A majority of Americans see the recent changes to the tax laws as benefiting the wealthy and large corporations, and most feel their own taxes have not gone down because of the law. Partisanship more than income drives views of how Americans view their tax situation.

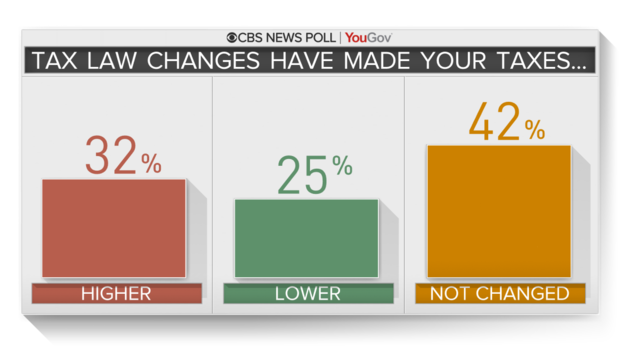

Four in 10 Americans say their taxes haven’t been impacted by the tax law changes that went into effect in 2018. For those who do see a change, more say it has made their taxes higher (32 percent) than lower (25 percent).

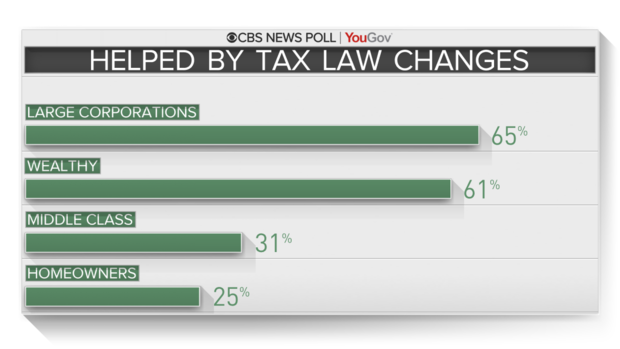

Most Americans believe large corporations (65 percent) and wealthy people (61 percent) have been helped by the recent tax law changes. Far fewer think the middle class (31 percent) and homeowners (25 percent) have been helped. More Americans think those groups have been hurt rather than helped by the new law.

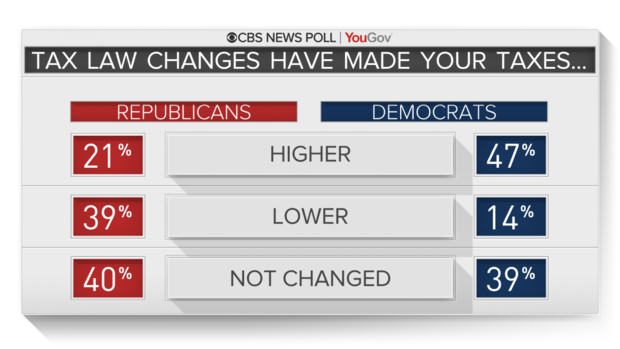

The public divides along partisan lines on how their own taxes have been affected by the law — more so than by income level. Americans across income groups are more likely to say their taxes are now higher than lower. Those earning less — with household incomes under $50,000 — are the most likely to say their taxes haven’t been affected by the law.

Trending News

More Democrats say their taxes have gone up because of the tax law changes, while more Republicans say theirs have gone down. Roughly four in 10 in each group say their taxes haven’t changed.

Views similarly cut along partisan lines when Americans are asked how they feel about their overall tax situation. Most Republicans are at least satisfied (63 percent), while most Democrats are dissatisfied or angry (59 percent).

The poll finds that more Americans think people in Republican states have been helped by the law (43 percent) than say that about people in Democratic states (27 percent). Republicans are inclined to think both those in red and blue states have been helped by the tax law. Democrats, on the other hand, see differences. Just 16 percent of Democrats think people in Democratic states have been helped, while 40 percent believe those living in Republican states have been helped.

Filing 2018 taxes

Most Americans are expecting to get a tax refund this year (56 percent), while about a quarter expect to owe money (27 percent) in federal taxes.

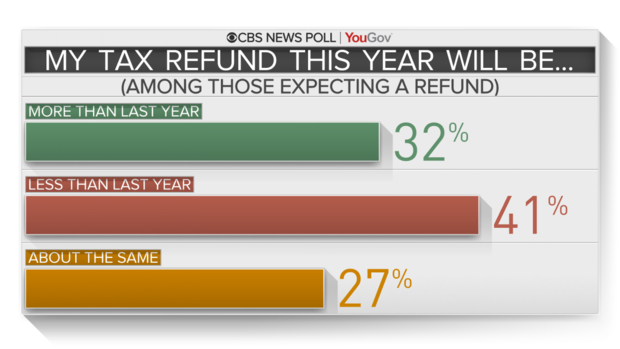

Few Americans who are getting refunds are expecting to get more money than they did last year, however. While 32 percent expect to get more money, 41 percent expect to get a smaller refund than they did last year. Another 27 percent expect about the same amount.

