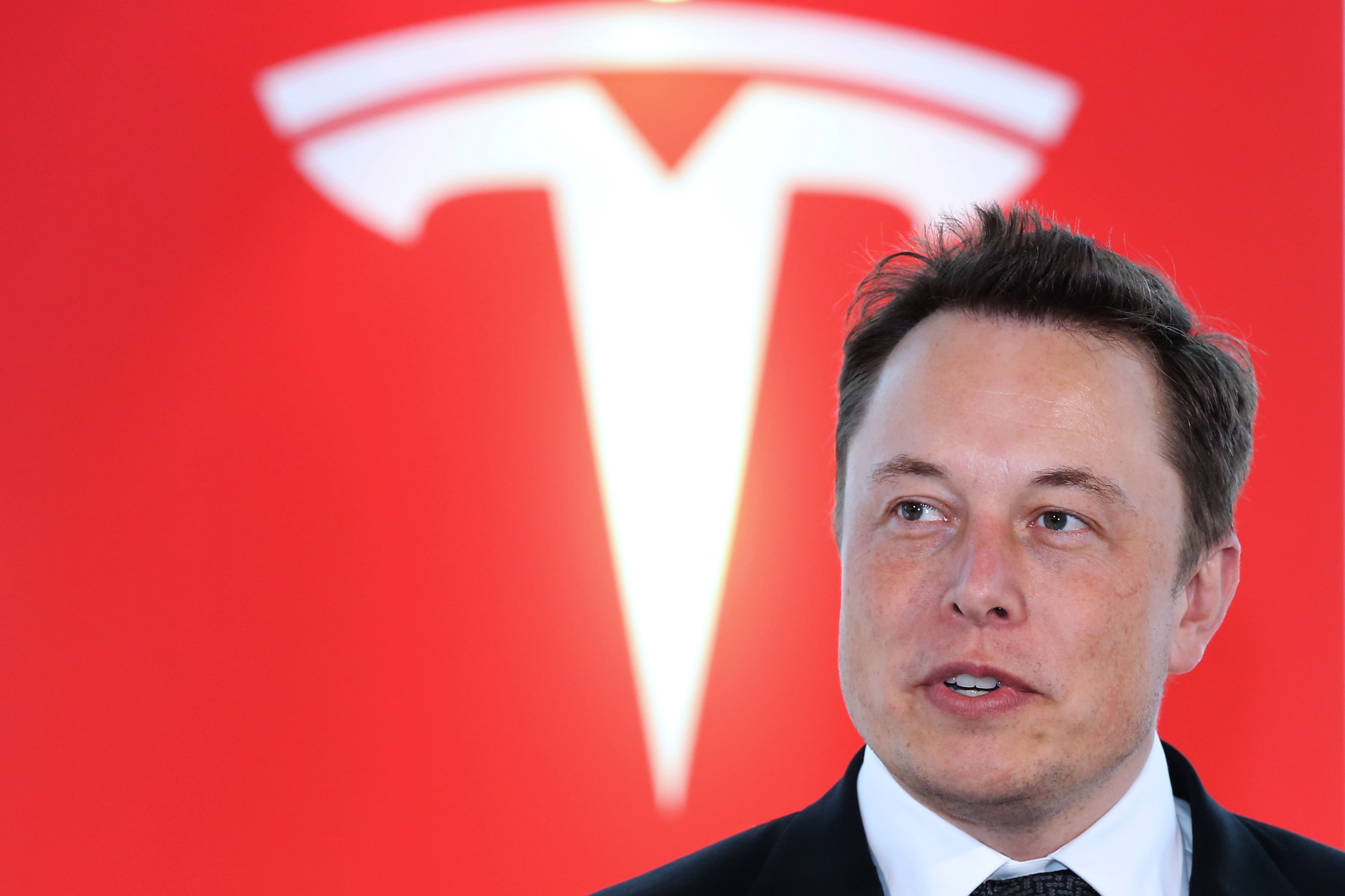

Elon Musk, co-founder and chief executive officer of Tesla Motors Inc.

Yuriko Nakao | Bloomberg | Getty Images

Goldman Sachs slashed its price target on Tesla on Thursday and said it was expecting shares to continue to decline over concerns about demand.

“Sustainable demand [is] the key question as shares [are] likely continue to de-rate,” the bank said in a note, slashing Tesla’s price target to $158 from $200.

“We believe that is the largest question for investors to underwrite at this point — what are sustainable demand levels for the Model S, Model X, and Model 3 — and how does that change with the introduction of Model Y production,” Goldman Sachs analyst David Tamberrino said. “We believe a downward path for shares will resume as it becomes more clear that sustainable demand for the company’s current products are below expectations.”

Tesla shares are down 0.81% in premarket trading. The stock is down 30% this year as the company continues to be mired in a myriad controversies. Analysts and investors also continue to mull whether the company will need to raise more capital.

Watch: Analysts are divided on Tesla — one investor makes the bull case