As the averages bounced back on Tuesday after a late-Monday decline, CNBC’s Jim Cramer noticed a particular commodity roaring with them: oil.

“I’ve been telling you repeatedly that we need to be more cautious on fossil fuels in general as there’s a whole new generation of money managers who views all these companies as kind of the moral equivalent of tobacco,” the “Mad Money” host said. “But there’s no denying that crude oil is doing very well here as the Middle East heats up.”

To make sense of the action and find the best investments in the energy space, Cramer turned to technician Bob Lang, the founder of ExplosiveOptions.net and part of TheStreet.com’s Trifecta Stocks newsletter team.

Cramer warned that the top energy investments were not obvious: while energy giants Exxon Mobil and Chevron performed strongly on Tuesday, they have lagged the sector for months, partially due to their exposure to natural gas.

“When you look the next tier down, though, in terms of size, there are some real nice Cramer winners here [like] Anadarko as well as ConocoPhillips,” Cramer said, noting that each stocks is up over 10 percent since the start of 2018.

Lang started by looking at the daily chart of Anadarko, one of the market’s top big-cap oil stocks. He liked the series of higher highs and higher lows the stock has made since its February lows, particularly since the moves have been backed by a high volume of investing activity.

“Don’t forget, for technicians, volume is like a polygraph: it lets you know when a move is telling the truth,” Cramer explained. “To Lang, this is a clue that big institutional money managers are buying Anadarko here — always a positive sign.”

Better yet, Lang noticed that the moving average convergence divergence line, a key indicator that helps predict changes in a stock’s direction before they occur, is about to make a bullish crossover. That could push the stock above its $63 ceiling and take it to $70 a share, Lang said.

Lang also had a rosy outlook for the stock of ConocoPhillips. Shares of the oil and gas play recently made a W-shaped bottom, hitting a low and successfully retesting it. During the retest, Lang noticed the MACD indicator sending a “buy” signal. Since then, the stock has taken off.

Better yet, the Chaikin Money Flow oscillator, which tracks the level of buying and selling pressure on a given stock, turned positive a few weeks ago, a sign that institutional investors were buying in. And while Lang expects ConocoPhillips’ shares to stall after their run higher, he could see the stock running from its $62 level to the $70s.

“Now, when oil gets its groove back, the pin action also extends to other parts of the market,” Cramer said. “When oil’s expensive, there’s a lot more demand for alternative energy sources, hence why the solar stocks broke down when oil collapsed in 2014 and why they’ve been making a monster comeback of late.”

