Traditional money managers are racing to sell their own exchange traded funds as investors continue to pour money into a business that has been dominated by a handful of giant fund companies.

“The industry is following the flows. Passive strategies and smart beta are gaining market share and no one wants to be left out of the ETF gold rush,” said David Lafferty, chief market strategist at Natixis Global Asset Management.

On Monday, 70-year-old Franklin Templeton began trading its first passive ETFs — a group of 16 funds focused on a single country or region. The news followed the launch of the first ETFs with the USAA brand on October 26. USAA is a financial services company for members of the military and their families.

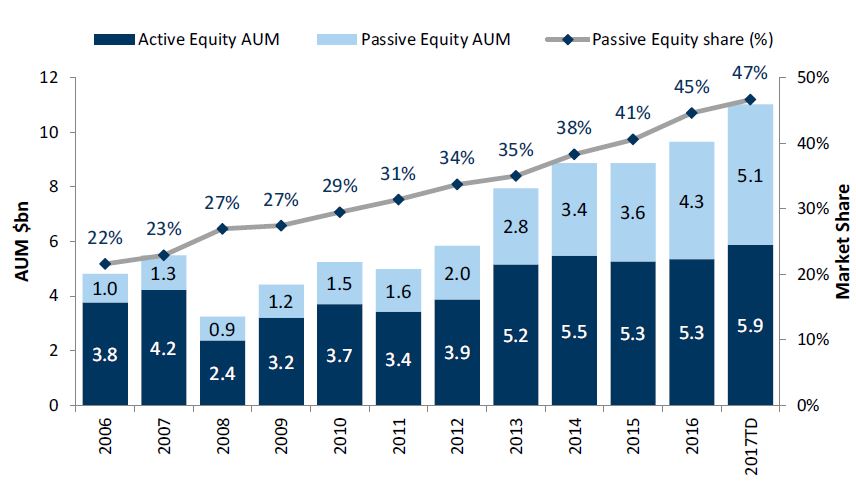

Passive investment products, including index mutual funds and index ETFs, account for nearly 47 percent of assets under management in U.S. stock funds, Goldman Sachs analyst Alexander Blostein said in a note on Monday.

Passive has nearly reached 50% of the retail equity market

Source: Morningstar, Goldman Sachs Global Investment Research

Passive investing is a style that minimizes trading by tracking an index, the opposite of actively managed funds that try to beat the index by buying and selling securities frequently to generate extra return. So-called smart beta is an extra twist, tracking an index by reweighting it or using other objectives.

As the passive approach has grown more popular among investors in the last few years, passive funds have been a major source of new money for the money management industry and are only expected to grow from here.

Global assets under management are expected to almost double to $145.4 trillion by 2025, and the share of money managed passively will grow to 25 percent of that total, from 17 percent last year, PricewaterhouseCoopers predicted in an Oct. 30 report.

Traditional asset managers “have to be involved, or they’re going to get left behind,” said Mike Venuto, chief investing officer and co-founder of Tosoro Investments, which this April launched an ETF to track ETF companies. The ETF Industry Exposure & Financial Services ETF (TETF) is up 16 percent over the last six months.

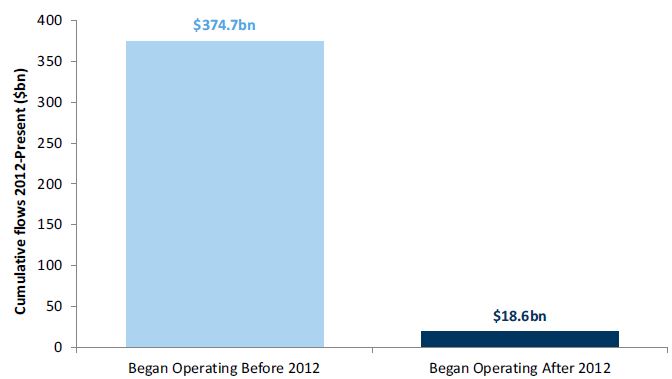

Until fairly recently, however, the ETF sector has been dominated by a few giants, such as BlackRock iShares and Vanguard. Money managers that rolled out smart beta ETFs in the last few years have received just 5 percent of cumulative investor inflows since 2012, with the bulk of new money going to the largest companies, the Goldman report said.

Many traditional fund managers began selling smart beta ETFs in the last two years, with 107 introduced in 2015 and 91 in 2016, according to the Goldman Sachs report. But the note also pointed out that 11 smart beta funds closed in 2015 and 24 in 2016. Fifteen have already closed this year.

“In response to nearly a decade of market share losses to passive, the industry’s response is beginning to accelerate,” Blostein said. “The success so far, however, has been limited.”

Smart beta ETFs launched since 2012 gathered just 5% of flows

Source: Morningstar, Goldman Sachs Global Investment Research

One of the stumbling blocks has been the low-fee nature of ETFs, he said, making it difficult for asset managers to make money off of them.

Twelve of Franklin Templeton’s 16 new ETFs have an expense ratio of 9 basis points, as does the Goldman Sachs Equal Weight U.S. Large Cap Equity ETF (GSEW), which rolled out in September as one of the lowest-cost ETFs of its kind.

Dina Ting, vice president, senior portfolio manager of Franklin Templeton’s Global ETFs Group, told CNBC in a phone interview the company built a sustainable business model for the products. The company’s 38 ETFs have more than $1 billion in assets under management, as of last week, Ting said.

Ting said the company created its latest group of ETFs in response to hearing more investors using active and smart beta passive together. “It’s opening up the horizon for new clients now that we have a product that satisfies their needs,” she said.

Competitive pressure is leading to consolidation in the ETF industry as well. Invesco agreed in late September to buy Guggenheim Investments’ ETF business for $1.2 billion. The two companies are the fourth-largest and eighth-largest, respectively, in the industry by assets under management, according to ETF.com.

“We believe scale is becoming more critical, evidenced by Invesco’s recent acquisitions of Source in the EU and the announced acquisition of Guggenheim’s ETF business in the U.S. (we take no view on the likelihood of the deal closing), further limiting opportunities for new entrants, in our view,” Blostein from Goldman said in his report.

He did add that traditional fund managers may find opportunities in active ETFs, which incorporate active management strategies within a exchange-traded fund.