President Donald Trump‘s anticipated decertification of the Iranian nuclear deal should not immediately impact the oil market, but it could create an atmosphere of uncertainty that could go on for months.

The president is expected to disavow the agreement between Iran and the U.S. and five other nations, which was engineered by previous President Barack Obama. Trump has a scheduled announcement for midday Friday, at which he is expected to say the deal is not in the national interest and potentially propose new conditions for the U.S. to continue its participation.

That action would not re-impose the financial sanctions on Iran or ban its oil sales. But it does now put the onus on Congress, and what it will do is not clear.

“[Congress] can vote to re-impose sanctions that are currently waived, and then the president would have to sign it…But I think what’s going to happen instead is there’s lower-hanging fruit they’re going to go to. They’re going to push on non-nuclear sanctions,” said Scott Modell, managing director at Rapidan Group.

Modell said that could include a crackdown on Iranian ballistic missile testing, or could be a push to punish Iran for its financial support of Hezbollah and its destabilizing actions in Syria and elsewhere. The Iranian Revolutionary Guard Corp., a branch of the armed forces of Iran, could even be called out as a terror group, he said.

“There’s always a push to add new names to the list. …There’s no real appetite even among Iran hawks to unravel the deal. They don’t want to re-impose sanctions that would blow up the deal,” said Modell.

Just ahead of Trump’s announcement, CIA Director Mike Pompeo Thursday called Iran a “thuggish police state” and a “despotic theocracy,” comparing its ambitions to ISIS.

Helima Croft, RBC global head of commodities research, said it is unclear whether the Iran deal stays together in long run. Another key date is mid-January, when Trump would have to again waive the oil and financial sanctions. “If he does not waive the sanctions in January, we’re out of the deal. We’re out of the deal, and the deal dies,” she said.

Croft said some of the possible new penalties that could be imposed on Iran could be deal-breakers, such as one that could stop Iran from acquiring aircraft and parts.

“Iran can drop out. If we ban aircraft, they will go through the dispute resolution process,” Croft said. “This is such a three-ring circus. I’m not sure people understand how complicated this is. The Iranians are not going to allow this to be reopened. It’s going to come to an impasse if you don’t give them the aircraft they want.”

Iran has said it would remain the in the deal even if the U.S. leaves, so long as the other participants remain.

Croft said she expects the White House and Congress to move ahead with efforts to amend the agreement, possibly including new requirements for nuclear inspections but also imposing new penalties for non-nuclear transgressions.

“Such efforts could be a catalyst for the deal falling apart at a later date,” she said.

For the oil market, the situation does not mean any lost barrels for now, but it does create an air of uncertainty.

“There’s nothing that’s going to happen for a good, long time. The bad expectation in the market would be a re-imposing of those sanctions which force the U.S. to try to get allies to reduce a significant amount of the oil imported from Iran,” said Edward Morse, global head of commodities research at Citigroup.

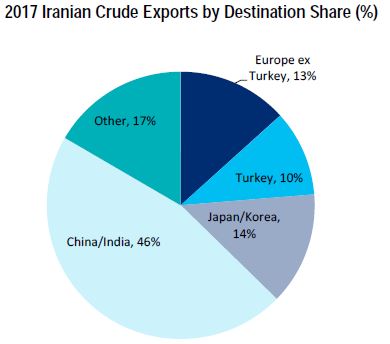

“China would probably ignore it and add more from Iran if the U.S. goes ahead with something along those lines,” he said. “We suspect both Japan and Korea will be cooperative, potentially reducing their imports from Iran by 500,000 barrels a day.”

European countries may be split. “It’ s not like there’s a lot of sympathy for doing anything that would result in lower imports because the Europeans think this is kind of a unilateral decision by the U.S. government, which has reneged on an official government policy – which has nothing to do with Iran violations of the conditions of the JCPOA,” Morse said.

Source: Citigroup

Trump’s advisors have said there is no evidence that Iran violated the Joint Comprehensive Plan of Action, the deal that suspended sanctions on Iran and is seen as a way to keep the country from building a nuclear bomb.

Morse said it is possible the Senate could introduce legislation that would create tougher red lines for Iran, but then also eliminate the need for the president to continue the 90-day certification process, which is required by Congress under the Iran Nuclear Agreement Review Act.

“It could be the nuclear agreement, per se, but there is a clamoring to do what Obama didn’t want to do, which would be to bring in complaints about Iran on the use of cash in the neighborhood,” Morse said, noting the concerns about Iran’s aid to Hezbollah.

He said a toughened nuclear specific deal would “go over better with our allies and it might get better in terms of Iran’s own reaction to it … and then if they put in the missile stuff that will be a problem.”

Oil prices Thursday shrugged off news of Trump’s anticipated announcement. U.S. West Texas Intermediate oil futures fell 1.4 percent on news of higher U.S. inventories.

“If he doesn’t surprise us with more than just de-certification it shouldn’t move prices. But he is talking about a new strategy, so I don’t know if there’s something more there than just de-certification,” said John Kilduff of Again Capital.