Wall Street is prone to making errors over-extrapolating growth trends. Analysts made this mistake on their Walmart online sales predictions this week.

The retailer’s shareholders fell victim to elevated expectations as the company’s e-commerce sales growth, previously boosted by its Jet.com acquisition, waned.

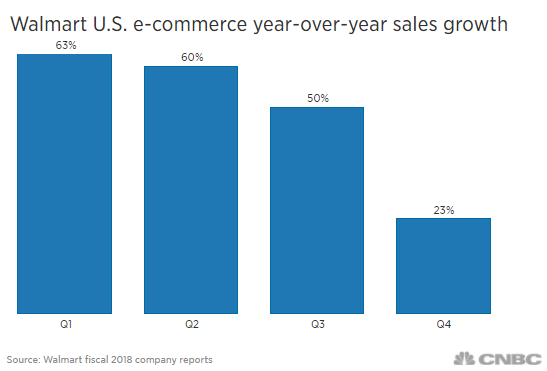

Walmart’s shares plunged 13 percent in the two trading sessions after the retailer reported fourth-quarter financials Tuesday morning. Its online sales grew just 23 percent year-over-year during the quarter ending in January, down from the prior quarter’s 50 percent increase. In comparison, Amazon’s sales rose 38 percent in its latest quarter.

Analysts covering Walmart were stunned over the results.

Walmart’s “slowdown in digital sales is a bit perplexing,” Gordon Haskett’s Chuck Grom wrote in a note to clients Tuesday. Baird’s Peter Benedict also wrote the retailer’s “slowdown in e-commerce sales was more material than expected” the same day.

Perhaps Wall Street should have been more skeptical over Walmart’s previous acquisition-fueled online sales numbers. The retailer acquired e-commerce startup Jet.com for $3.3 billion in Sept. 2016, which benefited the company’s e-commerce growth the past year.

Walmart did not break out the specific incremental revenue numbers or percent of sales that came from the acquisition, making it difficult for investors to figure out the true apples-to-apples year-over-year growth figures.

Even though analysts knew Jet.com’s sales added to Walmart’s e-commerce sales growth, many analysts gushed over retailer’s online sales numbers last year anyway.

Baird’s Benedict said the retailer had proven its ability to compete with Amazon in November as a result of the growth numbers.

Walmart is “becoming a powerful omni-channel force,” he wrote in November. “Efforts to broaden the online assortment, improve the customer value proposition (free two-day shipping, pick-up discounts on non-store items), and enhance convenience have helped fuel the impressive ramp in U.S. e-commerce sales growth.”

He wasn’t alone in his praise. Citi Research’s Kate McShane upgraded the retailer’s shares in December.

“Walmart’s e-commerce operations are emerging as a true challenger to Amazon,” she wrote.

But Walmart’s January quarter online sales growth deceleration, more than one full year after the Jet.com deal, proved the hyper-growth numbers were mainly due to the acquisition.

The retailer admitted the “majority” of the drop in sales growth was due to its Jet.com business fully passing its one-year acquisition anniversary.

“Walmart U.S. e-commerce sales growth in the fourth quarter was 23 percent, down from 50 percent in the third quarter. The majority of this slowdown was expected as we fully lapped the Jet acquisition as well as creating a healthier long-term foundation for holiday,” Walmart said during Tuesday’s conference call with investors. “A smaller portion of the slowdown was unexpected, as we experienced some operational challenges that negatively impacted growth.”

Investors and analysts should be skeptical when companies generate stunning business growth numbers after significant acquisitions. The metrics may not be an accurate portrayal of the long-term sustainable growth rates of a business.

When asked for comment a Walmart spokesperson sent this statement:

“Overall, we finished the year with eCommerce sales growth of more than 40 percent. So, we feel better about the year than the quarter.

Looking ahead, we expect eCommerce growth to increase from the fourth quarter level as we enter the new year with about 40 percent growth for the year. Jet.com complements Walmart.com nicely. Walmart.com, including online grocery, is and has been the key driver of our eCommerce growth, and that will continue. The Jet brand over-indexed with higher income, urban, millennial customers when we made the acquisition and we intend to build on that strength going forward. The cost to acquire a new customer on a nation-wide basis is cheaper with the Walmart brand so we’ve been investing more in Walmart.com on a national basis and reducing marketing investment in Jet except in certain urban markets. Due to this change, Jet will not grow as quickly as it did in the early days but it will be well-positioned where we’ve chosen to focus the brand.”