The IRS on Tuesday experienced multiple outages on its website just hours ahead of the midnight deadline to file taxes.

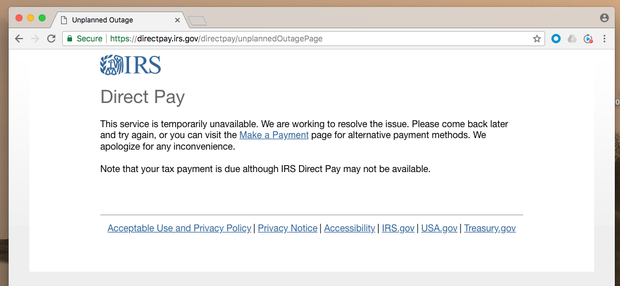

A page on the IRS website that allows taxpayers to make a payment directly was not working for many as of Tuesday afternoon. Clicking on “Make a payment” on the payments page redirects users to a page titled “unplannedOutagePage.”

People affected by the outage will get an extension, the IRS confirmed, with a deadline of midnight on Wednesday, April 18.

The IRS attributed the issues to a hardware problem. A page that allowed taxpayers to make a payment directly was not working as of Tuesday afternoon.

“Note that your tax payment is due although IRS Direct Pay may not be available,” the page notes.

The IRS’ “Direct Pay” page redirects to this message on Tuesday morning.

irs.gov

A separate page noted that the so-called Modernized e-File system, which accepts returns electronically was also down. “We are working this as a priority,” the IRS said. That system allows the agency to accept returns from popular software problems like TurboTax and H&R Block.

Acting Commissioner David Kautter acknowledged the issue Tuesday morning during a House Oversight Committee hearing.

“I was told a number of systems are down at the moment. We are working to resolve the issue and taxpayers should continue to file as they normally would,” he said.

Last year, about 5 million Americans filed their tax returns on the last day before the deadline, according to the IRS.

The IRS site problems caused plenty of grousing over Twitter. “Oh, government, you fool,” one user tweeted.

April 17 had been the deadline for Americans to pay any taxes owed to the U.S. Treasury this year. It’s also the deadline for business owners and freelancers to pay their estimated taxes for the first quarter of 2018.

While Direct Pay isn’t the only way to make a payment, it’s one of the few that doesn’t cost extra. Paying with a credit card through the IRS’ site will cost around 2 percent of the payment amount, starting at $2.50.

Taxpayers who are expecting a refund can request a six-month extension to file. More than 9 in 10 taxpayers file their returns electronically, according to IRS figures.

— Jonathan Berr and Jillian Harding contributed reporting

© 2018 CBS Interactive Inc.. All Rights Reserved.