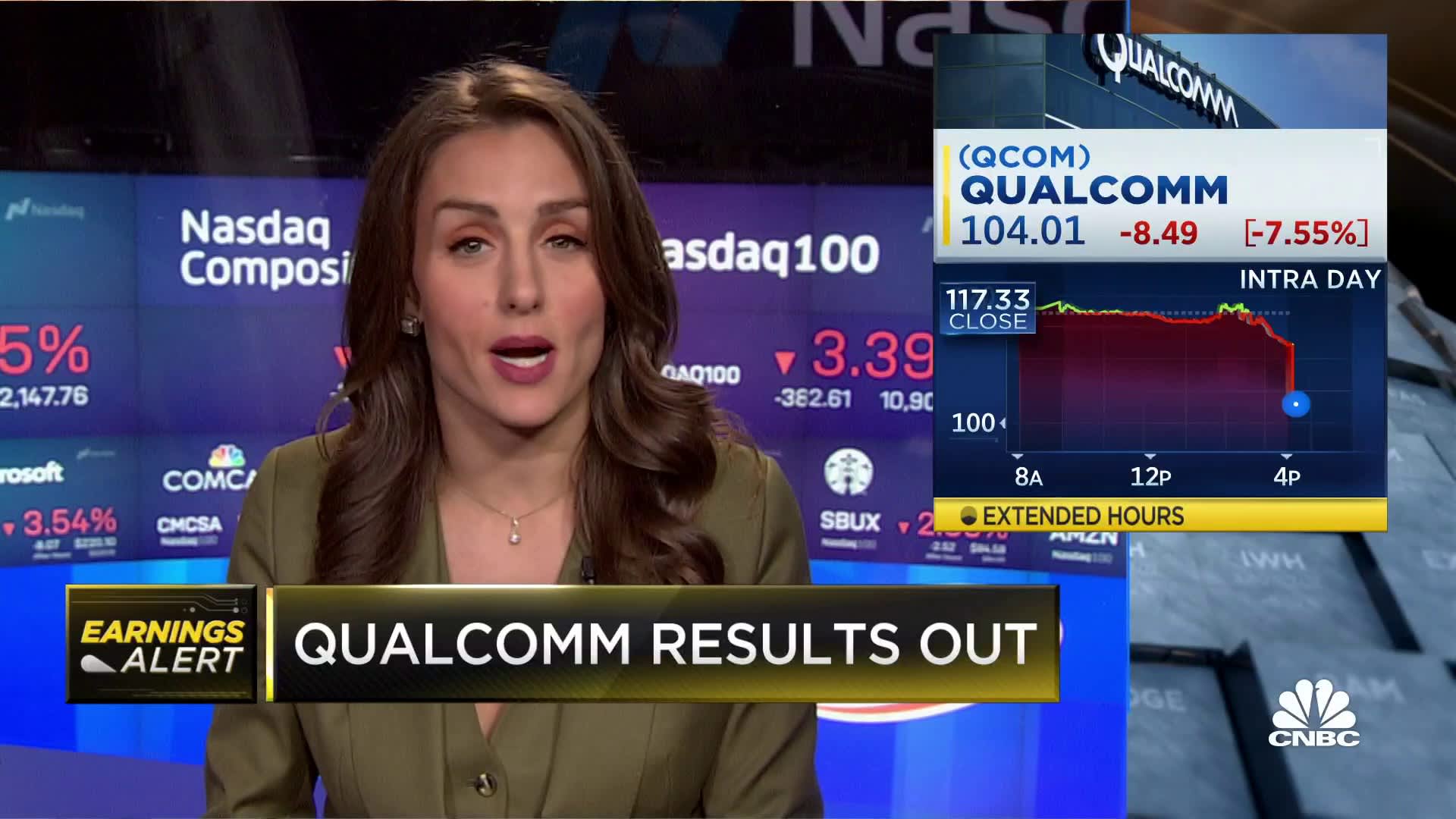

Qualcomm shares fell 7% in extended trading on Wednesday after the chipmaker reported in-line fiscal fourth-quarter earnings but offered poor first-quarter guidance.

Qualcomm also said it implemented a hiring freeze at the start of the current quarter.

Here’s how the company did:

- Earnings: $3.13 per share, adjusted, vs. $3.13 per share as expected by analysts, according to Refinitiv.

- Revenue: $11.39 billion, adjusted, vs. $11.37 billion as expected by analysts, according to Refinitiv.

Overall revenue grew 22% year-over-year in the quarter that ended Sept. 25, according to a statement.

With respect to guidance, Qualcomm called for fiscal first-quarter adjusted earnings of $2.25 to $2.45 per share on $9.2 billion to $10 billion in revenue. Analysts polled by Refinitiv had expected earnings per share of $3.42 and revenue of $12.02 billion.

“Given the uncertainty caused by the macroeconomic environment, we are updating our guidance for calendar year 2022 3G/4G/5G handset volumes from a year-over-year mid-single-digit percentage decline, to a low double-digit percentage decline,” Qualcomm said in the report. “The rapid deterioration in demand and easing of supply constraints across the semiconductor industry have resulted in elevated channel inventory.”

Revenue in Qualcomm CDMA Technologies, or QCT category, which includes smartphone chips, radio frequency front-end components, automotive chips and internet of things devices, totaled $9.9 billion. That was up 28%, and it’s more than the $9.87 billion consensus among analysts polled by StreetAccount.

Within the QCT segment, revenue from mobile handsets came to $6.57 billion, up 40% and a hair below the StreetAccount consensus of $6.59 billion. Automotive chips grew 58% on an annual basis to $427 million. Qualcomm’s IoT business, which makes low-power chips for connected devices, grew 24% to $1.92 billion. RF front-end chips fell 20% to $992 million.

The Qualcomm Technology Licensing, or QTL, the other major Qualcomm unit that’s comprised of licensing fees related to 5G and other technologies the company makes, produced $1.44 billion in revenue, which was up 8% but lower than the $1.58 billion StreetAccount consensus.

On a call with investors Wednesday, CEO Cristiano Amon said the semiconductor industry is facing macroeconomic headwinds “from which we are not immune.” He added the company has already implemented a hiring freeze and is prepared to make further reductions to operating expenses as needed.

“We are in a strong position to manage the near-term headwinds,” Amon said. He emphasized during the call that the company was facing a “temporary cyclical inventory drawdown.”

A spokesperson told CNBC the hiring freeze was implemented at the beginning of fiscal 2023.

During the quarter, Qualcomm said it had extended a patent-licensing agreement with Samsung through 2030. And Arm, which provides the chip architectures Qualcomm uses, filed suit against Qualcomm over breach of license agreements and trademark infringement.

Notwithstanding the after-hours move, Qualcomm shares are down 37% so far this year, while the broader S&P 500 index is down 20% over the same period.

WATCH: We are going through a bottoming process in the chip sector, says Piper Sandler’s Kumar

Correction: Updated to reflect Qualcomm reported $6.57 billion in handset revenue. An earlier version rounded up to $6.6 billion.