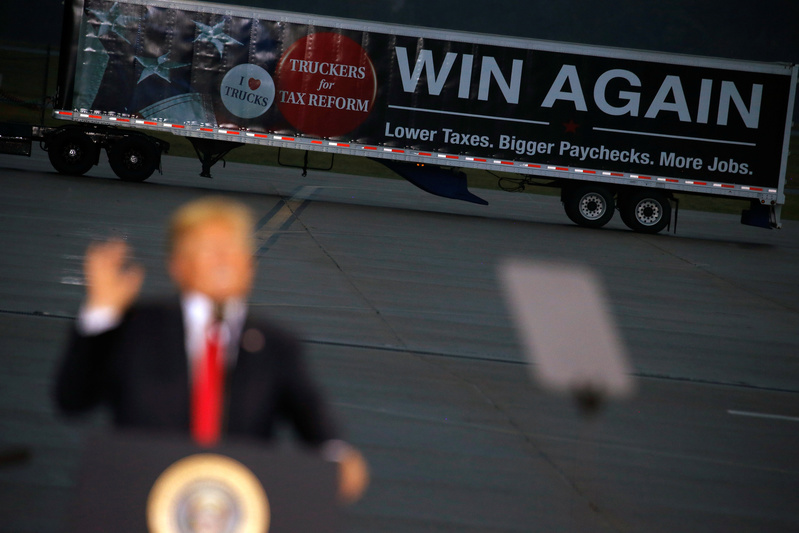

President Trump speaks about tax reform in Harrisburg, Pennsylvania. REUTERS/Joshua Roberts

October 12, 2017

By David Morgan

WASHINGTON (Reuters) – Republican lawmakers are considering indirect paths to meeting President Donald Trump’s goal of slashing the corporate tax rate to 20 percent, one of the toughest challenges they face in trying to overhaul the U.S. tax code.

Tax writers in the House of Representatives may opt to phase in the 20 percent corporate rate over three to five years by lowering it in stages from the current 35 percent, said two sources close to the tax discussions.

A phase-in surfaced as an option among Republicans on the House Ways and Means Committee as it closed in on completion of actual tax legislation, working off of a nine-page “framework” unveiled by Trump on Sept. 27.

The House was expected to be inactive on Friday and all of next week. “We’ll come back in a week and be able to put together the bill that will move through committee,” Republican Representative Kristi Noem told reporters.

One of the biggest problems confronting the Republican tax reform push is the federal budget deficit, which would be hugely expanded by Trump’s proposals, according to independent analyses.

Cutting the corporate rate immediately to 20 percent would reduce U.S. tax revenues by nearly $2 trillion over a decade, according to the nonpartisan Tax Policy Center think tank.

Sources said House Republicans believed they could halve the projected revenue loss if the rate cut were phased in. Details of such an option were unavailable.

The administration contends the cuts would pay for themselves through stronger economic growth generating new tax revenues, although most economists say that is unlikely.

‘CORPORATE INTEGRATION’

A different approach may emerge from the Senate, where Republicans are writing their own tax legislation. Sources with knowledge of the discussions said senators might settle on a corporate tax rate above 20 percent, but use an unorthodox “corporate integration” strategy to achieve an effective rate of 20 percent or less.

Corporate integration, a brainchild of Senate Finance Committee Chairman Orrin Hatch, would help lower corporations’ tax bill by giving them a deduction for shareholder dividends, analysts said. The idea has faced opposition in the past.

Both the House and Senate alternatives surfaced this week as top Republicans and Trump administration officials confronted skepticism that the Republican-controlled Congress could cut the corporate rate to 20 percent without ballooning the deficit.

Trump, who earlier in the year called for a 15 percent corporate tax rate and only reluctantly agreed to 20 percent, is now insisting that it go no higher.

“The president has made it clear. He wants 20 percent. That’s the one part of this bill that’s not negotiable,” Treasury Secretary Steven Mnuchin told CNBC.

House Ways and Means Committee Chairman Kevin Brady told reporters on Thursday: “We continue to drive toward the framework … ensuring that our businesses don’t have anything higher than 20 percent on the corporate side.”

Asked if that meant a 20 percent rate in the first year, he said: “We’re moving toward that whole design.”

(Editing by Kevin Drawbaugh and Peter Cooney)