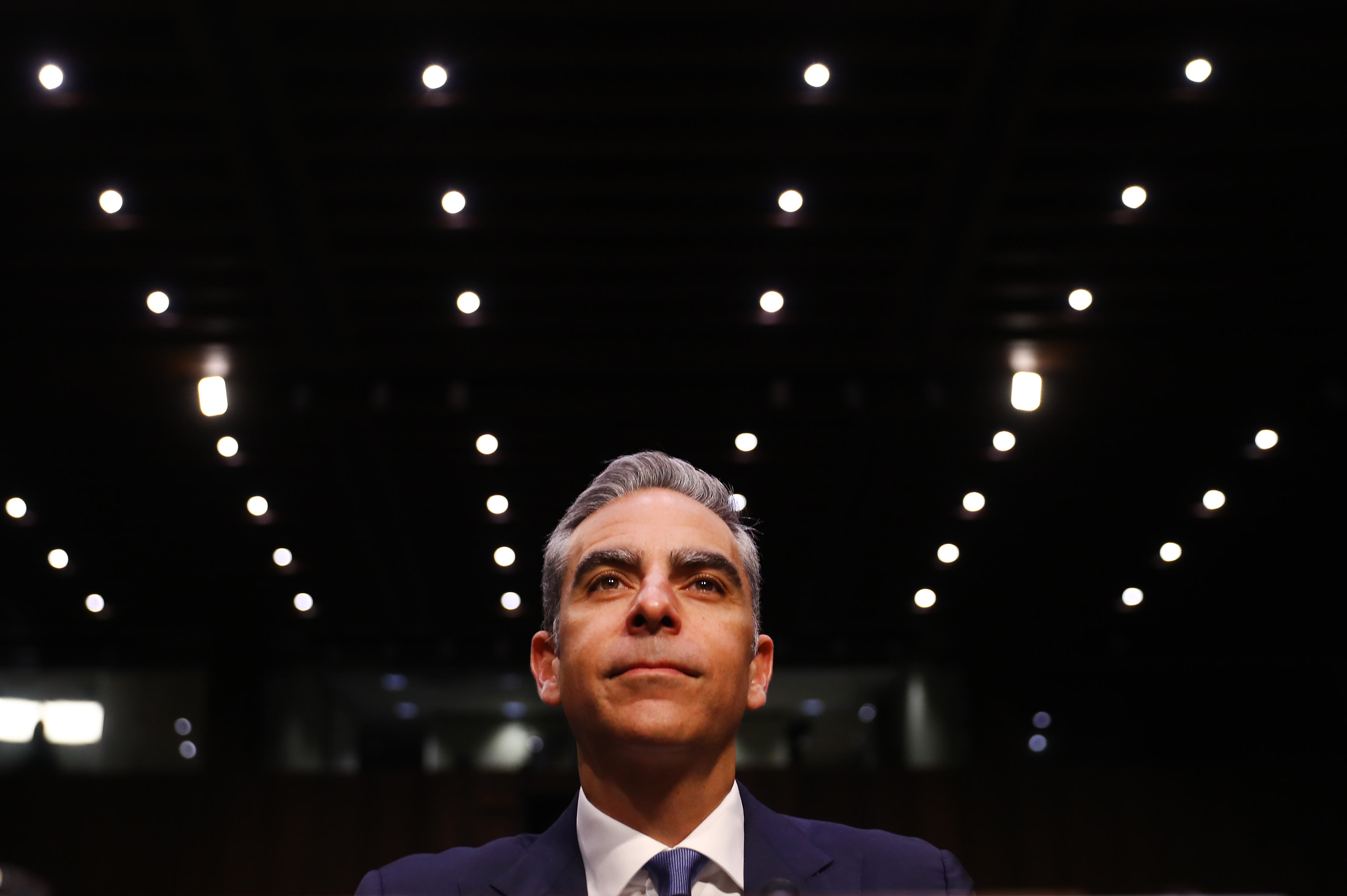

David Marcus, head of blockchain with Facebook Inc., waits for the start of a Senate Banking Committee hearing in Washington, D.C., U.S., on Tuesday, July 16, 2019.

Andrew Harrer | Bloomberg | Getty Images

PayPal is withdrawing from Facebook’s Libra Association, the company announced Friday.

“PayPal has made the decision to forgo further participation in the Libra Association at this time and to continue to focus on advancing our existing mission and business priorities as we strive to democratize access to financial services for underserved populations,” PayPal said in a statement. PayPal said it is still “supportive of Libra’s aspirations” and that it will continue to partner with Facebook in the future.

The Libra Association had been made up of 28 corporate backers including Facebook that are meant to help govern the new cryptocurrency known as libra. All founding members invested a minimum of $10 million to fund the operating costs of the association and launch an incentive program to drive adoption, according to Facebook’s initial announcement of the project. It’s unclear what happens to that investment if a backer pulls out.

David Marcus, who leads the project at Facebook, was previously the president of PayPal. Facebook has tried to mitigate lawmakers’ fears of libra by assuring them that Facebook would not have unilateral control of the currency due to the association.

But recently, that group of corporate backers has started to show some cracks. The Wall Street Journal reported that the group behind the global currency payments network is becoming fractured. Visa, Mastercard other financial partners that signed on are “reconsidering” involvement following a backlash from government officials, the Journal said, citing people familiar with the matter.

Libra was greeted with widespread criticism after announcing libra cryptocurrency in June. Facebook’s involvement caught the attention of senior congressional finance committee members, global regulators, former lawmakers and industry insiders who questioned Facebook’s motives. Federal Reserve Chairman Jerome Powell said this summer that libra raises “serious concerns regarding privacy, money laundering, consumer protection, financial stability” and the Fed had launched a working group to examine it.

Rep. Maxine Waters, D-Calif., chairwoman of the House Financial Services Committee, told CNBC in June that “it’s very important for them to stop right now what they’re doing so that we can get a handle on this” and Congress would “move aggressively” to deal with it.

Lawmakers in the House Financial Services Committee are now seeking to bring Facebook’s top executives back to Capitol Hill to testify on libra, CNBC reported Friday. Two sources familiar with the situation told CNBC that the committee has been in talks with Facebook about bringing COO Sheryl Sandberg to testify this month, but that the hearing would be contingent on CEO Mark Zuckerberg’s agreement to appear before the committee.

This is breaking news. Please check back for updates.