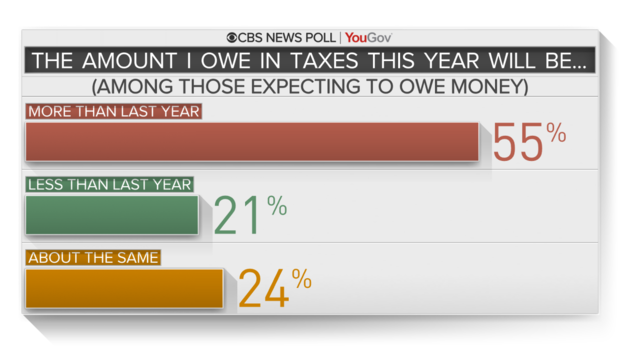

And for those who owe, most (55 percent) report owing more money that they did last year.

Most Americans attribute these changes to the tax laws that went into effect in 2018. Seventy percent of those getting less money back compared to last year say it’s because of the changes to the law, though 57 percent of Americans expecting a larger refund also attribute this to the changes made in 2018.

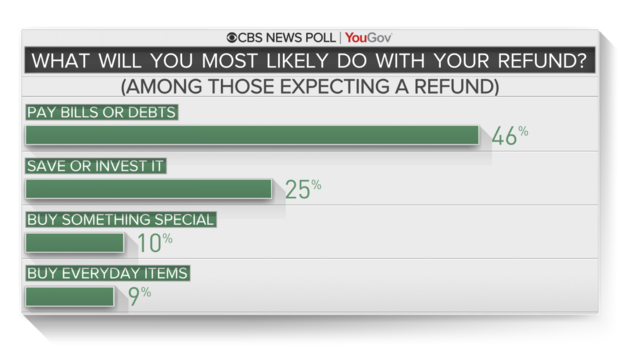

When those expecting a refund are asked what they plan to do with it, paying bills or debts is the top answer (46 percent), while another 25 percent will save or invest it. Just one in 10 will spend the money on something special.

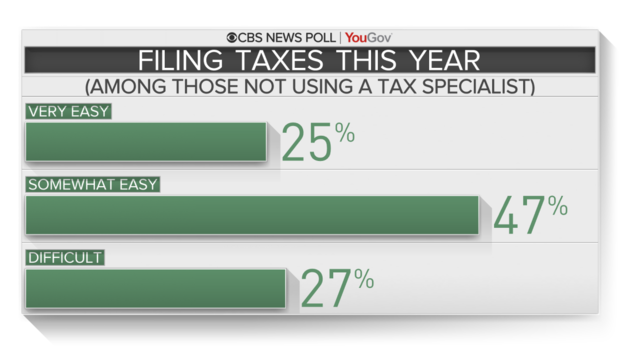

Sixty-two percent of Americans will prepare their own taxes this year — either on their own or with the assistance of tax software, while 38 percent will hire an outside specialist. Most Americans (72 percent) who do file and prepare their own taxes say it’s at least somewhat easy to do, but that includes only a quarter (25 percent) who describe the process as very easy.

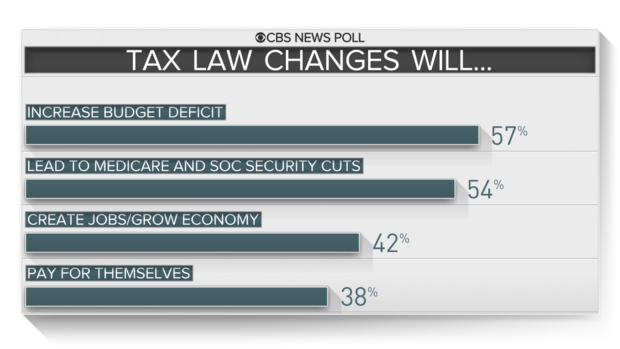

In the long run, most Americans don’t think the tax law changes will grow the economy and create jobs (58 percent), but do feel it will increase the budget deficit. A majority doesn’t think the changes will pay for themselves and more than half foresee cuts to Medicare and Social Security.

Republicans are more likely than Democrats to see upsides as a result of the recent tax law changes.

The CBS News survey is conducted by YouGov using a nationally representative sample of 2,075 U.S. residents interviewed online between April 1-3, 2019. This sample was weighted according to gender, age, race, and education based on the American Community Survey, conducted by the U.S. Bureau of the Census, as well as 2016 presidential vote and registration status. Respondents were selected from YouGov’s opt-in panel to be representative of all U.S residents. The margin of error is 2.4 percent.