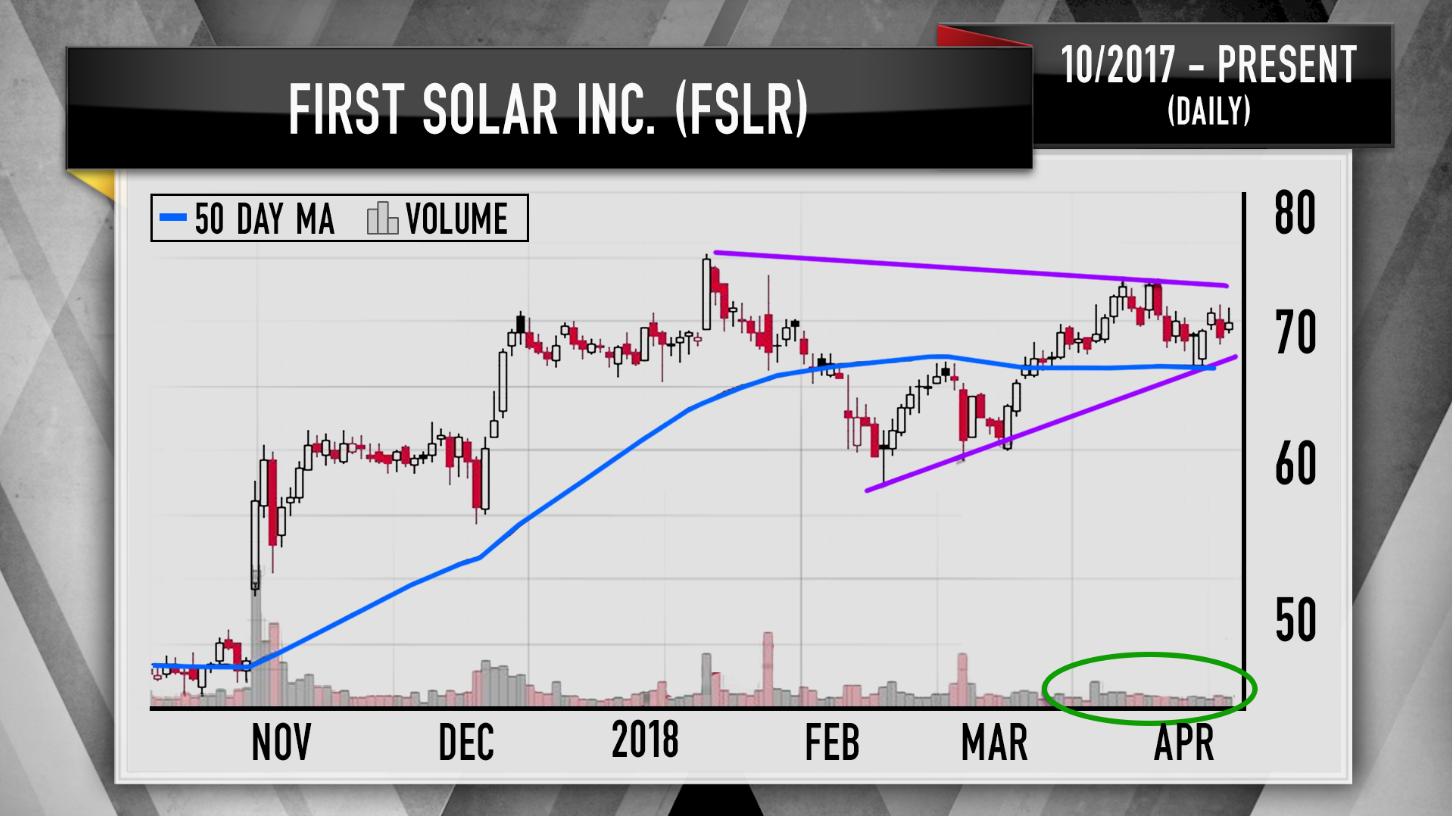

The daily chart of First Solar supported this theory. After a jump higher in March, shares of the solar energy play have been consolidating on low volume, which Lang interpreted as a sign that institutional buyers are staying in the stock.

“The fact that First Solar put up this kind of trajectory during a difficult month makes it stand out to chartists like Lang,” Cramer said. “After First Solar spends some more time trading sideways, Lang expects it to rally past this ceiling of resistance. The stock’s currently at $70, he sees it going to the $80s before too long.”

The “Mad Money” host added a caveat: “This is Lang’s favorite name in the space, but it’s run up a lot, more than doubling. I say stay calm. Be a little cautious.”

Lang also liked the daily chart of Solaredge Technologies, another renewable stock that has doubled in just the last seven months.

Like First Solar, shares of Solaredge have been consolidating lately on low volume, suggesting that the big money is not yet ready to sell. Better yet, after a major surge in late February and March, the Chaikin Money Flow oscillator has ebbed, but is still in positive territory — also a bullish sign as the stock digests its gains.

“Bottom line? The charts, as interpreted by Bob Lang, suggest that some of the better performing oils and solar stocks could have more room to run,” Cramer said. “Anadarko, ConocoPhillips, First Solar and Solaredge all managed to at least partially defy the gravitational pull of the averages — Lang’s betting these winners will keep on winning. I think he makes a compelling argument, although I’d be more selective. I say stick with long-term Cramer-faves Anadarko and old friend First Solar.”

Questions for Cramer?

Call Cramer: 1-800-743-CNBCWant to take a deep dive into Cramer’s world? Hit him up!

Mad Money Twitter – Jim Cramer Twitter – Facebook – Instagram – VineQuestions, comments, suggestions for the “Mad Money” website? madcap@cnbc.com