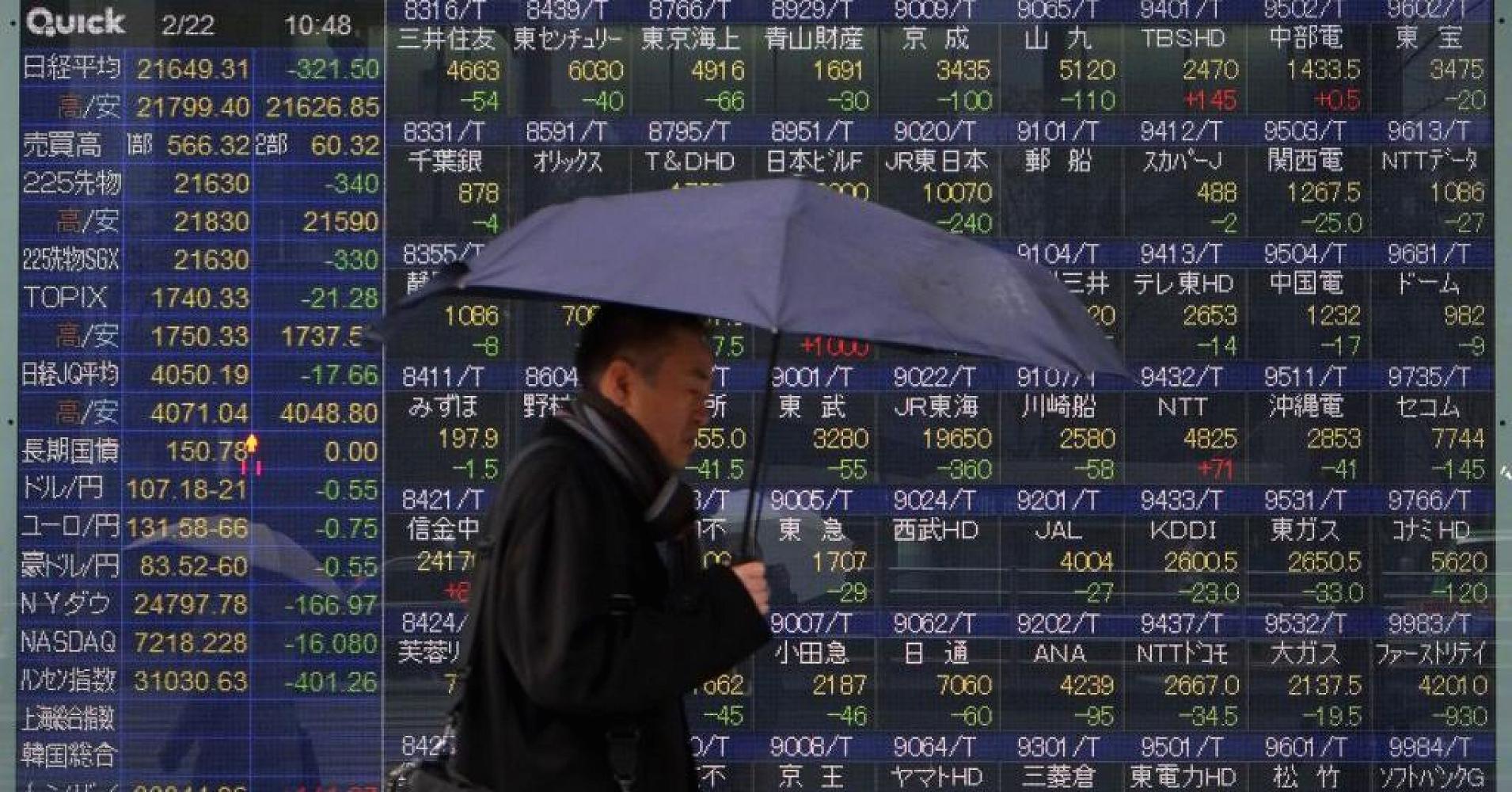

Asian markets traded mixed Thursday in what proved to be a choppy session after the U.S. Federal Reserve raised interest rates for the first time this year.

Japan’s Nikkei 225 rose 0.74 percent and the broader Topix edged up by 0.38 percent, with the mining and oil sectors climbing 4.53 percent and 2.83 percent, respectively.

Elsewhere, South Korea’s benchmark Kospi advanced 0.6 percent. Major sectors, including technology and manufacturing, traded mixed, while brokerages and oil-related stocks notched gains.

Greater China markets gave up early gains, with the Hang Seng Index easing 0.63 percent. Most sectors fell, with technology names dragging on the index, although oil producers firmed.

Over on the mainland, the Shanghai composite lost 0.81 percent and the Shenzhen composite edged lower by 0.23 percent.

In Australia, the S&P/ASX 200 slipped 0.26 percent in choppy trade as declines were seen in all sectors except energy, materials and gold producers.

Mining majors traded firmly in positive territory, while oil producers gained on the back of the more than 2 percent rise in oil prices overnight. Woodside Petroleum gained 2.52 percent and Beach Energy advanced 2.58 percent.

The Federal Reserve raised rates by 25 basis points to a range of 1.5 percent to 1.75 percent at the end of its policy meeting on Wednesday, as was widely expected.

The central bank indicated that it still expected two more hikes this year, but upgraded its projection for the benchmark rate in 2019 to 2.9 percent. Growth forecasts for this year and the next were also raised.

Those moves showed that the FOMC was seeking “to strike a balance between showing a need for more rate hikes in the long term … but not rocking market sentiment too much with the median for 2018 staying at three hikes,” Tai Hui, chief market strategist for Asia Pacific at J.P. Morgan Asset Management, said in a note.

He added that the lack of surprises on Wednesday meant that stock markets in the region would likely be relatively muted.

U.S. stocks whipsawed in the last session, touching session highs shortly after the Fed made its announcement, but ultimately closed slightly below the flat line.

Following the hike stateside, the Hong Kong Monetary Authority on Thursday also raised its base rate by 25 basis points due to the Hong Kong dollar’s peg to the greenback.

Meanwhile, concerns over trade tensions were also in focus in the region, with President Donald Trump expected to announce tariffs against China during U.S. hours, Reuters said, citing a White House official.

In corporate news, tech giant Tencent Holdings fell 3.29 percent after signaling more investments were in the works. It had announced that net profit for the quarter ending Dec. 31 rose 98 percent to 20.8 billion yuan ($3.3 billion) on Wednesday, topping expectations.

In currencies, the dollar remained on the back foot after its overnight fall. Analysts indicated that one reason for the decline was due to some investors having expected the Fed’s “dot plot” to reflect four rate hikes instead of the three that it maintained for this year.

The dollar index, which tracks the greenback against six rival currencies, stood at 89.537 at 12:21 p.m. HK/SIN. Against the yen, the dollar slipped further below the 106 handle to trade at 105.70.

Meanwhile, the Hong Kong dollar slid to a fresh 33-year low during the session.

On the commodities front, U.S. West Texas Intermediate crude edged higher by 0.08 percent to trade at $65.22 per barrel and Brent crude futures were flat at $69.47. Oil prices had jumped overnight after data on Wednesday showed U.S. crude inventories declined instead of rising, as was expected.

— CNBC’s Fred Imbert contributed to this report.