Barron’s associate editor Andrew Bary looks back at the best stocks of the past decade and gives his stock recommendations heading into 2020.

Wall Street thinks the longest bull market in history is set to ride into the next decade.

Continue Reading Below

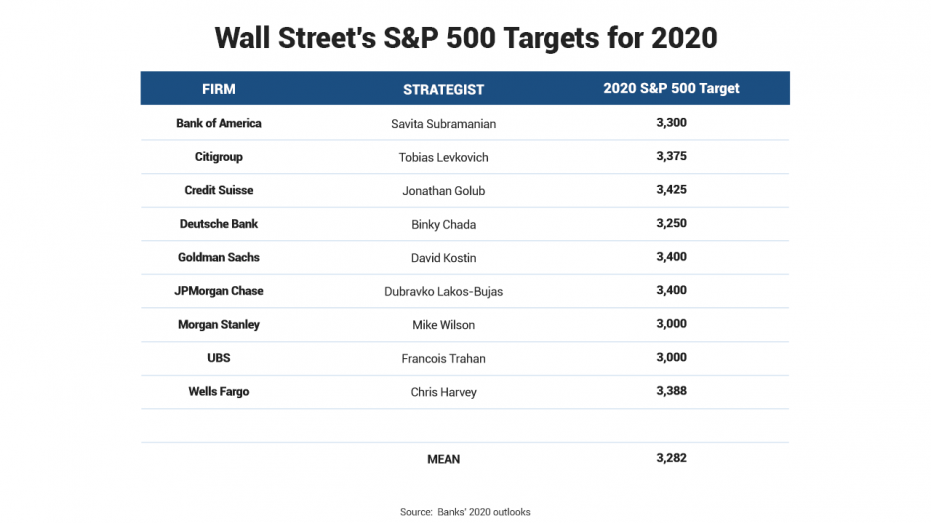

The S&P 500 will climb 2.1 percent to 3,282, according to 2020 forecasts from nine Wall Street strategists compiled by FOX Business. The small gain would be a sharp contrast from 2019, which saw the S&P 500 gain over 28 percent, marking the best year for the markets since 2013.

“Rising political and policy uncertainty will keep the index range-bound” for most of 2020, wrote David Kostin, chief U.S. equity strategist at Goldman Sachs. He predicts the S&P 500 will hit 3,400 by year-end, up 5.7 percent from current levels, as equity markets typically outperform under a divided federal government. Equities are also expected to benefit from ongoing U.S. economic tailwinds.

STOCK INVESTORS CELEBRATE BIG DECADE AS COMMODITIES TRAIL

A strong stock market is typical during election years.

Wells Fargo Institute crunched the numbers and found that the S&P 500 has experienced only four losing presidential election years out of the last 23 on a total return basis, gaining 11.3 percent on average.

JPMorgan Strategist Dubravko Lakos-Bujas sees pro-growth election-year rhetoric, the partial U.S.-China trade deal, a global cycle recovery and neutral investor positioning lifting the S&P 500 by 5.8 percent to 3,400 next year. He expects “most, if not all, of the market upside to be realized ahead of the U.S. elections.”

Meanwhile, Savita Subramanian, head of U.S. equity and quantitative strategy at Bank of America, thinks “trade risk has moderated and macro signals are showing signs of stabilization.” She thinks the S&P 500 will edge up 2.5 percent in 2020 to 3,300 driven almost entirely by multiple expansion.

But not everyone on Wall Street is bullish.

Mike Wilson, chief U.S. equity strategist and chief investment officer at Morgan Stanley, thinks the Fed expanding its balance sheet at a pace of $60 billion a month will goose the S&P 500 to a high of 3,250 in early 2020, but expects that rally to dissipate by April. His base case 2020 S&P 500 price target of 3,000 is nearly 7 percent below where the index finished 2019.

“The U.S. remains our least preferred region, given limited scope for multiple rerating or incremental flows, and earnings expectations that look materially too high to us,” Wilson said.

Francois Trahan, strategist at UBS, matches Wilson in his bearishness with a year-end target of 3,000, arguing that overly optimistic investors, a looming earnings decline a slowdown in the economy are the reasons why stock-market risks are skewed to the downside in 2020.

Trahan sees U.S. equities heading lower in the first half of the year before recovering just in time for the election.

CLICK HERE TO READ MORE ON FOX BUSINESS

“If history was a perfect guide, then the U.S. economy would bottom exactly as interest rates suggest in November of 2020 and equities would begin to discount that in Q2 ’20 or thereabouts,” he said.