President Donald Trump’s threat to slap heavy tariffs on imported cars and auto parts may cost hundreds of thousands of American jobs and raise the cost of your next vehicle by roughly 10 percent, economists estimate.

Echoing their dire predictions are companies, industry groups, global trading partners and even local city governments in comments about the proposal they’ve submitted to the U.S. Commerce Department pleading for Mr. Trump not to impose the 25 percent tariffs.

With the agency on Thursday starting two days of hearings to consider the plan, bets are Mr. Trump will enact the tariffs anyway. UBS strategists expect the U.S. to impose the car levies by year-end (though not on auto parts).

Here’s what the fight is about:

U.S. trade is “basically all about cars”

As part of a series of charts sent to clients this month, Torsten Sløk, chief international economist Deutsche Bank, recently wrote that U.S. trade is “basically all about cars.” U.S. production accounts for about 2.7 percent of GDP, and for every motor-vehicle assembly job, 10 are created, his slideshow points out. That’s more jobs than in computers and electronics, chemicals, motor vehicle parts alone, plastics and rubber, or food.

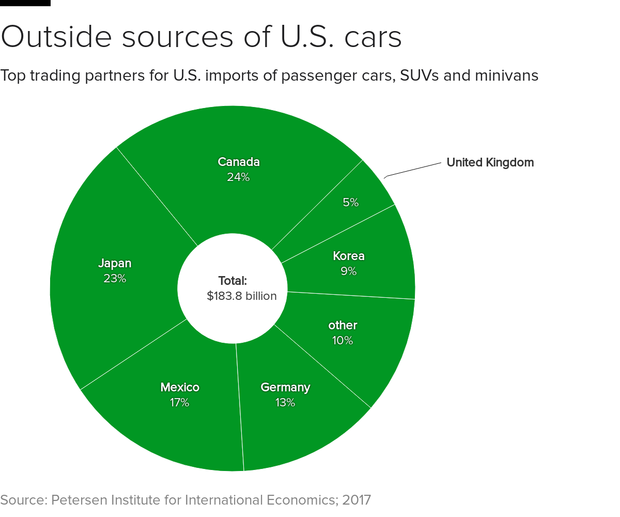

Cars from Germany, Japan and Korea are listed as the most important U.S. imports, while car parts are the most important from Mexico, Sløk’s analysis showed. Cars are the second-most important import from Canada and the U.K., along with auto parts from Japan.

The National Auto Alliance estimates that in the U.S. about 7.25 million jobs are tied to the industry directly: 2.44 million are employed by automakers, 1.6 million by dealers, and another 3.16 billion by auto suppliers.

Auto and related industries are against the proposed tariffs

This week, a group representing the auto industry released a public letter to Mr. Trump imploring him not to impose the tariffs. U.S. trade depends so much on autos and auto parts that American workers and drivers could suffer the biggest hits from the threatened tariffs, they argued. Mr. Trump has implied he’ll use the threat as a bargaining chip to gain better trade deals.

That might make the hearings ineffective, some economists argued.

“This is a show trial,” Adam Posen, president of the Peterson Institute for International Economics told The Wall Street Journal. “This is something where they predetermined the verdict and the schedule on which the verdict would be read.”

Many foreign carmakers build automobiles containing big hunks of U.S. parts and other content. The same is true of foreign cars and U.S. part content.

General Motors (GM) and Ford (F) have large percentages of foreign auto parts in their vehicles, sometimes more than half. GM recently warned the tariffs would hurt business and mean a “smaller GM” and fewer jobs, thanks to higher costs.

Autos can drive the U.S. economy

In June, manufacturing overall rebounded — mainly because of a 7.8 percent increase in auto-related production. About 75 percent of the 0.8 percent total rise came from cars, according to a recent note from Oxford economics.

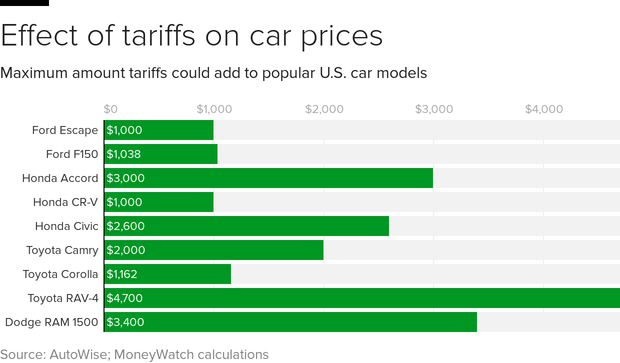

The top 10 most popular vehicles will be more expensive for U.S. consumers, and prices will go up as much as $3,410, according to recent calculations from AutoWise.

© 2018 CBS Interactive Inc.. All Rights Reserved.