Quick Take

After Congress passed the Inflation Reduction Act, which includes funding to increase staff at the IRS, social media posts falsely claimed members of Congress “voted to exempt themselves from IRS auditing of their personal finances.” An IRS spokesperson told us “there is no such special exemption,” and we found no such vote had been taken.

Full Story

After Congress voted to provide the IRS with nearly $79 billion in funding over 10 years in the Inflation Reduction Act, the agency has been a target of misinformation from Republicans and conservative social media posts.

Critics have misleadingly claimed that the IRS will now hire “87,000 new agents” to investigate average citizens. Some baselessly claimed that recent IRS ammunition purchases may be part of a “broader effort” to get ammunition off the market. And other posts shared a video falsely claiming it showed IRS agents in training.

Posts on social media are now spreading the false claim that members of Congress voted to exempt themselves from IRS audits of their personal finances. No such bill exists, and no vote for that exemption has occurred.

“In order to safeguard democracy, Congress has voted to exempt itself and its members from upcoming IRS audits,” read a tweet posted by an account called News That Matters. The post received over 18,000 likes and 11,000 retweets.

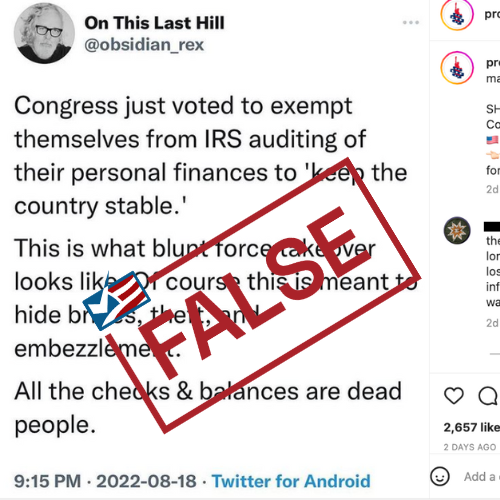

“Congress just voted to exempt themselves from IRS auditing of their personal finances to ‘keep the country stable.’ This is what blunt force takeover looks like. Of course this is meant to hide bribes, theft, and embezzlement,” read an Instagram post with the caption, “You literally can’t make this up.”

But the claim is made up.

IRS spokesperson Terry Lemons told us in an email, “The social media accounts are untrue.”

“There is no such special exemption,” Lemons said. “All tax filers are treated equally under the tax law.”

“Audits are determined ultimately on what is — or isn’t — included on the tax return,” Lemons said. “The IRS uses a number of processes to determine when to conduct an audit, including matching against third-party information from Forms W-2 and 1099 as well as using data-driven processes to determine possible non-compliance with the tax laws.”

“The IRS has strong safeguards in place to ensure that audits are conducted only based on what is on the tax return – and not other factors,” Lemons said.

We could find no bill exempting Congress members from IRS audits that was proposed or passed, and no exemption for members of Congress in the Inflation Reduction Act.

Henry Connelly, a spokesperson for House Speaker Nancy Pelosi, told us in an email, “The claim of Members exempting themselves is, indeed, nonsense!”

But Congress remains deeply unpopular, so such claims are readily accepted by social media users.

Some social media users responded to the made-up claim about the IRS audits by spreading bogus claims of their own — saying members of Congress exempted themselves from the Affordable Care Act (they didn’t) and recently gave themselves a pay raise (not true).

“They gave themselves a 20% raise not too long, while the ‘little people’ are losing businesses and dealing with inflationary prices! It is class warfare,” one Instagram user wrote, in commenting on the claim about the IRS. But, as we wrote in March, congressional pay is set by a formula, and members of Congress have voted against accepting a pay raise since 2010.

Editor’s note: FactCheck.org is one of several organizations working with Facebook to debunk misinformation shared on social media. Our previous stories can be found here. Facebook has no control over our editorial content.

Sources

Connelly, Henry. Spokesperson for House Speaker Nancy Pelosi. Email to FactCheck.org. 23 Aug 2022.

Gallup. “Congress and the Public.” Accessed 25 Aug 2022.

H.R.5376 Inflation Reduction Act of 2022. Congress.gov. (As signed into law 16 Aug 2022.)

Jones, Brea. “IRS Will Target ‘High-Income’ Tax Evaders with New Funding, Contrary to Social Media Posts.” FactCheck.org. 18 Aug 2022.

Jones, Brea. “Images Show IRS Educational Program, Not Training of Agents.” FactCheck.org. 19 Aug 2022.

Jones, Brea. “Spending Bill Includes Pay Raises for Staffers, Not Members of Congress.” 16 Mar 2022.

Lemons, Terry. Communications and liaison chief at the IRS. Email to FactCheck.org. 23 Aug 2022.

Robertson, Lori. “Obamacare Myths.” FactCheck.org. 16 Sep 2013.

The post Posts Fabricate Claim that Congress Voted to Exempt Members from IRS Audits appeared first on FactCheck.org.