During last year’s rise in bitcoin, some first-time investors had forgotten about a downside of making money off of trades: Taxes. Millennial investors are waking up to a looming April tax filing date, which some say may be contributing to the digital currency’s sell-off below $8,000.

“For younger people who don’t have taxes top-of-mind, or have never invested before, they’re shocked,” said Cathie Wood, CEO & CIO at ARK Invest. “People had huge gains last year, and they don’t have enough in crypto to pay those.”

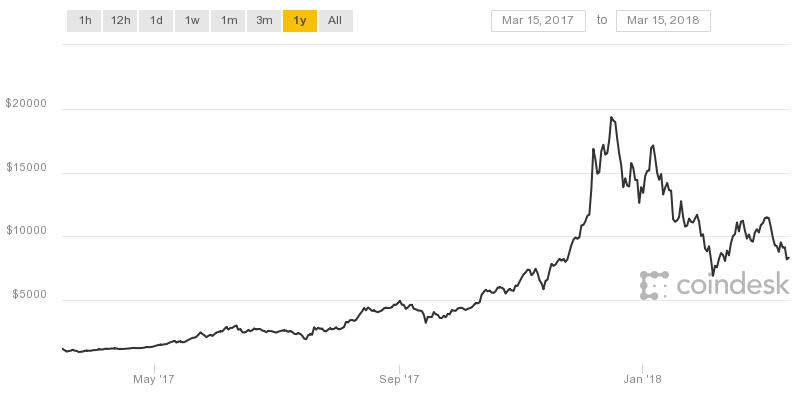

Those who traded bitcoin in 2017 had reason to celebrate. The digital currency rose 1,289 percent after starting the year around $997, according to data from CoinDesk. When the year ended on Dec 31, the price of bitcoin was above $13,000.

“I see people that bet the farm on it,” said Vincenzo Villamena, founder and CEO of OnlineTaxman.com. “They’re stuck with a large tax bill and they’re doing payment plans, or they’re selling off crypto.”

The IRS announced in 2014 that it would treat bitcoin and other cryptocurrencies as property, not currency. When you buy and sell bitcoin in the same year, it doesn’t matter if it’s traded into real money or “alt-coins,” it’s a taxable event, Villamena said. Those trades count as short-term capital gains, which can be taxed at as high as 39 percent depending on your bracket.

Bitcoin mining and airdrops (which are gifts of cyrptocurrency given by developers to drum up interest) are also taxed, but count as ordinary income, where the rate also depends on your tax bracket.

Those who hold bitcoin for more than a year and then sell it, however, are only liable for a long-term capital gain tax, which is taxed at a significantly lower rate of 15 to 23.8 percent.

Bitcoin prices are down more than 37 percent in this year, and fell below $8,000 Thursday, to a low of $7,676.52 as of 12:30 p.m. ET. Since the value of the asset has gone down, Bradley Rotter, vice chairman of Rivetz, said some millennials he invests with are selling cryptocurrency at its current level to “satisfy Uncle Sam.”

“The amount of capital gains from just U.S. investors in the rise of crypto pays for the damn wall,” said Bradley Rotter, vice chairman of Rivetz. “I think most people are just connecting those dots but its an important dot.”

While investors may not receive a Form 1099 from the exchange they trade on, they are responsible for paying taxes on these gains. The 1099 reflects income other than wages, such as freelance income or stock dividends.

“They’re in for a rude awakening in the next few days when they take their trading records into their accountants,” Rotter said.

The rise of bitcoin

Source: CoinDesk

The U.S. government seems to be taking notice, even if some investors are not. In November, a federal judge court ordered San-Francisco based exchange Coinbase to turn over more than 14,000 user accounts, which covered transactions from 2013 to 2015. The U.S. Securities and Exchange Commission said in a statement last week that online platforms trading digital assets that are considered securities need to register with the agency.

A common misconception among new investors is that trading cryptocurrency is a “like-kind exchange” similar to an ETF, which is tax-deferred, OnlineTaxman.com’s Villamena said.

“Some people cling to the ‘like-kind exchange’ argument, and are not willing to accept the reality of if they make a lot of money, they owe tax,” he said. “Newbies on this don’t want to pay, and they’re trying to figure out if they can be anonymous.”