A woman takes a selfie with a dog

Ezequiel Becerra | AFP | Getty Images

Most aspiring pet owners don’t factor in a $10,000 bill into the cost of adopting a 12-pound rescue dog.

Twenty-eight year old Berna Dikicioglu certainly didn’t when she adopted her terrier mix Scout from a Los Angeles shelter five years ago. Dikicioglu had a Rottweiler growing up, and was looking to get her own dog out of college. For the first two years, Scout was relatively low cost.

That was until a friend’s birthday party, where a much larger dog unexpectedly came lunging towards Scout, taking hold of Scout’s tiny paw and “completely snapping it.”

“It was the loudest yelp I’ve ever heard,” she said.

Scout got an X-ray, revealing a group of grain-sized broken bones. Dikicioglu was in her mid-20s, a couple of years out of college and starting her career in advertising, and was “freaking out,” about how to pay for the necessary surgery.

“It’s unconditional love — I never would have even hesitated to try and figure out a way to pay for it,” she said. “I was like okay, what do we need to do, and when are we going to do it?”

She opted for CareCredit, a relatively unknown financing option to non-pet-parents but a staple in more than 90% of veterinary offices across the country. It’s owned by Synchrony Financial, the Stamford Connecticut-based firm that also powers credit cards for Amazon, Lowe’s, Sam’s Club and PayPal.

Synchrony executives anticipate Americans becoming even more obsessed with their dogs and cats— a trend they call the “humanization of pets — and are looking to the booming animal care market for its next leg of growth.

The business of pets

Last year, U.S. pet owners spent a record $72.5 billion on their animals, according to the American Pet Products Association. They spent $18.1 billion on vet bills alone. More than half of Americans now own a pet of some sort, according to Synchrony.

“That increasing human animal bond is without doubt playing a significant factor in this,” said Beto Casellas, CEO of CareCredit.

The company also offers financing for health care that’s often not entirely covered by insurance, like dentists and dermatologists. Since it started three decades ago, CareCredit has opened 29 million accounts, with 11 million of those still open today. Synchrony said the cardholders have an average ticket price that’s eight-times higher than spending on a general purpose credit card.

Synchrony, which has a $21 billion market capitalization, added another avenue to pet owners’ bank accounts last year through its acquisition of pet insurance company Pets Best in March. The Boise, Idaho-based company offers pet insurance for dogs and cats in every state.

Caiaimage/Robert Daly | Caiaimage | Getty Images

The segment of insurance is “quite literally on fire right now,” said Chris Middleton, senior vice president and general manager of Pets Best at CareCredit. “It’s one of the fastest growing segments in the insurance market.”

Much of the company’s growth is coming from employers looking to offer pet insurance as a benefit to accommodate younger works. In the past four years, Pets Best said it has seen a fourfold increase in the number of firms looking for information about adding pet insurance as a voluntary benefit. The Synchrony executives said this is largely thanks to a demographic shift.

“People, particularly millennials, are delaying having children — pets are becoming children and millennials are now the largest cohort of pet owners,” Middleton said.

Vet endorsement

The main way to get people using the CareCredit card, or to sign up for pet insurance, is their vet. Those recommendations “are a hugely important endorsement,” Casellas said.

Dr. Meg Thompson, Cornell veterinary hospital medical director, said most vets offer care credit or some sort of financing options — especially since the cost of care for animals is going up. She pointed to routine magnetic resonance imaging machines as an example, which cost $1 million and growing popularity of expensive procedures like chemotherapy. Mid-life problems are even more common, like Labrador Retrievers that “blow their knees like football players” and need $3,000 surgeries per leg.

That cost is largely being passed on to patients. And unlike human healthcare, there’s no Medicaid, or state and federal funding sources paid by insurance.

“It’s different than human healthcare that has government subsidy,” Thompson said. “Vet care is purely paid by you and me.”

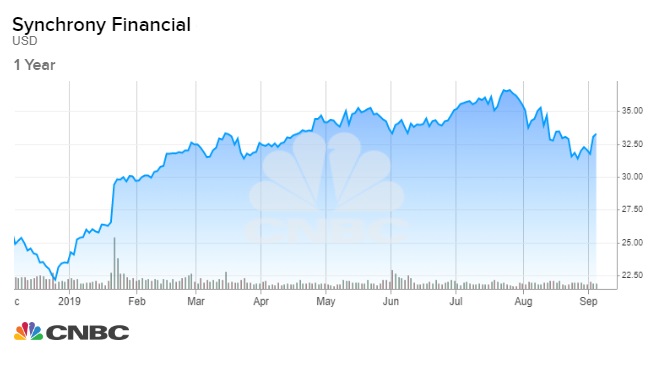

Synchrony has been on a stock buyback spree, and according to Credit Suisse, has bought back the equivalent of 12% of its shares over the past year.

That’s one reason investors are bidding up the credit card issuer, according to Bill Carcache, senior analyst at Nomura Securities. Shares are up more than 40% this year. Carache said while its veterinary care dominance through CareCredit might provide a small bump for Synchrony, it’s not a game changer.

“It’s a part of the story, and a part of the incremental growth opportunity, but it’s not a core tenant of our thesis,” Carache said. “It’s complimentary but it’s not the number one bullet point for us.”

Regardless, Synchrony is leaning into the opportunity. Casellas said pet owners are returning and spending on their card more than 5 times per year. CareCredit is in more than 220,000 healthcare offices already.

Synchrony executives anticipate more growth in the pet portion of that as Americans increase pet spending. And while they are hoping that cardholders use the Care Credit card to shop for their pets, Casellas said they don’t have plans to compete with e-commerce players like Chewy.

“This is a market that we want to grow with, and diversifies the sources of customers and sources of revenue for us for Synchrony overall,” Casellas said.