The S&P 500 fell officially into correction territory on Thursday, down more than 10 percent from its record reached in January.

If this is just a run-of-the-mill correction, then we are looking at another four months of pain, history shows. If the losses deepen into a bear market (down 20 percent), then it could be 22 months before we revisit these highs, history shows.

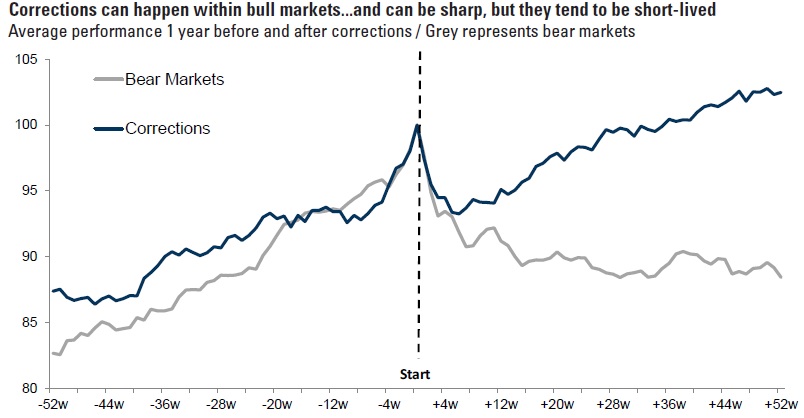

“The average bull market ‘correction’ is 13 percent over four months and takes just four months to recover,” Goldman Sachs Chief Global Equity Strategist Peter Oppenheimer said in a Jan. 29 report.

Source: Goldman Sachs

But the pain lasts nearly two years on average if the S&P falls at least 20 percent from its record high — past 2,298 — into bear market territory, the report said. The average decline in a bear market is 30 percent, according to Goldman.

The last week of stock market drops has taken the S&P 500 into correction territory for the first time in two years

Stocks remain in an upward bull market trend, the second longest in history.

S&P 500 corrections and bear markets since WWI

Source: Goldman Sachs