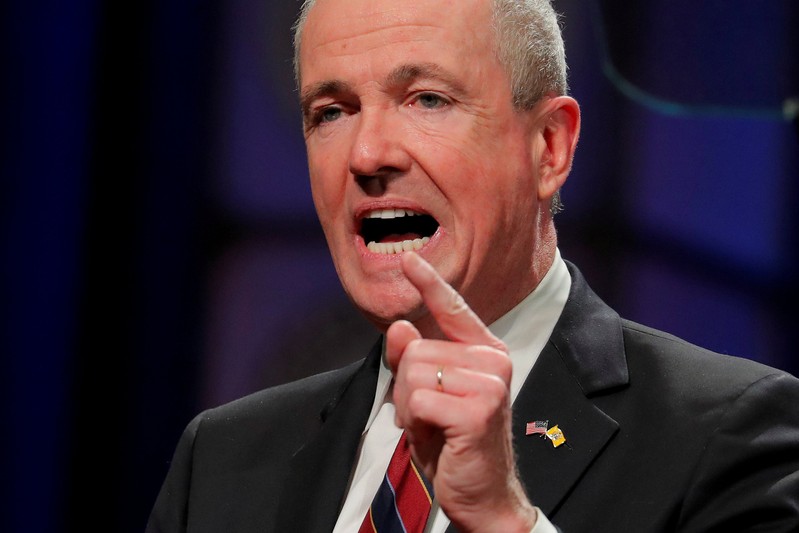

FILE PHOTO: New Jersey Governor Phil Murphy speaks after taking the oath of office in Trenton, New Jersey, U.S., January 16, 2018. REUTERS/Lucas Jackson/File Photo

April 10, 2018

By Hilary Russ

NEW YORK (Reuters) – New Jersey is projecting higher revenue growth for the next fiscal year, but most of it would come from tax hikes, according to testimony by Acting State Treasurer Elizabeth Muoio on Tuesday.

Total revenue for fiscal 2019, which begins July 1, is projected to grow by $2 billion, or 5.7 percent over the current fiscal year.

Governor Phil Murphy’s proposals for increased taxes – mostly on sales and millionaires – will account for $1.565 billion or 78 percent of the total, Muoio told the state Senate’s budget committee.

Muoio said a flat budget – without the revenue raisers and with no new spending – would leave the state with a deficit next fiscal year.

“This is not only unsustainable, it’s unacceptable,” she told lawmakers.

Years of tepid job and revenue growth have left New Jersey lagging its neighboring states. New Jersey’s revenue is still 6 percent below its pre-recession peak, compared with revenue growth of 10.2 percent in New York, 3.8 percent in Connecticut and 2.7 percent in Pennsylvania, she said.

By the time former Republican Governor Chris Christie left office in January, the state’s credit rating had been downgraded 11 times during his eight years in office.

In March, Murphy, a Democrat, made his opening salvo with a budget proposal for tax hikes and new spending in the already high-tax state.

Now lawmakers are debating which budget measures to approve. Next year’s projected revenue growth shakes out differently for each tax category.

Collections of the state’s largest revenue source, the gross income tax, are expected to rise by $1.25 billion, or 8.4 percent, versus the current fiscal year. Of the 8.4 percent rise, 4.1 percentage points are expected to be from underlying growth from wage and employment gains.

Murphy’s proposed tax increases would generate the remaining 4.3 percentage points of growth, Muoio said. Most would come from a tax increase to 10.75 percent from 8.97 percent on taxpayers earning more than $1 million.

On its own, sales tax revenue would grow by only 2.4 percent in fiscal 2019. With Murphy’s plan to broaden the sales tax base and revert the rate to 7 percent, growth is projected at 8.2 percent, Muoio said.

Christie and Democratic lawmakers agreed in 2016 to lower the sales tax to 6.875 percent as of January 2018, in exchange for higher gasoline taxes to fund transportation projects.

That agreement may unravel if any one of its major components is changed, budget committee members said.

(Reporting by Hilary Russ; Editing by Matthew Lewis)