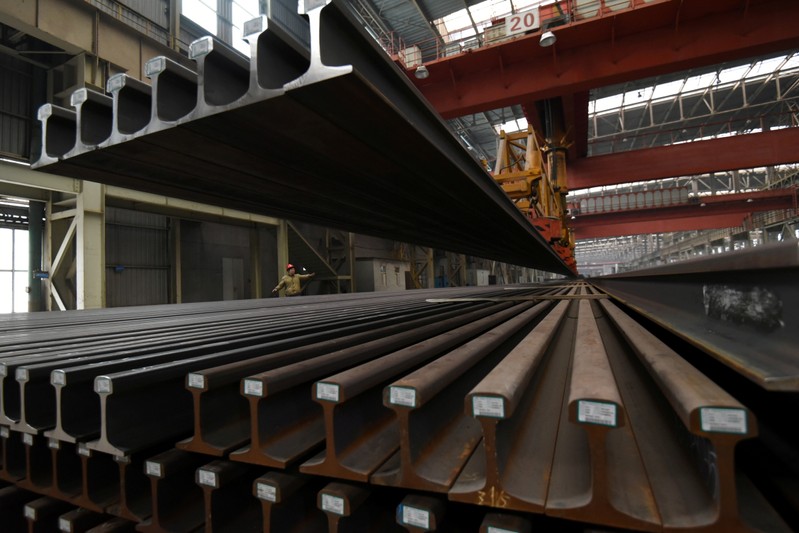

FILE PHOTO: A worker directs a crane lifting steel rails at a steel factory in Handan, Hebei province, China November 23, 2018. REUTERS/Stringer/File Photo

January 7, 2019

BEIJING (Reuters) – China’s steel and iron ore futures started the week firmly on Monday, buoyed by central bank policy easing and by hopes that talks could help end Sino-U.S. trade tensions.

China’s central bank on Friday cut the amount of cash that banks have to hold as reserves for the fifth time in a year, freeing up $116 billion for new lending.

A group of U.S. delegates are meeting with their counterparts in Beijing this week for the first face-to-face talks since leaders of the two countries agreed to a 90-day truce in a trade war in December.

“The market is improving its expectations over the macro-economic situation amid Beijing’s attempts to stabilize the economy,” analysts from Huatai Futures said in a note.

Meanwhile, Baoshan Iron & Steel Co <600019.SS>, the largest listed steel firm in China, said on the weekend that it would raise prices of some steel products for March delivery by 50 yuan ($7.30) a tonne.

Benchmark construction steel debar prices on the Shanghai Futures Exchange <SRBcv1> had risen 1.2 percent to 3,500 yuan a tonne by 0155 GMT. They jumped as high as 3,517 yuan during early trade, a level last seen on Dec. 24.

However, analysts also warned of waning demand in the off-peak season.

Inventories of steel products at Chinese traders rose for the second week in the week to Jan. 4, adding 416,000 tonnes from the prior week to 8.38 million tonnes, data compiled by Mystery consultancy showed. Reba stocks were up 6.4 percent at 3.35 million tonnes and hot-rolled coil stocks were up 2.5 percent at 1.8 million tonnes.

Construction sites in northern China typically halt work in winter due to freezing conditions.

Investors are closely watching the Sino-U.S. trade talks, as well as waiting for further potential stimulus measures from Beijing that could ease downward pressure on China’s economy, the analysts said.

The most-active iron ore contract on the Dalian Commodity Exchange <DCIOcv1> inched up 0.3 percent to 507 yuan a tonne.

Coking coal futures <DJMcv1> climbed 0.7 percent to 1,185.5 yuan, while coke for May delivery <DCJcv1> rose 1.1 percent to 1,956.5 yuan.

($1 = 6.8455 Chinese yuan termini)

(Reporting by Muyu Xu and Dominique Patton; Editing by Joseph Radford)