Timothy A. Clary | AFP | GettyImages

The recent celebrity college admissions cheating scandal meted out its first criminal sentence this week — one day of jail for a former Stanford University sailing coach, already dismissed as time served — but at a larger level, it has revealed the insane lengths the rich and well-connected will go to when it comes to their child’s chances of attending a top college or university.

Just how far and how wide do these tactics extend throughout the corridors of affluence in America? There is good and bad news from a new CNBC survey of America’s millionaire population. Many wealthy Americans remain sane when it comes to helping their kids get into a good university or college, spending relatively small sums of money on the effort. But the signs of privilege in accessing elite educational opportunities are reflected in the results.

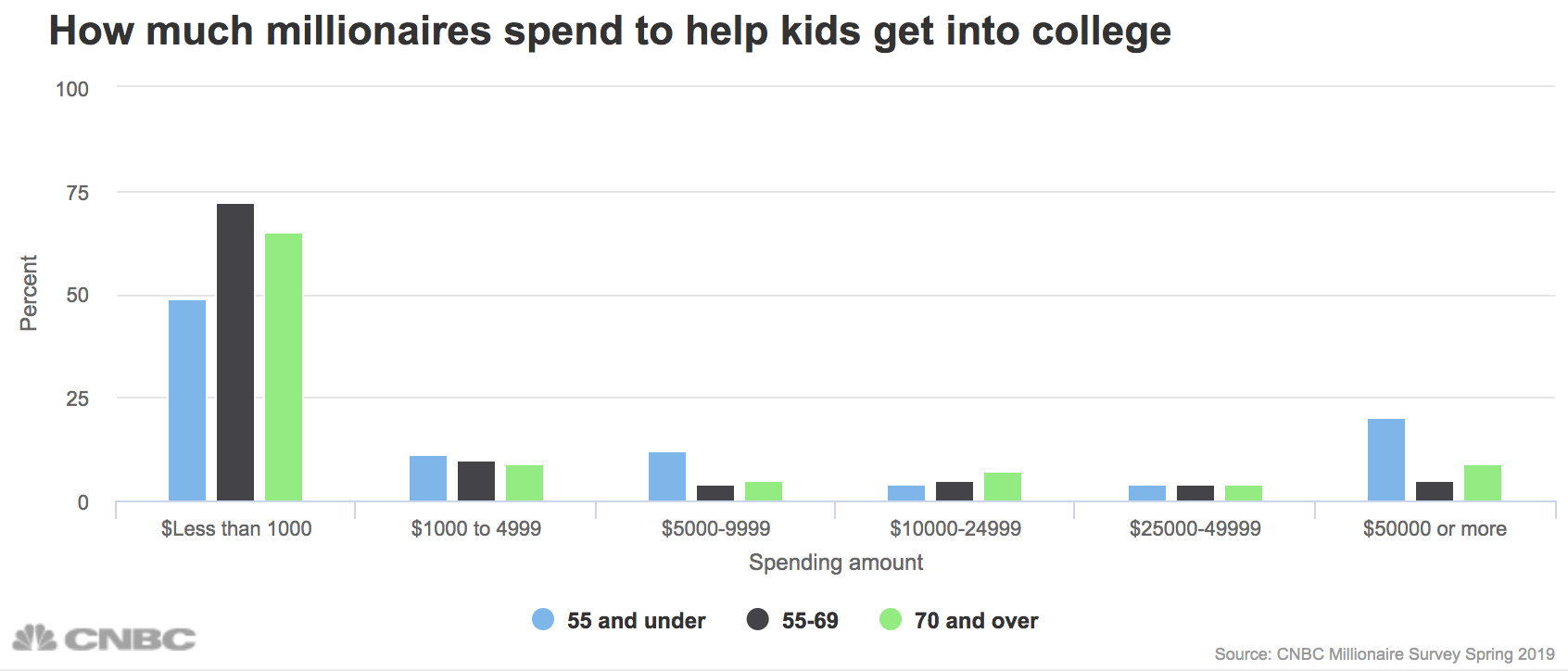

On average, American millionaires — those with at least $1 million of investable assets — spent less than $1,000 to increase their child’s college entrance odds.

