In a bull market, CNBC’s Jim Cramer knows all too well that money managers tend to chase fast-growing stocks like the industrials and sell slow growers like the health care names.

“Yet this time appears to be different,” the “Mad Money” host said. “Since the beginning of the year, the health care sector has been roaring right alongside the industrials and the financials.”

To understand whether the health care rally is sustainable, Cramer called on legendary technician Marc Chaikin, the founder and CEO of Chaikin Analytics.

Chaikin, who invented several key technical indicators including the accumulation-distribution line and the Chaikin Money Flow, looked at three very different stocks to get a comprehensive view of the space: Centene, Cardinal Health and Amgen.

The technician started with the daily chart of Centene, a Medicare and Medicaid provider heavily levered to federal health care spending.

In the last 12 months, shares of Centene have managed to outperform the broader market even during times of weakness for the health care cohort.

After some negative action in December, Centene’s Chaikin Money Flow, an indicator that measures buying and selling pressure in a given stock, has recently gotten very positive, which Chaikin said suggests that institutional investors are buying it hand over fist.

Better yet, the stock has found a floor of support at its 50-day moving average, $9 below its Monday closing price.

“Centene has surprised to the upside in each of the last four quarters and it reports again next week,” Cramer said. “Chaikin recommends buying it on any pullback down to the $105, $107 area ahead of that earnings report. You know what? I agree with him, although I think you’d be very lucky to get that kind of dip.”

