Oil prices extended the previous session’s losses on Tuesday, tracking the broader market as stock futures pointed to another day of sharp declines.

Crude oil futures had been climbing back toward positive territory overnight, but lost traction in early morning trade, with international benchmark Brent crude hitting a one-month low.

Brent was down 79 cents, or 1.2 percent, at $66.83 a barrel by 8:34 a.m. ET (1334 GMT) after falling as low as $66.53 earlier in the session.

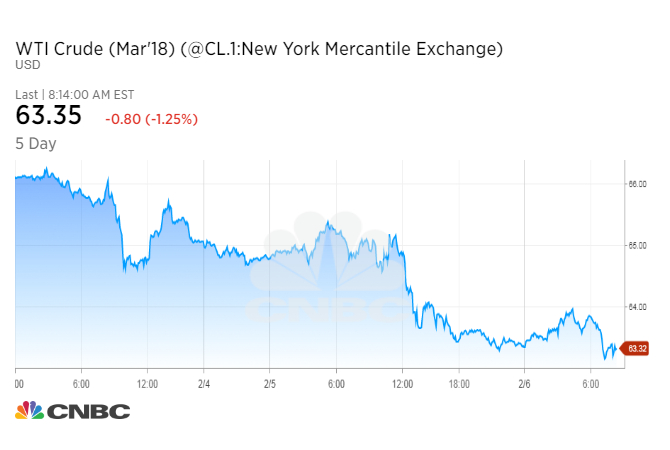

U.S. West Texas Intermediate crude dropped 85 cents, or 1.3 percent, to $63.30. It earlier fell to a more than two-week low of $63.12.

Both contracts are down nearly 4 percent since the stock market rout, sparked by concerns about rising interest rates and inflation, began on Friday.

The Dow Jones Industrial Average closed down 1,175 points on Monday, posting its biggest point decline on record. Ahead of trading on Tuesday, Dow futures were down more than 200 points in volatile trade.

“This equity market sell-off is going to bleed over here into commodities,” said John Kilduff, founding partner at energy hedge fund Again Capital.

However, Kilduff notes that the sell-off appears to be fueled by concerns that stocks are overvalued, rather than fears that the economy is slowing down. Faith in the economy would typically support crude oil futures on the view that demand for energy will continue to grow.

“It gets tricky because to the extent you see a flight to safety, which usually favors dollars and and bonds, sometimes crude gets caught up in that because it’s seen as a hard asset,” Kilduff said.

The oil market decline has also been fueled by a stronger dollar and signs of stress in the physical market for crude.

The correlation between crude oil and the dollar has reasserted itself recently. A stronger greenback, boosted on Friday by a better-than-expected U.S. jobs report, typically makes commodities sold in dollars more expensive to foreign buyers who hold other currencies.

Refineries are also preparing to shut down for maintenance, a seasonal event that temporarily suppresses demand for crude oil, the primary feedstock for refined fuels like gasoline, home heating oil and diesel.

Surging U.S. supplies also threaten to offset the impact of OPEC’s deal with Russia and other producers to limit production. U.S. oil production nearly matched and all-time record above 10 million barrels a day in November, surpassing output from Saudi Arabia.

Brent has fallen further than U.S. crude faster in recent weeks, shrinking its premium over WTI. The so-called Brent-WTI spread has narrowed to about $3.50. The difference in prices reached roughly $7 about a month ago.

U.S. crude’s significant discount to Brent has made it more attractive to overseas refiners, helping to keep U.S. oil exports stay above 1 million barrels a day. The record is just over 2 million barrels a day.