Rep. Mikie Sherrill, D-N.J., speaks during the press conference outside the Capitol on Wednesday, May 15, 2019.

Bill Clark | CQ-Roll Call Group | Getty Images

BLOOMFIELD, N.J. — Congress fights with the White House over financial records. President Donald Trump rages against the first Republican to call for impeachment proceedings against him.

But for many voters in areas like the northeast New Jersey town of Bloomfield, those issues shrink behind concerns about property taxes and a high cost of living. And the state’s largely Democratic congressional delegation has fixed much of its ire on one target: the 2017 Republican tax overhaul.

Near the start of a town hall meeting earlier this month in Bloomfield, Rep. Mikie Sherrill tried to assure constituents that she is working to lift the new $10,000 limit on state and local tax deductions. The change disproportionately hit residents of high-tax blue states. She got some of her strongest applause of the day when she noted that “every single member of your New Jersey delegation is on a bill to get rid of the state and local tax deduction cap.”

“The New Jersey delegation has been adamant that this is our number one issue,” Sherrill told CNBC after the May 19 event.

Earlier this month, Sherrill and three other House members — Democrat Gil Cisneros of California and Republicans Elise Stefanik and Peter King of New York — introduced a bill to hike the state and local deduction to $12,000 for single taxpayers and $24,000 for married filers. Those levels match the standard deduction. A bill that Democratic Reps. Lauren Underwood and Sean Casten of Illinois introduced in March would more dramatically lift the cap to $15,000 and $30,000 for single and married filers, respectively.

Those Democrats have a clear political incentive to target the deduction cap. It allows them to criticize Trump’s signature legislative achievement while offering financial relief to their districts, where a significant share of voters benefited from state and local deductions before they went away in the 2018 filing year.

But efforts to hike the deduction limit may not play as well politically nationwide. Democrats have spent a year and a half eviscerating the Republican tax law as a giveaway to the wealthy and corporations that blows a hole in the federal budget deficit. Not only do analyses show high earners would see the most benefits from raising the deduction cap, but doing so is expected to further reduce federal revenues.

“Anything that you do to raise the cap is generally going to benefit higher income taxpayers,” said Frank Sammartino, a senior fellow at the Urban-Brookings Tax Policy Center, an organization usually considered left of center.

Democrats are still using the tax law to score political points against Trump: Top Democratic presidential contenders such as former Vice President Joe Biden and Sen. Bernie Sanders have bashed the plan on the campaign trail. Still, Congress appears to have limited appetite for addressing the state and local tax deduction limit, for now.

House Speaker Nancy Pelosi has not publicly mentioned plans to try to lift the deduction cap even though she criticized it as Republicans pushed to pass the tax law in 2017. A spokesman for the California Democrat did not respond to a request to comment on whether the speaker planned to bring any deduction-related bills up for a vote in the House.

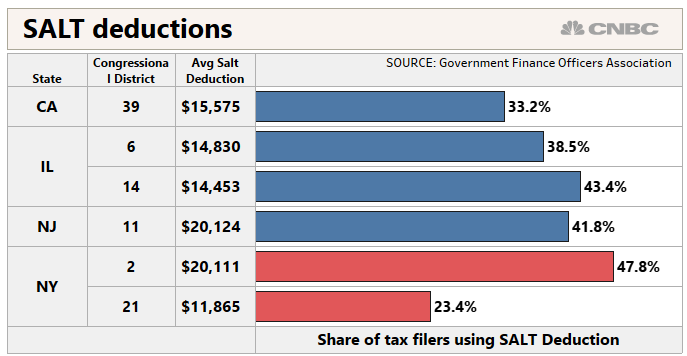

The lawmakers who introduced the legislation have numerous constituents who would benefit from it. In Sherrill’s New Jersey 11th District, for example, more than 40% of taxpayers previously used state and local deductions, with an average of more than $20,000, according to the Government Finance Officers Association. She and other Democrats who flipped Republican-held House seats in New Jersey in last year’s midterms campaigned in part on reversing the deduction limit.

But easing the limit may not be as politically palatable for many of her colleagues. As of 2016, about 30% of tax returns claimed state and local deductions, at an average of about $12,500, according to the Tax Policy Center.

Reps. Lauren Underwood, D-Ill., left, and Val Demings, D-Fla., in front of the U.S. Capitol, Jan. 4, 2019.

Cheriss May | NurPhoto | Getty Images

Estimates about who raising the cap would benefit may make Democrats shy about supporting it, too. It is unclear whether any organizations have analyzed the limited deduction increase backed by Sherrill. But the Tax Policy Center estimates repealing the cap outright would give 56% of the benefits to the top 1% of households, or those making $755,000 or more.

The Underwood and Casten plan would increase after-tax income by an estimated 0.82% and 0.42% for the top 5% and 1% of earners, respectively, more than any other income groups, according to the conservative-leaning Tax Foundation. It would also decrease federal revenues by about $223 billion over a decade, the analysis found.

The Congressional Leadership Fund, a super PAC that boosts House Republicans, called Underwood and Casten hypocrites for criticizing the GOP plan for helping the wealthy and then introducing a bill to lift the state and local deduction cap. Spokespeople for the lawmakers did not immediately respond to requests to comment.

Sherrill, for her part, disputes that her bill will prop up the wealthy. She in part cites the lofty average state and local deductions taken in her high-tax district.

“This is not some windfall for the rich here. This is your average middle-class taxpayer being hugely affected in a negative way by this tax plan,” she told CNBC.

Even if the bills stall in Congress, the state and local deduction issue is unlikely to go away soon. Blue-state governors such as New York’s Andrew Cuomo have repeatedly criticized the state and local deduction caps, and some set up workarounds to help ease the new limits. However, the Treasury Department put rules in place ahead of the last tax season to prevent states from circumventing the cap.

— Graphic by CNBC’s John Schoen