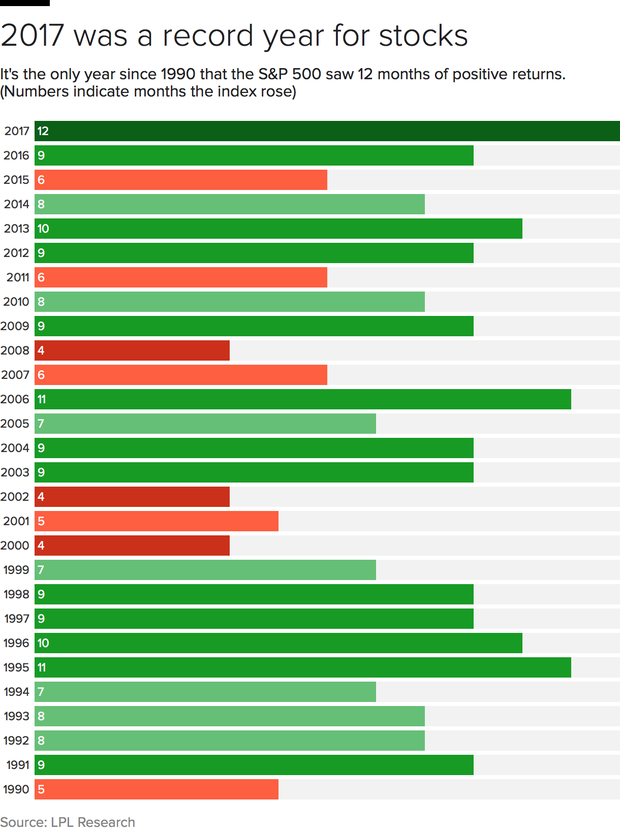

It doesn’t get better than this: Encouraged by the surprise electoral victory of President Donald Trump and his aggressive push for tax cuts and deregulation, the U.S. stock market ended the first ever “perfect year.” That is, one in which all 12 months featured a gain for the S&P 500 index on a total-return basis, according to LPL Financial’s Ryan Detrick.

December caps a record 14th consecutive month of gains and represents the 21st rise over the last 22 months. From a preelection low of 2,083, the S&P 500 ended the year at 2,674, a gain of more than 19.5 percent. The last major market downturns came in January-February 2016 (led by the collapse in oil prices) and in August 2015 (caused by worries over China’s bad debts and currency volatility).

Are we due for another?

Mr. Trump’s victory and pro-business agenda were the spark that ignited a market drenched with raw fuel from years of aggressive Federal Reserve monetary policy. Plus, corporate profit growth was already rebounding from the energy-driven earnings recession between 2015 and 2016. Investor sentiment exploded, pushing prices higher in one of the fastest, steadiest and volatility-free uptrends in Wall Street’s history.

For now, the consensus among analysts is that the uptrend will continue.

Goldman Sachs (GS) is looking for “rational exuberance” in 2018 on a combination of strong GDP growth, low and slowly rising interest rates, and profit growth fueled by the recently passed GOP tax cut. The firm forecasts earnings will rise 15 percent, and the S&P 500 will climb to 2,850, a 6 percent gain from here, before peaking sometime after 2020.

JPMorgan (JPM) said investors should “Eat, drink and be merry” in the new year on higher consumer spending and an even tighter labor market. Should the bull market continue until August 2018, it will take the record for longevity.

But others, including Societe Generale and Bank of America Merrill Lynch (BAC), are sounding the alarm. The former is looking for the S&P 500 to drop to 2,000 by the end of 2018, a loss of 26 percent in what would be a bear market decline. The latter, courtesy of strategist Michael Hartnett, fears a 1987/1994/1998-style “flash crash” within the next three months. Why? A withdrawal of central bank support as interest rates rise, ending a 50-year low in stock market volatility.

How high could rates go?

With the economy already operating above full potential and with the labor market extremely tight, the fiscal boost provided by the GOP tax cuts is likely to stoke inflation more than economic growth, according to Capital Economics. That will likely force the Fed into a more aggressive rate hike pace in 2018 (coming off the three increases in 2017).

Currently, short-term rates stand at upwards of 1.5 percent, up from a low of a range of 0.25 percent to 0.50 percent at the end of December 2015. Capital Economics believes inflation will surge toward 3 percent by third-quarter 2018, which would force the Fed to raise interest rates to 2.5 percent by year-end.

So look for four quarter-point hikes — and some turbulence to return to markets.

© 2018 CBS Interactive Inc.. All Rights Reserved.