Hugh Johnson Advisors Chief Economist Hugh Johnson and Meridian Equity Partners Senior Managing Partner Jonathan Corpina discuss how investors should play Fed rate hikes on ‘The Claman Countdown.’

As the Federal Reserve hikes interest rates to the highest level since the 2008 financial crisis, the White House is trying to navigate a way to combat inflation without sending the country into a full-scale recession.

“I believe there is a path through this,” Treasury Secretary Janet Yellen told the Atlantic Thursday. “I think of a full-scale recession as a period when there’s excessive unemployment. You don’t have a strong labor market. We have one of the tightest labor markets right now.”

Yellen predicts that inflation will finally be under control next year.

“There are risks. The Russian invasion of Ukraine hasn’t come to an end. We are seeing Putin weaponize oil and gas,” Yellen said. “We will remain vulnerable to supply shocks.”

YELLEN SAYS FED CAN TAME INFLATION WITHOUT CRUSHING LABOR MARKET

Janet Yellen holding a news conference in the Cash Room at the U.S. Treasury Department in Washington July 28, 2022. (REUTERS/Jonathan Ernst / Reuters Photos)

Yellen is keeping an eye on where Russian’s oil reserves will be distributed in the global market as the U.S. tries to solidify its energy capacities.

“Russia is now seeking very actively to find places to sell their oil. They’re giving enormous discounts to China and to India, who were two big purchasers,” said Yellen.

In building a clean energy future, Beijing remains an obstacle, despite the bipartisan CHIPS Act spurring more confidence in domestic semiconductor manufacturing.

“There are rare earths, solar panels, battery, electric battery components that we are really too dependent on China for,” said Yellen.

President Biden signs into law the CHIPS and Science Act of 2022 on the South Lawn of the White House in Washington, Aug. 9, 2022. (Demetrius Freeman/The Washington Post via Getty Images / Getty Images)

To create a smooth transition to clean energy, Yellen says the U.S. needs to make sure “communities that are dependent and have been dependent on fossil fuels aren’t left behind.”

Biden has appropriated a record $360 billion in the Inflation Reduction Act to climate change measures. The White House now must pitch a green energy transition to the entire nation.

FEDERAL RESERVE RAISES INTEREST RATES BY 75 BASIS POINTS FOR THIRD STRAIGHT MONTH

“This is important because I really think it’s contributed to polarization in the country to have, especially the coasts, enjoy rapid growth,” said Yellen. “Of course, with rising housing prices in these areas, they don’t have that easy.”

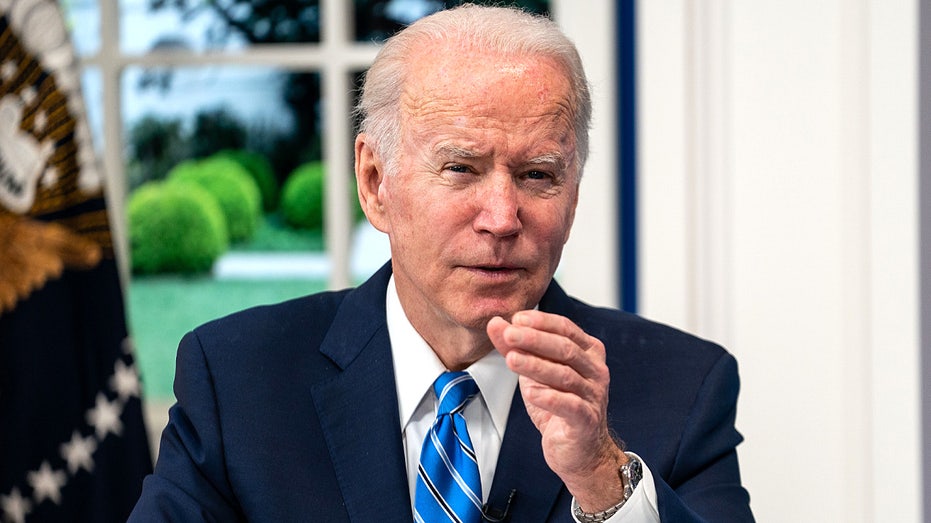

President Biden and the White House COVID-19 Response Team participate in a virtual call with the National Governors Association from the South Court Auditorium of the Eisenhower Executive Office Building of the White House Complex Dec. 27, 2021. (Kent Nishimura / Los Angeles Times via Getty Images / Getty Images)

Over the past year, mortgage rates have doubled, and the 30-year fixed rate mortgage is over 6% for the first time since 2008.

CLICK HERE TO READ MORE ON FOX BUSINESS

According to new Fox News polling, 78% of voters say inflation has caused financial hardship. Fifty-nine percent of voters are also “extremely” concerned about inflation and higher prices.

As the Federal Reserve warns that Americans will have to endure a rise in unemployment and higher interest rates, it’s a waiting game before consumers will be able to feel economic relief.