Premium prices for health care policies sold on the Affordable Care Act marketplaces were finally made public just before open enrollment started on Nov. 1. As shown in a recent Kaiser Family Foundation analysis, the numbers offer a revealing look into some surprising trends and some important points consumers need to keep in mind while they shop for 2018 plans.

Kaiser reviewed premium data in each county of the 39 states with exchanges run by the federal government. Eleven states and the District of Columbia run their own exchanges and aren’t included in the analysis. (More about them later.)

Here’s what you need to know.

Premiums will rise…

As expected, premiums are climbing at a fast clip. And consumers who don’t qualify for a premium tax credit will see the most sticker shock. The Kaiser analysis looked only at the lowest-cost plans in each of the bronze, silver and gold levels, and it found the average premium for bronze plans, which offer the highest deductibles and least comprehensive coverage, will rise 17 percent. The lowest-cost gold plans, which provide much lower deductibles and more comprehensive coverage, will have an average premium increase of 19 percent.

Silver plans are where the real action is. Kaiser found silver-level premiums will rise an average of 35 percent in 2018 over 2017 prices. Silvers see the highest price rise because of the much-talked-about cost-sharing subsidies. Under the Affordable Care Act, insurance companies must help low-income consumers pay for out-of-pocket health care costs such as deductibles and co-pays with cost-sharing subsidies. These subsidies are available only in silver plans. In return, insurers receive reimbursements for those consumer payments from the federal government.

However, last month the Trump administration announced that the federal government will no longer reimburse insurers for cost-sharing subsidies. Nonetheless, under the law, insurers must continue to share these costs with eligible consumers. So most insurers made up for the lack of reimbursement income by charging higher premiums, largely in the silver plans.

Other factors have also contributed to the rise in premium costs, such as reduced competition in many of the exchanges and confusion over the future of the ACA in general.

…But lots of consumers will pay less anyway

That’s because big premium increases translate into higher premium tax credits. Those credits are calculated based on the second-lowest silver plan in each area, but the credits may be applied to any plan a qualified enrollee chooses.

So a 40-year-old individual making $35,000 will on average pay 7 percent less for her share of the lowest-cost silver plan premium in 2018 when tax credits are taken into consideration. Lower-income individuals would receive even more in tax credits and thus pay less in premiums.