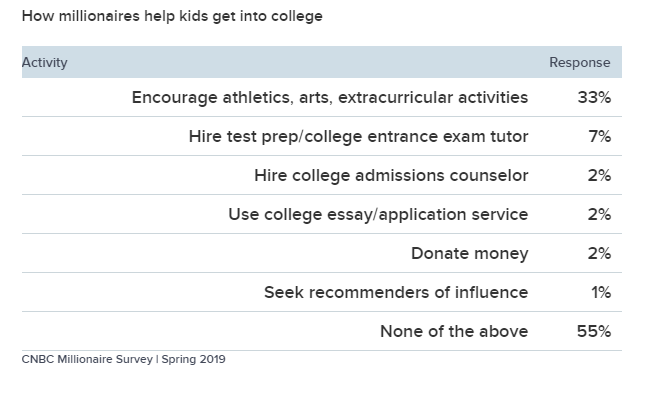

The most common effort made was not spending on SAT or ACT test prep and tutoring, but encouraging children (and grandchildren) to participate in athletics, arts or extracurricular activities.

Thirty-three percent of affluent parents recommend that their children get involved with extracurricular activities to increase their admissions chances, according to the new CNBC Millionaire Survey, conducted in May and which included 750 Americans representative of the affluent population. That was much more popular than paying for test prep and tutors.

While the dollar signs may seem small, research suggests that extracurricular activities represent a form of widespread social and income inequality. The New York Times’ demographic and politics trends writer Thomas Edsall recently used the case of education as a way to evaluate the idea of meritocracy in America. He pointed to a 2018 article by Freddie deBoer, of the Office of Academic Assessment at Brooklyn College, that “holistic assessments” of college applicants, particularly of extracurricular activities and special skills and hobbies, are likely to favor the rich even more than test results:

“The student who is captain of the sailing team, president of the robotics club, and who spent a summer building houses in the Global South will likely look more ‘holistically’ valuable than a poorer student who has not had the resources to do similar activities. Who is more likely to be a star violin player or to have completed a summer internship at a fancy magazine: a poor student or an affluent one?”

The first person sentenced in the college-cheating scandal this week was the sailing coach at Stanford.

Test prep has low return on investment

While the lack of spending on test prep and tutors may point to a more level playing field, many wealthy may have children enrolled at the best public schools or private schools. And they may be well aware of the limitations, or potential return on investment, from spending on these extras.

DeBoer noted in his work that while affluent parents can spend more, a major 2013 study showed that the “effect of coaching on a 1600-point scale was about 20 points.”

Edsall noted in his recent review of the education sector that the National Center for Fair & Open Testing lists 335 colleges that now “deemphasize” applicant scores on the ACT and SAT test. And he noted that while many of those schools are not elite universities, some top schools are making similar moves, such as the University of Chicago.

Among the most important part of the survey audience, though, these tactics are more prevalent. Younger millionaires and working millionaires (the ones most likely to have children in college or going to college in the future) are much more likely to hire test preparation tutors, special college admissions counselors and donate money to schools in hopes it will help their child.

While most millionaires spend less than $1,000 to help a child get into college, 20% of younger millionaires (those 55 and under) spent in excess of $50,000 in hopes it would help their kid land a spot at a college of their choice.

All of these college-spending decisions are not likely to change: the majority of young millionaires, female millionaires and working millionaires say the efforts were helpful.

Widespread opposition to free college

Millionaires of all ages agreed on one thing: no free college paid for by the government.

The survey found significant support for a wealth tax on Americans with $50 million or more in assets. And it uncovered a few potential 2020 matchups versus President Trump where Democrats are ahead (Biden and Buttigieg). But 70% oppose tuition-free college at state and public schools paid for by the federal government, which has become an important platform position for some Democratic candidates.

Almost half of millionaires (49%) strongly oppose the policy, and only 6% strongly support it. Politics played a role in this result.

Eighty-nine percent of Republicans oppose the idea versus 47% of Democrats. Forty-four percent of Democrats support the policy idea (9% were undecided).

Level of affluence did not influence results: Those with $1 million to $5 million, and those with over $5 million, have almost the same views, percentage-wise.

The CNBC Millionaire Survey audience included 39% of millionaires who have children in college or already attended college, but only 5% of respondents will have children attending college in the next five years. Nineteen percent have grandchildren who will soon be applying to schools, and another 14% percent have grandchildren who attended college or are currently in school. Forty-five percent of the total Millionaire Survey audience does not have a child or grandchild in college or close to attending college.

A slim majority of millionaires overall said they thought these efforts were not effective — 38% responding they were “not at all effective” and 14% saying their were “somewhat ineffective.

Forty-seven percent of millionaires said the efforts were effective, with 10% describing it as “very effective.”

But among the younger millionaires, age 55 and under, 64% describe the efforts as effective, by far the highest among age groups. While more than 50% of millionaires age 55–69 and 70 and over described the efforts as “ineffective,” that drops to 36% among the wealthy age 55 and under.

Check out How a couple’s whiteboard strategy helped them pay off $18,000 in Debt in 2 years via Grow with Acorns+CNBC.

Disclosure: NBCUniversal and Comcast Ventures are investors in Acorns.