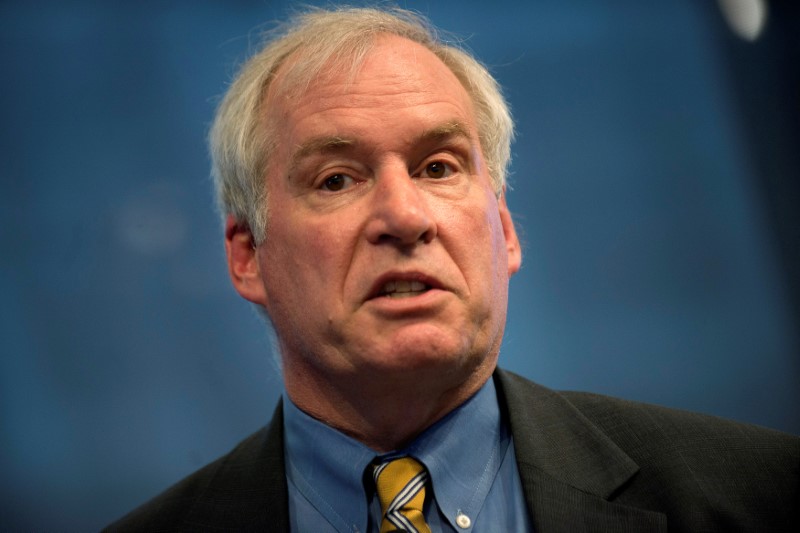

FILE PHOTO: File Photo: The Federal Reserve Bank of Boston’s President and CEO Eric S. Rosengren speaks in New York, April 17, 2013. REUTERS/Keith Bedford

March 5, 2019

By Trevor Hunnicutt and Ann Saphir

NEW YORK/SAN FRANCISCO (Reuters) – With inflation muted but other risks to the U.S. economy on the rise, the Federal Reserve’s patience on policy is nowhere close to running out, with one previously hawkish central banker on Tuesday signaling he could wait until at least June before touching interest rates again.

“It may be several meetings of the Federal Open Market Committee before Fed policymakers have a clearer read on whether the risks are becoming reality – and by how much the economy will slow compared to last year,” Eric Rosengren, president of the Federal Reserve Bank of Boston, told a chapter of the National Association of Corporate Directors in Boston.

That timeline suggests that for him at least, the Fed’s next two meetings in mid-March and in late April would be too soon to expect a change to policy. The next meeting after that takes place in mid-June.

It was a stark shift for a policymaker who for most of last year warned that the economy could overheat without rate hikes. On Tuesday, Rosengren noted little inflation pressure and sharp market swings at the end of last year made those concerns seem “less pressing.”

At the same time, slower growth in Europe and China and ongoing trade conflict make it hard to have confidence about the U.S. economy staying strong, Rosengren said.

“Patiently watching to see how the economy develops is the appropriate policy for now,” he said.

Ever since the Fed unanimously embraced a wait-and-see approach to rate hikes in January, the big question was how long that patience would last.

“Months, not weeks,” according to Dallas Fed President Robert Kaplan, who earlier on Tuesday added worries about record corporate debt to the list of factors that bolster his commitment to patient policy. [L1N20R1FR]

“I think there is still slack in the labor market, and until we see wages growth really pick up I’m going to believe that there are still more Americans out there,” said Minneapolis Fed President Neel Kashkari, who has opposed rate hikes for more than a year. “I’m going to do my part not to screw it up, and raise rates unnecessarily that could end the expansion.”

Fed policymaker comments Tuesday follow those of Fed Chair Jerome Powell and Fed Vice Chair Richard Clarida last week. Both laid out a case for sticking to patience even though some economic models suggest the current 4 percent unemployment rate justifies jumping in with rate hikes to head off inflation.

The risk of tightening rates unnecessarily, curbing a 10-year recovery without cause, is now greater than the risk inflation may unexpectedly spike, Clarida said last week, laying out a case now embraced by most, if not all, Fed policymakers

Data on the U.S. economy has continued to be mixed, with reports on Tuesday showing a rise in home sales and a rebound in service sector activity, following gloomy reports on the manufacturing sector last week. U.S. stocks have recovered from much of their late-2018 slump, but debt markets are still pricing in risks.

Asked if a rate hike would be warranted if the economy develops as he expects, Rosengren was noncommital but said there could be circumstances that would require tightening to be “on the table.” He added that the Fed’s “patient” stance means not giving “a lot of guidance” as to what the Fed is expecting.

(Reporting by Trevor Hunnicutt in New York; Editing by Leslie Adler and Chizu Nomiyama)