Gold plans may be a better deal than silver

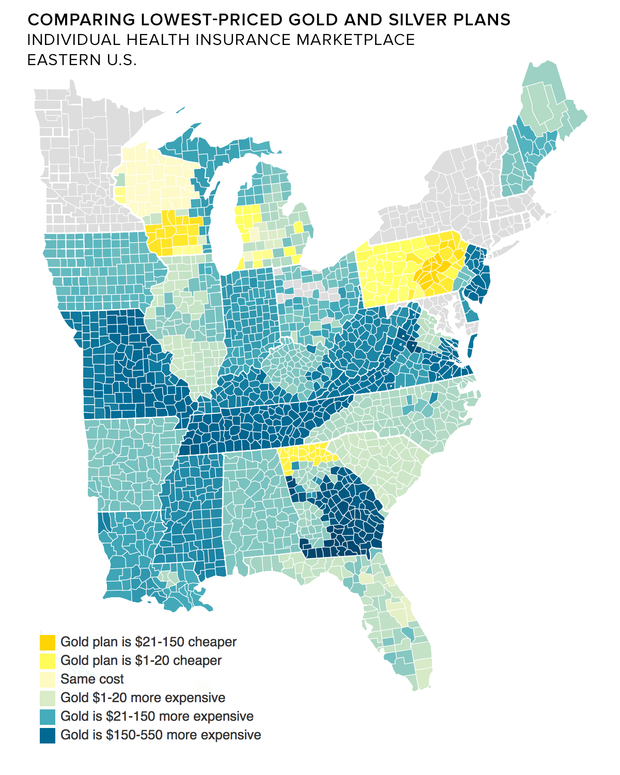

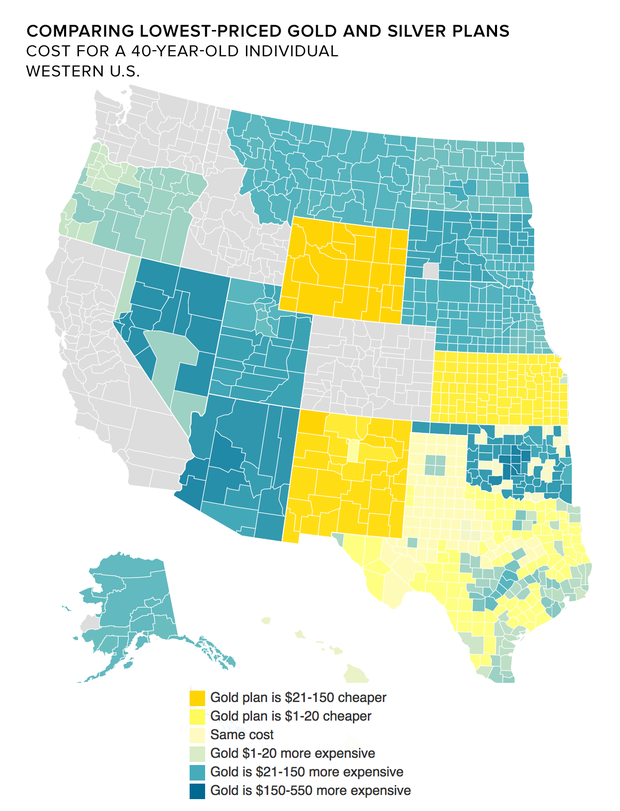

A funny twist in all this is that gold plans, which traditionally have charged higher premiums in return for lower deductibles and more comprehensive coverage than silver plans, may, in some cases be cheaper than silver plans. In 459 counties, the lowest-cost gold plan is less expensive that the lowest cost silver premium, according to the Kaiser analysis (see the maps below).

MoneyWatch analysis of healthcare.gov data

Irina Ivanova/CBS MoneyWatch

MoneyWatch analysis of healthcare.gov data

Irina Ivanova/CBS MoneyWatch

And because many insurers concentrated their premium increases on silver plans, even people who don’t qualify for premium tax credits may find gold plans will have lower premiums than silver plans. In the past, it has been easy for consumers to simply dismiss gold plans as too expensive. But depending on where you live, that may not be true for 2018.

Beware the bronze

At first glance bronze plans may be the cheapest option, which has always been the case. They have the highest deductibles and often have higher out-of-pocket costs such as co-pays. As a result, bronze plans always carry the lowest premiums.

But the difference is particularly remarkable for 2018. With premium tax credits, some consumers may find they’ll pay no premium at all. That same 40-year-old making $35,000 who receives a tax credit would pay 39 percent less for her share of the lowest-cost bronze plan premiums. A 40-year-old making $25,000 would find that the premium tax credit would cover the full cost of her premiums in 1,540 counties.

But premiums aren’t the whole story. Out-of-pocket costs for bronze plans are significant and may not be affordable for many low-income consumers. It’s more important than ever to evaluate the cost of premiums versus the cost of actually receiving health care.

State-run marketplaces are trying hard

Open enrollment is expected to be a bit chaotic this year because of the Trump administration’s efforts to cut back on advertising, the enrollment period and federally funded help for consumers. But several states that run their own marketplaces are trying to fill the gaps, according to a report from The Commonwealth Fund.

For instance, the Trump administration had cut the open-enrollment period dramatically for the federally run exchange to Dec. 15. But eight of the 11 state-run exchanges and D.C. have extended their open-enrollment period to anywhere from the end of December to the end of January. And many of those states have increased their own budgets to boost advertising and grass-roots awareness efforts to make sure people know it’s time to enroll.