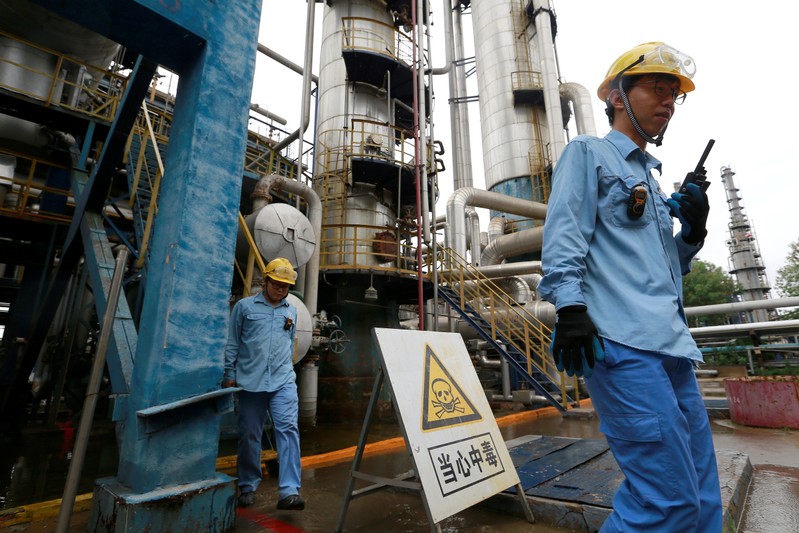

FILE PHOTO – Technicians walk down the refinery which produces ethanol gasoline for vehicles, at China’s Petroleum and Chemical Corporation, or Sinopec, Tianjin company, in Tianjin China August 14, 2018. REUTERS/Stringer

August 30, 2019

By Marcelo Teixeira

SAO PAULO (Reuters) – Brazil’s ethanol industry is looking to grab a chunk of China’s ethanol market as the Asian nation targets a 10% blend in gasoline to improve air quality, but a short-term jump in exports is unlikely, according to people following the matter.

China wants to add 10% of ethanol to all gasoline used in the country by 2020, a policy that could sharply boost the country’s ethanol market and potentially increase imports, since local production capacity is too small to meet the target.

Brazilian ethanol industry representatives were part of a trade mission organized by the Sao Paulo state government that visited China this month. The mission’s agenda included meetings with Chinese authorities and a visit to the headquarters of commodities trader COFCO, which owns four ethanol plants in Brazil.

Sao Paulo state is the largest ethanol producer in Brazil. The state’s agriculture secretary, Gustavo Junqueira, who went along on this month’s China visit, said the opening of China’s ethanol market was discussed.

In a statement, Junqueira added that he thought Sao Paulo mills could sharply increase deals but did not elaborate.

Felipe Vicchiato, chief financial officer for Sao Martinho SA <SMTO3.SA>, a large Brazilian ethanol producer, said Chinese officials seemed to be serious about the 10% ethanol plan during the talks. Sao Martinho’s Chairman Marcelo Ometto was also part of the trade mission.

A source at COFCO, however, told Reuters it was unlikely China would implement the blend nationally next year.

“Implementation has been slow … E10 has been done only in some regions for now,” the source said, asking not to be named because he lacked authorization to speak publicly about the issue.

The Chinese government would most likely seek to balance ethanol use with local production, refraining from pushing for an immediate implementation of the E10 that would necessarily spur imports, the COFCO source added.

“There is also pressure from oil companies, so I don’t think it is going to happen,” he said, referring to implementation next year.

The United States Department of Agriculture (USDA) estimates that China will be far from reaching the national E10 target next year. It projects the country’s total ethanol blending volume to gasoline in 2020 at between 3% and 3.5%.

If Chinese imports were to jump, Brazil would be in a good position in relation to the United States, the world’s biggest ethanol producer. China slapped a 25% additional tariff on imports of U.S. ethanol this year as part of the trade war between the world’s two largest economies.

(Reporting by Marcelo Teixeira in Sao Paulo; Additional reporting by Dominique Patton in Beijing; Editing by Tom Brown)