Republicans in the House of Representatives released an ambitious and long-awaited tax reform bill Thursday that seeks to simplify the tax code and reduce corporate rates, the latest step as the party works toward passing a major item on its agenda.

The Tax Cuts and Jobs Act reduces the number of tax brackets from seven to five, maintaining the top marginal rate at 39.6 percent, while almost doubling the standard deduction, the amount which can be removed from one’s income prior to taxes. Under the bill, the country’s corporate tax rate would be permanently reduced from 35 percent to 20 percent.

The bill was originally scheduled to be released Wednesday before it was pushed back a day as Republicans fine-tuned the text. GOP members of the Ways and Means Committee, the group primarily responsible for tax-writing, worked into the evening Tuesday and throughout the day Wednesday to address some of the sticking points dividing party members, including state and local tax (SALT) deductions.

After early proposals called for a wholesale elimination of the ability to deduct the amount paid toward some state and local taxes from the sum owed to the federal government, it was partially maintained in the final bill. Taxpayers can continue to deduct property taxes under the bill — though the amount is capped at $10,000 — while income tax deductions were eliminated.

On 401(k)s, the text released Thursday appears to maintain the current maximum that individuals may contribute on a tax-free basis at $18,000, following through on a pledge made by President Donald Trump that the plans would not be affected by reform.

“There will be NO change to your 401(k),” Trump tweeted less than two weeks ago. “This has always been a great and popular middle class tax break that works, and it stays!”

Other changes include lowering the cap on the mortgage-interest deductions which subtract interest payments taxpayers make toward their mortgages from their taxable income. The Tax Cuts and Jobs Act halts the deductions at interest paid on the first $500,000 in loans; the current cap is $1 million. Critics believe the move would disproportionately affect residents of areas with a high cost of home ownership.

Ways and Means Committee Chairman Kevin Brady, R-Texas, said the plan — which he labeled a “complete redesign of the code” — adheres to budget rules requiring the measure to only add $1.5 trillion to the federal deficit over 10 years. He expressed his excitement about the at a press conference unveiling the plan Thursday.

“Real relief from today’s complex, costly and unfair tax code is on the way. With this bill, there’s relief for real American families,” Brady said. “There’s relief for American workers and there’s tax relief for hard-working job creators of all sizes.”

He added that the legislation has Trump’s “full support.”

The White House released a statement shortly after in which the president applauded the release of the bill, calling it “another important step toward providing massive tax relief for the American people.”

“We are just getting started, and there is much work left to do … but my administration will work tirelessly to make good on our promise to the working people who built our nation and deliver historic tax cuts and reforms.”

Speaker of the House Paul Ryan, R-Wis., claimed that the bill would save “the typical family of four” $1,182 per year on their taxes. In recent weeks, some White House officials had been promoting a potential $4,000 savings for the average family, through the criteria set forth by the administration. Ryan further pointed to reduction of loopholes and simplification of the code as added benefits.

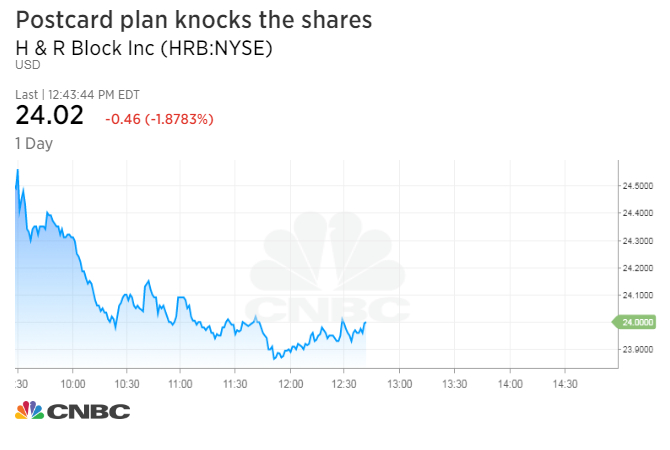

“We’re making things so simple you can do your taxes on the form the size of a postcard,” said Ryan, holding a sample card.

This is a developing story. Please check back for updates.

ABC News’ Trish Turner, John Parkinson, Alexander Mallin and Adam Kelsey contributed to this report.