The growth-value battle is getting interesting.

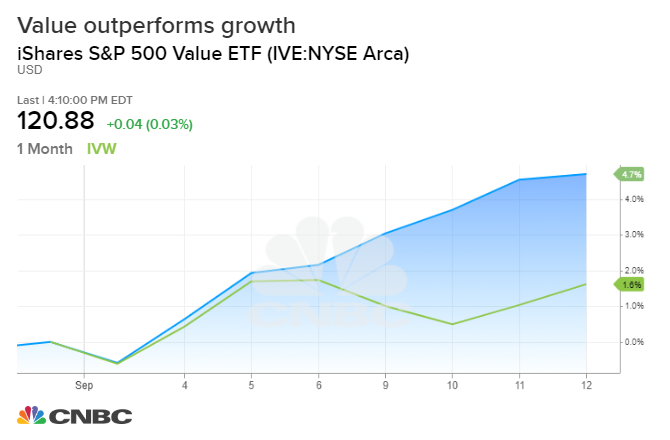

In the last two weeks, value stocks have far outperformed growth names, with the iShares S&P 500 Value ETF rising 5% over that period to a new 52-week high on Friday, leaving its counterpart, the iShares S&P 500 Growth ETF, in the dust. The retail, bank, energy and industrial sectors are typically considered to be value plays, while cyclical sectors like technology are viewed as growth groups.

The moves were in large part caused by Wall Street’s skittishness around the seemingly never-ending U.S.-China trade dispute and the future of interest rate policy, both of which have weighed heavily on U.S. markets in 2019 as investors try to navigate the uncertainty.

But that doesn’t necessarily mean buyers should be rotating into value here, particularly considering growth’s long-term winning streak, says Chris Hempstead, a top ETF consultant and the former head of ETF sales at Deutsche Bank.

“I wouldn’t chase it, personally,” he said Wednesday on CNBC’s “ETF Edge.” “This deviation … is still very new. We used to say on Wall Street — we still continue to say — ‘the trend is your friend.’ And I’m not sure a two- or a three-day gap of value over growth is … going to be something that you want to necessarily bet on just yet.”

For context, in the last 10 years the iShares growth ETF, ticker IVW, has handily outperformed the value ETF, ticker IVE, climbing over 240% versus the value fund’s 139% gain. The growth ETF counts stocks like Microsoft, Amazon and Facebook among its top holdings, while the value ETF has large positions in shares of Apple, J.P. Morgan and AT&T.

“The way that this market has been going, the way growth stocks have been outperforming, it tells you something,” Hempstead said, noting that value’s outperformance happened amid very low trading volume on the major exchanges.

“This recent activity that you’ve seen in value over growth hasn’t been accompanied with massive participation,” he said. “Sure, there might be some people positioning the way it’s suggesting, but I would probably guess that the trend is going to continue, growth is going to be in favor, momentum’s going to be in favor and value’s going to still lag.”

In short, “I expect growth to continue to be a safe place to put your money,” Hempstead said Wednesday.

Nicholas Colas, co-founder of DataTrek Research, noted in the same “ETF Edge” interview that “the [recent] rally in financials has driven the rally in value.”

Because nearly a quarter of the IVE is made up of U.S.-based financial stocks, Wall Street shying away from the prospect of an imminent recession has actually given value a boost, Colas said.

“That’s really helped … European financials,” which have rallied nearly 10% since the start of September and given U.S. financial stocks a boost, Colas said. “There’s still a lot of concern, it’s something to watch, but it gives these stocks a chance to bounce.”

It’s also helped small-cap names, which are tracked by the Russell 2000, but momentary reprieve does not make a market trend, Colas warned.

“The small caps have been really challenged this year because everybody was worried about a recession in the U.S., which was going to hurt both the top line of these companies and capital availability. Now that worry’s a little bit released and we’re getting a nice rally in small caps,” he said. “Do I think it’s a start of a huge trend? No.”

That goes to the point investors at home should consider as they watch value trend higher, Colas said: This temporary trend doesn’t necessarily mark the start of sustained outperformance, “not unless you think we’re going to get, like, 3 to 4% GDP growth next year and everything’s going to be fantastic.”

“In that environment, some value stocks could work,” he said. “Banks could work. Retail could work. More realistically, value tends to work for a year or two at the trough of a cycle up through the first two years of recovery, not this late in the cycle.”