The current “secular stagnation” for bond yields offers close parallels to the long depression of the late 1800s, according to TS Lombard Managing Director of Global Macro Dario Perkins.

The past year has seen multiple inversions of the U.S. two-year/10-year Treasury yield curve and record low bond yields, which move inversely to price, across Europe and beyond.

An inverted yield curve marks a point on a chart where short-term investments in U.S. Treasury bonds pay more than long-term ones, and is widely regarded as an ominous sign for the economy.

Despite a recent sell-off for fixed income, which primarily reflects traders pricing out the immediate risk of a global recession, the experience of the past decade suggests yields are unlikely to rise materially without something “breaking” in global markets, Perkins said in a research note on Wednesday.

TS Lombard compared the current persistent low-rate equilibrium and market hysteresis against the Bank of England’s historical database to analyze past “secular real-rate depressions” and what event triggered their reversal.

“The answer — wars, epidemics, famines and more wars — makes even the ‘Armageddonists’ look optimistic. But there is one episode in history, perhaps the period with the closest parallels to today’s situation, which offers a less pessimistic way out: the long depression of the late-1800s,” Perkins said.

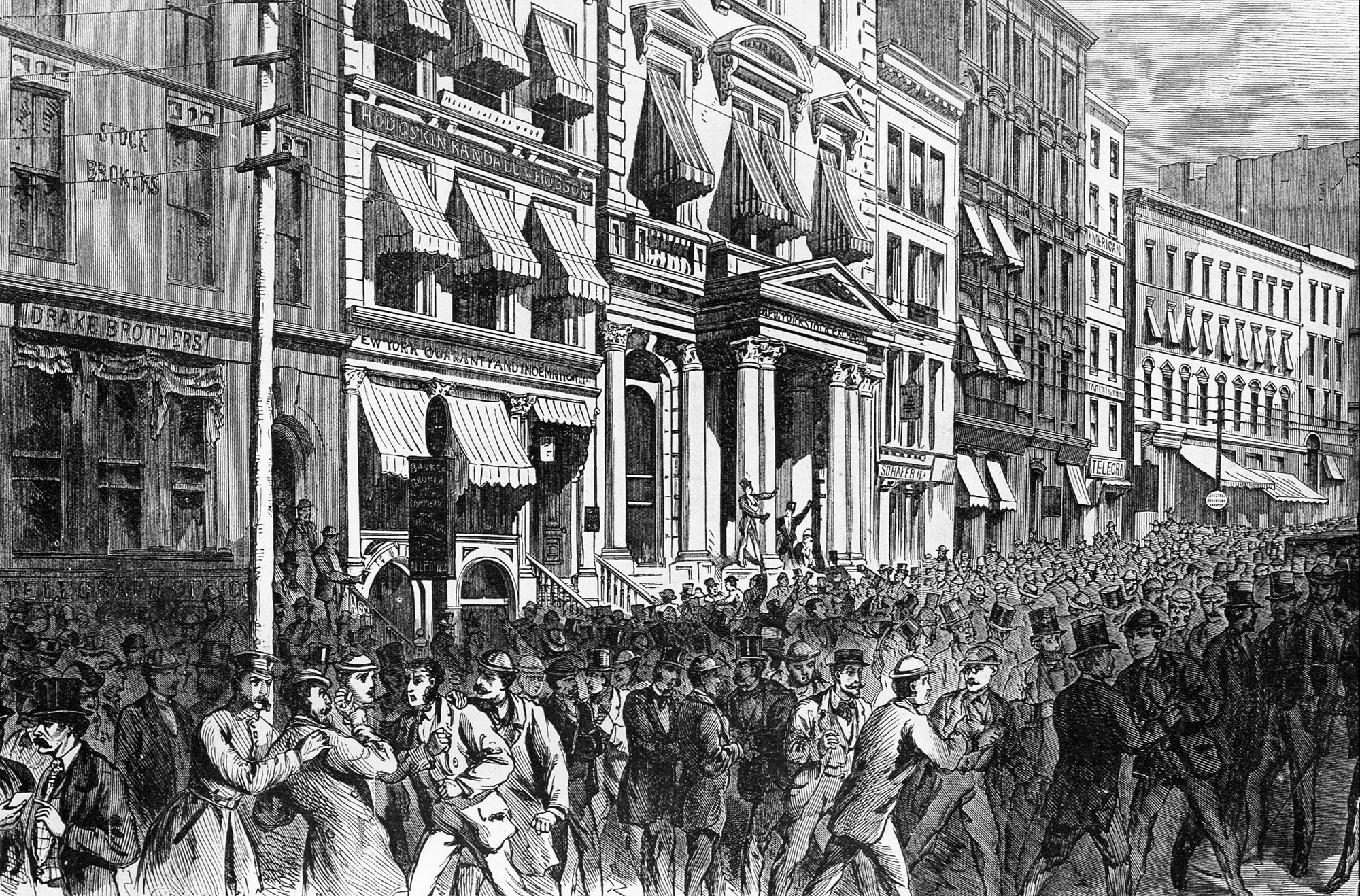

The Long Depression began with a financial panic in 1873 which facilitated two decades of dire productivity, deflationary price dynamics, stagnant middle-class incomes and a surge in populism coupled with a backlash against globalization.

Productivity resurged in the 1890s due to an acceleration of “technological diffusion,” Perkins suggested, adding that technology can offer a route out of the slump providing the gains extend beyond the behemoth companies. However, an acceleration of wages is also important.

“Populism played a role, especially as it led to the development of the welfare state and the organization of workers into trade unions,” Perkins highlighted.

“There was no Marxist revolution but worries about ‘socialism’ did cause a powerful shift in the distribution of income.”

So while the appeal of Modern Monetary Theory (MMT) puzzles some investors, Perkins suggested that “the left might actually have history on its side.”