The top J.P. Morgan Chase strategist who told his clients to expect a year-end rally in 2018 acknowledged Thursday that “the month of December proved us wrong,” but added that he still sees reason for buying stocks early in the new year.

“Our call for a year-end recovery was based on near-record low equity positioning, near five-year low in valuations, positive seasonality, and two positive catalysts (G20 and the Fed’s dovish pivot). All of this was ‘too little, too late,'” wrote Marko Kolanovic, global head of quantitative and derivatives strategy at J.P. Morgan.

“It seemed briefly that the G20 and Powell’s speech would be sufficient to prod the market into a December rally,” he continued. “Instead, already fragile sentiment was undermined by political uncertainty from the US administration, the December FOMC meeting, a slowdown in economic data, and a viciously negative news and social media cycle.”

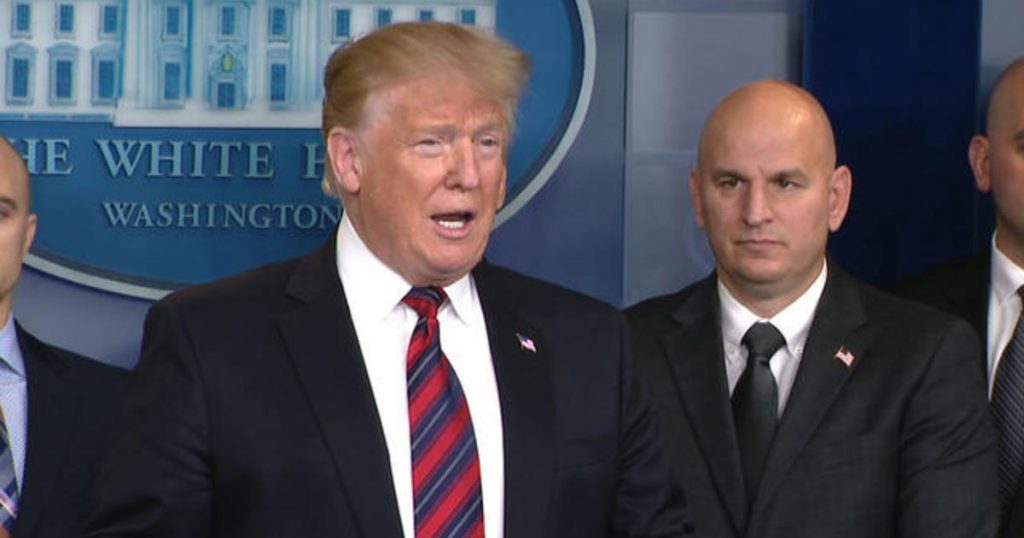

Kolanovic’s mea culpa came one month after he doubled down on his bullish market call given “significant” progress in trade deliberations at a Group of 20 meeting between President Donald Trump and China President Xi Jinping. At that time, he wrote that “we think that the path for near-term market upside is largely clear and the pain trade is on the upside.”

Kolanovic, whose calls have moved the stock market in the past, cited a slew of reasons in his call for year-end rally, including a decline in volatility and strong earnings in addition to forecasts on Fed and trade policy.

Though both the Dow Jones Industrial Average and the S&P 500 were well out of correction levels when Kolvanovic penned his note on Dec. 3, both indexes plunged shortly thereafter. The blue-chip Dow swooned 2,498.97 points — or 9.6 percent — between the market’s close on Dec. 3 through the end of the year while the S&P 500 lost more than 10 percent over the same time.

All 11 S&P 500 sectors finished in the red for the month of December while U.S. Treasury bonds, considered a safe haven for worried investors, saw buying balloon. The Dow and S&P 500 remain more than 15 percent off their all-time highs and both closed more than 2.4 percent lower Thursday.

Follow the money

Kolanovic said there was a buy signal in the flow of money into and out of stocks. The retail investor was selling stocks en masse to end the year, but the major pension funds were buying. Historically, it has paid off to follow the institutional money flows while fading the little guy, said the analyst.

“Retail flows are generally considered to be a contrarian market indicator. More often than not, retail investors tend to buy at times of exuberance and sell at times of panic,” Kolanovic wrote. Looking at historical data, “one can see that buying after large mutual fund outflows was historically profitable.”

Meanwhile, institutional fixed-weight portfolios, such as large pension funds, usually have a better track record of market timing, he added. In December, such funds bought at levels similar to those of 2002, 2008 and 2011, near the end of cyclical market bottoms.

“For unlevered investors, and those with less sensitivity to market-to-market volatility, pension fund buying is likely a positive market signal,” he added. “In summary, both mutual fund and pension flows suggest positive market performance in the future.”