The market rebound on Friday is worth celebrating given that Wall Street had its worst week of 2019, CNBC’s Jim Cramer said.

Businesses added 20,000 jobs in February, far short of the 170,000 that economists forecast, but the market shrugged it off, he said. The Dow Jones Industrial Average originally fell 221 points before closing less than 23 under, while the S&P 500 and Nasdaq both slipped more or less 0.20 percent.

“I think, on some level, there’s an understanding that this hiring data is just not representative. The numbers were severely distorted by both the government shutdown and the terrible weather,” the “Mad Money” host said, explaining that Costco delivered strong quarterly earnings but blamed bad weather on why it didn’t do even better.

Additionally, Cramer said the federal Labor Department has a history of poorly handling the payroll data.

Global headwinds — including U.S.-China trade, Brexit and weakness in Europe — are still present but the consumer appears to remain confident, Cramer said.

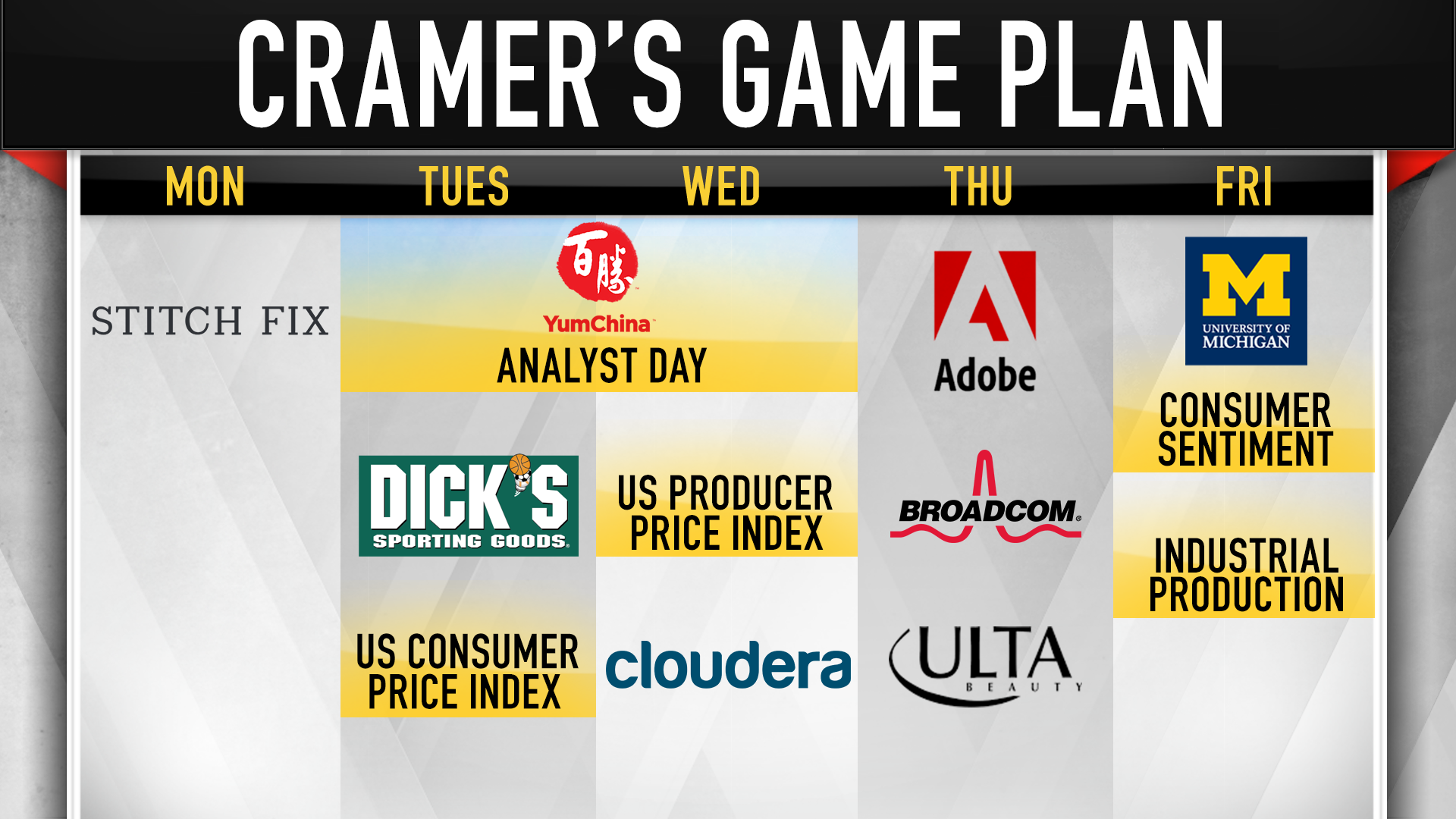

Here’s his game plan for the week ahead:

Stitch Fix: The online subscription and personal shopper reports after the bell. It beat on sales but missed on active users in its most last earnings results, which caused shares to slump and many digital subscription stocks followed suit.

“Stitch Fix has been trading higher of late. Maybe they’ve returned to hyper-growth mode. We’ll see. It could have an impact,” Cramer said.

Yum China: Cramer said the restaurant group, which includes KFC and Pizza Hut, will have an analyst meeting in Shanghai that could give insight into spending in China.

“The issue with all things related to China is that, to some extent, bad is good and vice versa. The weaker the Chinese economy gets, the more likely they are going to make a trade deal with President Trump that President Trump will like,” he said. “So I’m gonna take any data I can anywhere, and Yum China will give us some good data.”

Dick’s Sporting Goods: The sports retail franchise will deliver its latest earnings after the bell. Cramer said he would refrain from buying the stock due to company-related risk, but the conference call could give good news about Nike.

“You can buy the sneaker stock if we get any kind of pullback related to market weakness today,” he said. “That would be a terrific opportunity because I bet Dick’s management has got great things to say about Nike’s footwear and probably more importantly their apparel.”