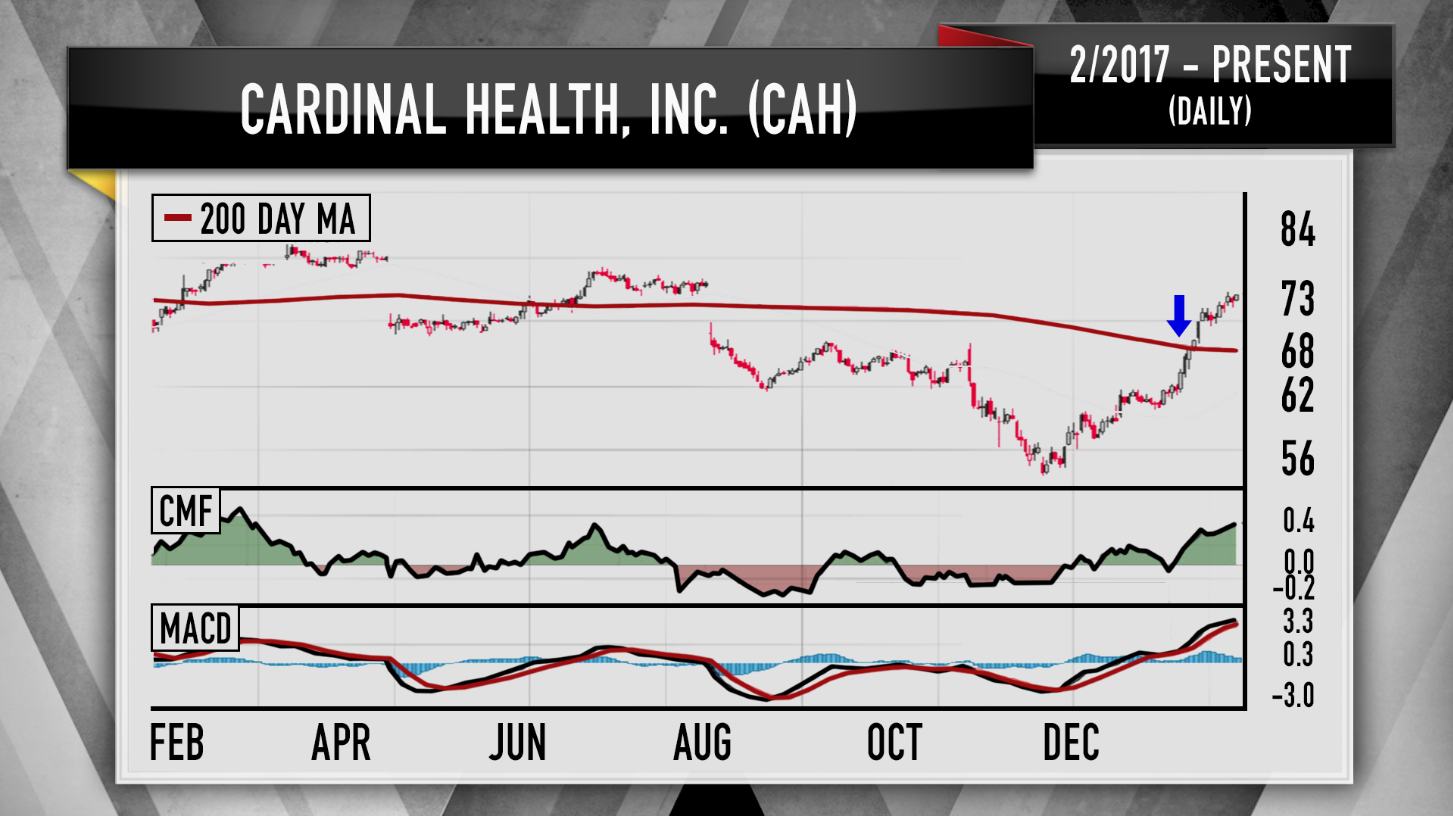

Next, Chaikin turned to the daily chart of Cardinal Health, one of the top three pharmaceutical wholesalers.

Since mid-December, when shares of Cardinal broke a nine-month losing streak, the stock has been soaring, breaking above its 200-day moving average in the beginning of January.

The Chaikin Money Flow has also been rising for over two months, suggesting that buying pressure is growing in Cardinal’s stock.

Chaikin also called attention to Cardinal’s moving average convergence divergence, or MACD, indicator, which can predict changes in a stock’s trajectory before they occur.

Since making a bullish crossover — depicted by the black line crossing above the red line in the chart above — the MACD indicator has been hitting new highs, confirming the market’s revived love for the drugmaker.

“Cardinal has gone from a hated stock to a beloved stock in no time flat,” Cramer said. “Chaikin suggests buying the stock on a pullback below $73, down less than $3 from here, before the company reports earnings in a week and a half.”

Finally, Cramer and Chaikin tackled the daily chart of biotechnology giant Amgen, shares of which hit an all-time high on Monday.

Despite the run, Chaikin felt less bullish about Amgen’s trajectory, particularly considering the irregular and only slightly positive action in the Chaikin Money Flow.

“Unlike Centene or Cardinal, Chaikin doesn’t see Amgen as being deluged by desperate buyers,” Cramer added. “Meanwhile, the stock is now nearly 20 points above its 50-day [moving average], and in the recent past, that short-term moving average has failed to act as a decent floor of support.”

Cramer recalled Amgen’s October volatility, when the stock fell to its 50-day moving average, failed to find a floor, and continued to slide until it found support at its 200-day moving average. In other words, shares of Amgen tend not to respond well to negative action.

Looking ahead to Amgen’s Thursday earnings report, Chaikin noted that the company’s last three reports have triggered sell-offs in the stock, hurting shareholders.

“That’s why Chaikin recommends ringing the register and taking some profits into Amgen’s current strength,” Cramer said. “I can’t blame him. Nobody ever got hurt taking a profit, and given how much Amgen’s stock has run going into this quarter, the company needs to deliver a real upside surprise or else people will bail on the stock en masse.”

Overall, Cramer and Chaikin’s analysis reaffirmed the health care cohort’s positive action, but supported a strategy of looking at each stock in the group case by case.

“As much as the health care stocks have rallied here, the charts, as interpreted by Marc Chaikin, … suggest that this group has been climbing thanks to major accumulation by big institutional money managers,” Cramer said. “In many cases, like Cardinal and Centene, he thinks it’ll continue, although in some cases, like total popular fave Amgen, he thinks the stock’s run too much. In general, though, Chaikin believes this bizarre, out-of-place rally in health care is poised to keep going, and I learned a long time ago not to be on the other side of a Chaikin trade.”

Questions for Cramer?

Call Cramer: 1-800-743-CNBCWant to take a deep dive into Cramer’s world? Hit him up!

Mad Money Twitter – Jim Cramer Twitter – Facebook – Instagram – VineQuestions, comments, suggestions for the “Mad Money” website? madcap@cnbc.com