Lowe’s (NYSE: LOW) is one of the two dominant home improvement stores. Scotts Miracle-Gro (NYSE: SMG) makes lawn care products sold at Lowe’s. So far, 2018 hasn’t been particularly great for either company. That said, recent performance would appear to favor Lowe’s as an investment, unless you believe that Scotts’ attempts to serve the marijuana market are going to be a long-term winner. Here’s some background to help you understand which stock is a better buy for you.

Overhauling the place

Continue Reading Below

In early July, Lowe’s hired a new CEO, Marvin Ellison. He wasted little time revamping the company’s leadership team and announcing plans to slim down the business by closing stores. Effectively, Lowe’s is refocusing on its core U.S. business as it works to improve performance.

During the third-quarter conference call, Ellison made it clear that Lowe’s was lagging behind chief competitor Home Depot because of poor execution and not because of a macro issue. So the overhaul would appear to be the right move. But it will result in some near-term pain, as the company expects relatively weak performance to continue at least through the holiday season. In fact, Ellison lowered Lowe’s sales outlook for the fourth quarter at a time when Home Depot was raising its guidance. Then there are the one-time charges related to the closures. The company took a $280 million charge in the third quarter and expects a charge of as much as $580 million in the fourth quarter.

While this may sound somewhat dire, it’s not. Lowe’s sales increased in five of the last six quarters. Ellison is simply trying to improve Lowe’s performance, not resuscitate the company. There’s nothing fundamentally wrong with the business, it’s just not performing as well as its primary competitor and the company is working to close that gap. For long-term investors, particularly those with a more conservative bent, Lowe’s is a worthwhile stock to consider.

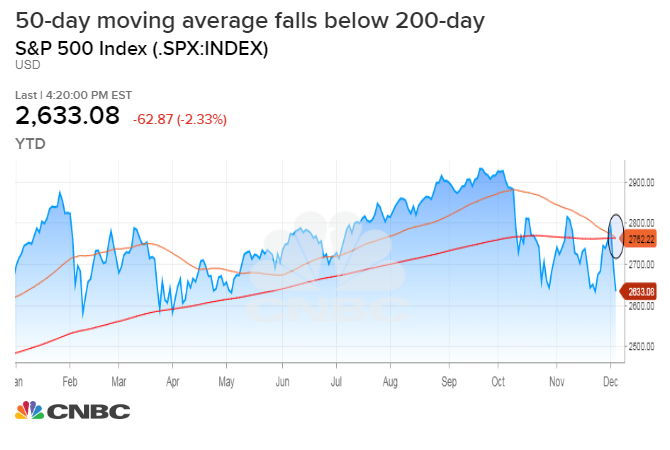

As for valuation, the company’s ratios for price to sales, price to earnings, and price to cash flow are all around their five-year averages. So while it’s not exactly cheap, Lowe’s looks fairly valued today — not a bad thing given that the market remains near all-time highs even after the recent sell-off.

A big bet

Advertisement

Scotts Miracle-Gro is one of the largest providers of lawn care products. As you might expect, it’s a highly seasonal business, with a peak during the summer quarters. While the big change at Lowe’s is an overhaul meant to improve execution, Scotts’ big move is expanding into the hydroponic space. That segment, which made up around 13% of fiscal 2018 sales, essentially serves the marijuana market. And it’s growing quickly, with a year-over-year revenue increase of 20%, driven largely by acquisitions. The company is swiftly moving to build its position in what it believes will be a key growth sector as marijuana is legalized in more states and regions.

The bigger problem here is that Scotts’ overall sales have been weak for years. The top line fell in fiscal 2016 and 2017. And while sales rose in fiscal 2018, the 1% increase was driven by the company’s marijuana-related acquisitions. That segment, known as the Hawthorne division, didn’t turn a profit in 2018. Meanwhile, the acquisitions the company is making have taken long-term debt from around $500 million to nearly $2 billion in just five years. Long-term debt makes up nearly 85% of the company’s capital structure at this point, which is a troubling number.

To be fair, Scotts is still a profitable company. And it is entirely possible that fiscal 2018 was just a particularly bad year, with income from continuing operations down by roughly a third year over year. In fact, Scotts’ outlook for fiscal 2019 is for sales and earnings to turn around, with slow growth in the core lawn-care segment (sales growth between 1% and 2%) bolstered by faster growth in the Hawthorne division (about 9%). Which, in the end, is the crux of the story here.

Scotts is using the core lawn-care business to build the Hawthorne operation. So when you step back, an investment in Scotts is a bet on marijuana. But with a rapid increase in the company’s debt, that bet is getting increasingly risky. Scotts is only appropriate for more-aggressive investors looking for a way to invest in the expansion of the marijuana market.

The tortoise and the hare

Lowe’s is a slow and steady performer going through a revamp. Yes, it is lagging behind Home Depot, but that doesn’t make it a bad company. And with any luck, the new CEO’s streamlining will rapidly close the performance gap. Although it’s not a screaming deal today, it looks fairly valued in what is otherwise an expensive market. For most investors, Lowe’s is a much better investment option than Scotts Miracle-Gro.

That said, if you are specifically looking for a way to play the marijuana market, Scotts may get the nod. Just make sure that you understand the aggressive and debt-fueled move that management is making. If the Hawthorne division doesn’t live up to expectations in a timely fashion, the company’s heavy leverage could quickly become a major headwind.

10 stocks we like better than Lowe’sWhen investing geniuses David and Tom Gardner have a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has quadrupled the market.*

David and Tom just revealed what they believe are the 10 best stocks for investors to buy right now… and Lowe’s wasn’t one of them! That’s right — they think these 10 stocks are even better buys.

Click here to learn about these picks!

*Stock Advisor returns as of November 14, 2018

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has the following options: short February 2019 $185 calls on Home Depot and long January 2020 $110 calls on Home Depot. The Motley Fool recommends Home Depot and Lowe’s. The Motley Fool has a disclosure policy.