Consumer Price Index: “I think it’s gonna be very low,” Cramer said.

Producer Price Index: Combine the PPI with the CPI and February’s employment results, Cramer thinks people will question why the Federal Reserve raised interest rates in December.

“I say Fed chief Jay Powell has basically gotten what he wants when he talked about needing to slow the economy back in October. He won,” Cramer said. “So he’s not gonna be a problem for the bulls going forward. That’s another reason by the way why we bounced today.”

Cloudera: The software enterprise will report after the market closes. Cloudera recently acquired competitor Hortonworks and Cramer expects positive results on the call.

This is “a smallish cloud company with a very big task: tell us why we should still believe in a formerly red-hot group that’s become one of the weakest segments of the entire market, the cloud kings,” the host said. “I genuinely believe that this little company could put a floor under the group. Yes, Cloudera could be that meaningful.”

Adobe – The software company will report at the end of the session. Cramer cautioned that if Cloudera gives a strong report but the stock sells off like Workday did last week, Adobe could see a similar fate.

“I desperately want to tell you to buy Adobe ahead of the quarter, but that negative pattern needs to be broken before I can give you my blessing,” he said.

Broadcom: This semiconductor’s earnings results will also come after the bell. Cramer expects strong numbers in the wake of buying CA Technologies for $18.9 billion in cash.

“I want to hear how much stock [the company] repurchased this quarter, too,” he said. “I bet [they] bought a ton because Broadcom’s been a horse.”

Ulta Beauty: The beauty chain will also deliver earnings after the market closes. Cramer is bullish on the stock, especially with Estee Lauder being a supplier.

“The look-your-selfie-best economy remains a major tailwind for Ulta and the stock has more upside.”

“These two could be integral to putting today’s tepid employment figures to bed, by offering us a positive spin on a real bummer of a number,” Cramer said. “I think confidence did take a bit of a hit, because of all that nonsense in Washington … but the industrial production number I think it will be just fine.”

Questions for Cramer?

Call Cramer: 1-800-743-CNBCWant to take a deep dive into Cramer’s world? Hit him up!

Mad Money Twitter – Jim Cramer Twitter – Facebook – InstagramQuestions, comments, suggestions for the “Mad Money” website? madcap@cnbc.com